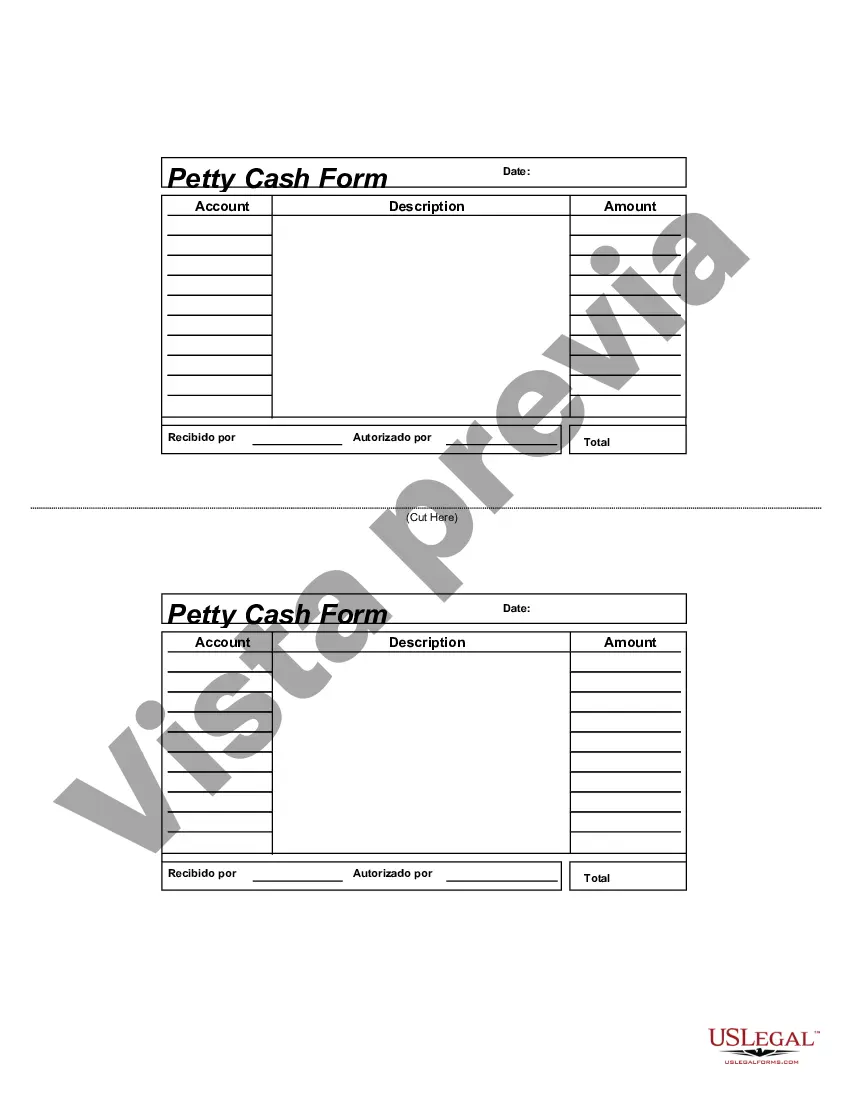

Tarrant Texas Petty Cash Form is a standardized document used in Tarrant County, Texas, to track and manage small, miscellaneous expenses incurred by various departments or individuals within the county organization. It serves as a record of cash disbursements made from a designated petty cash fund. The Tarrant Texas Petty Cash Form is designed to maintain transparency, accountability, and proper financial control over the county's petty cash transactions. It is typically utilized when immediate cash payments are necessary, such as purchasing office supplies, reimbursing small travel expenses, or covering minor emergency expenditures. The form captures essential details about each petty cash transaction, which includes: 1. Date: The date when the expense was incurred. 2. Payee: The name of the individual or organization receiving the cash. 3. Description: A brief explanation of the purpose or nature of the expense. 4. Amount: The monetary value disbursed. 5. Account Number: The account to which the expense will be charged. 6. Receipt: A receipt or invoice attached as support for the transaction. 7. Signature: The signature of the person requesting or approving the petty cash disbursement. Furthermore, Tarrant Texas may provide different types of Petty Cash Forms specific to various departments or purposes. Some common variations include: 1. General Petty Cash Form: This form is used for miscellaneous expenses incurred across multiple departments or needs within the county. 2. Department-Specific Petty Cash Form: Different county departments, such as Public Works, Human Resources, or Finance, may have unique forms tailored to their specific requirements and reporting structures. 3. Event or Project Petty Cash Form: In cases of events, programs, or projects requiring an independent petty cash fund, a specialized form may be used to track expenses solely related to that specific activity. By diligently completing and keeping records of the Tarrant Texas Petty Cash Form, the county ensures transparency, efficient management of small expenses, and the ability to accurately track and report financial disbursements for auditing purposes. It promotes a responsible fiscal culture within the county organization and helps prevent any misuse or mishandling of petty cash funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Formulario de caja chica - Petty Cash Form

Description

How to fill out Tarrant Texas Formulario De Caja Chica?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Tarrant Petty Cash Form, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the latest version of the Tarrant Petty Cash Form, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Tarrant Petty Cash Form:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Tarrant Petty Cash Form and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!