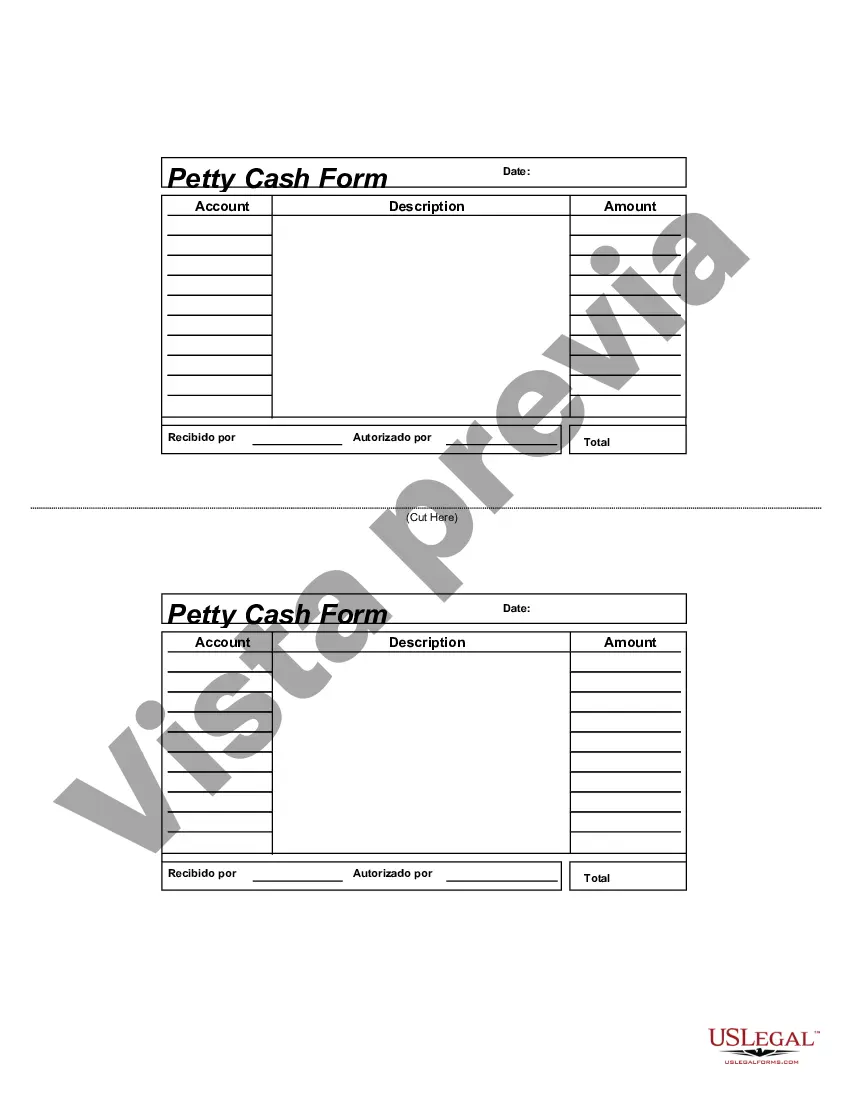

The San Jose California Petty Cash Form is a document specifically designed to track and record expenditures related to minor and miscellaneous business expenses. It serves as a crucial tool for businesses in efficiently managing and reconciling petty cash transactions. This detailed description will shed light on its purpose, significance, and potential variations. Petty cash refers to a small sum of money, often kept on hand by businesses, to cover various day-to-day expenses such as office supplies, travel allowances, minor repairs, and meal reimbursements. To ensure accurate bookkeeping and transparency, businesses utilize the San Jose California Petty Cash Form. The San Jose California Petty Cash Form generally includes the following key details: date of expenditure, description of the expense, amount withdrawn, purpose of the expense, and the signatures of both the person requesting the cash and the manager/authority approving it. This form establishes accountability and prevents any mishandling of cash, ensuring that each transaction is properly documented. In the context of San Jose, California, there may not be distinct types of Petty Cash Forms. However, variations can exist in terms of design and formatting across different businesses or organizations. For example, some companies might have customized Petty Cash Forms with specific fields or sections tailored to their unique requirements. Despite these possible variations, the fundamental purpose remains the same — to control and monitor petty cash expenditures. Utilizing the San Jose California Petty Cash Form offers numerous advantages. It helps maintain accurate financial records, facilitates internal controls, and ensures compliance with financial regulations. By using this detailed form, businesses can easily track expenses, identify patterns of spending, and detect any irregularities that may warrant further investigation. Implementing an efficient petty cash system, supported by the San Jose California Petty Cash Form, is essential for businesses of all sizes to manage small outlays and maintain financial integrity. It provides a streamlined process for recording expenditures, minimizes the risk of errors, and ensures transparency in financial operations. In conclusion, the San Jose California Petty Cash Form is an integral document for businesses in the region to manage and monitor minor expenses accurately. While there may not be different types per se, customization and formatting variations can occur. By utilizing this form effectively, businesses can maintain accurate financial records and exercise better control over their petty cash expenditure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Formulario de caja chica - Petty Cash Form

Description

How to fill out San Jose California Formulario De Caja Chica?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including San Jose Petty Cash Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to document execution simple.

Here's how you can find and download San Jose Petty Cash Form.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the similar document templates or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase San Jose Petty Cash Form.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Jose Petty Cash Form, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to cope with an exceptionally complicated situation, we advise getting a lawyer to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!