Phoenix, Arizona Purchasing Cost Estimate: A Comprehensive Analysis and Breakdown If you are considering purchasing a property in Phoenix, Arizona, it is vital to have a robust and accurate estimation of the purchasing cost involved. A Phoenix Arizona Purchasing Cost Estimate provides a detailed analysis and breakdown of the various expenses you will encounter during the property acquisition process. Types of Phoenix Arizona Purchasing Cost Estimates: 1. Home Purchase Cost Estimate: Whether you are buying a single-family home, a condominium, or a townhouse, this type of cost estimate covers the expenses associated with acquiring residential properties. It takes into consideration the purchase price, closing costs, property taxes, homeowner's insurance, and potential Homeowner Association (HOA) fees. 2. Commercial Property Purchase Cost Estimate: If you are interested in investing in commercial real estate in Phoenix, Arizona, this cost estimate provides a comprehensive overview of all the expenses involved. It factors in the property's purchase price, closing costs, property taxes, commercial insurance, and potential maintenance and repair costs. 3. Land Purchase Cost Estimate: For those interested in buying vacant land or undeveloped lots in Phoenix, Arizona, this cost estimate focuses on the expenses associated with land acquisition. It includes the purchase price, closing costs, property taxes, land surveys, environmental tests, and potential development costs. Key elements included in a Phoenix Arizona Purchasing Cost Estimate: 1. Purchase Price: The estimated market value of the property you intend to buy. 2. Closing Costs: This encompasses various charges, such as loan origination fees, appraisal fees, title search, title insurance, and attorney fees that you will incur at the closing of the property purchase. 3. Property Taxes: An estimation of the annual property taxes you will be responsible for paying based on the assessed value of the property. 4. Insurance Costs: The cost estimate assesses the homeowner's insurance rates or commercial insurance premiums required depending on the property type and its location. 5. Homeowner Association (HOA) Fees: If the property is part of an HOA, the cost estimate outlines the monthly or annual fees you have to pay for community maintenance, amenities, and other shared expenses. 6. Maintenance and Repair Costs: This covers the potential expenses associated with maintaining and repairing the property after purchase. It includes routine maintenance, repairs, and unforeseen repairs that might arise as part of homeownership. Remember that a reliable and accurate Phoenix Arizona Purchasing Cost Estimate is crucial for making informed decisions about your real estate investment. It allows you to plan your budget effectively and ensures you are financially prepared for all associated expenses.

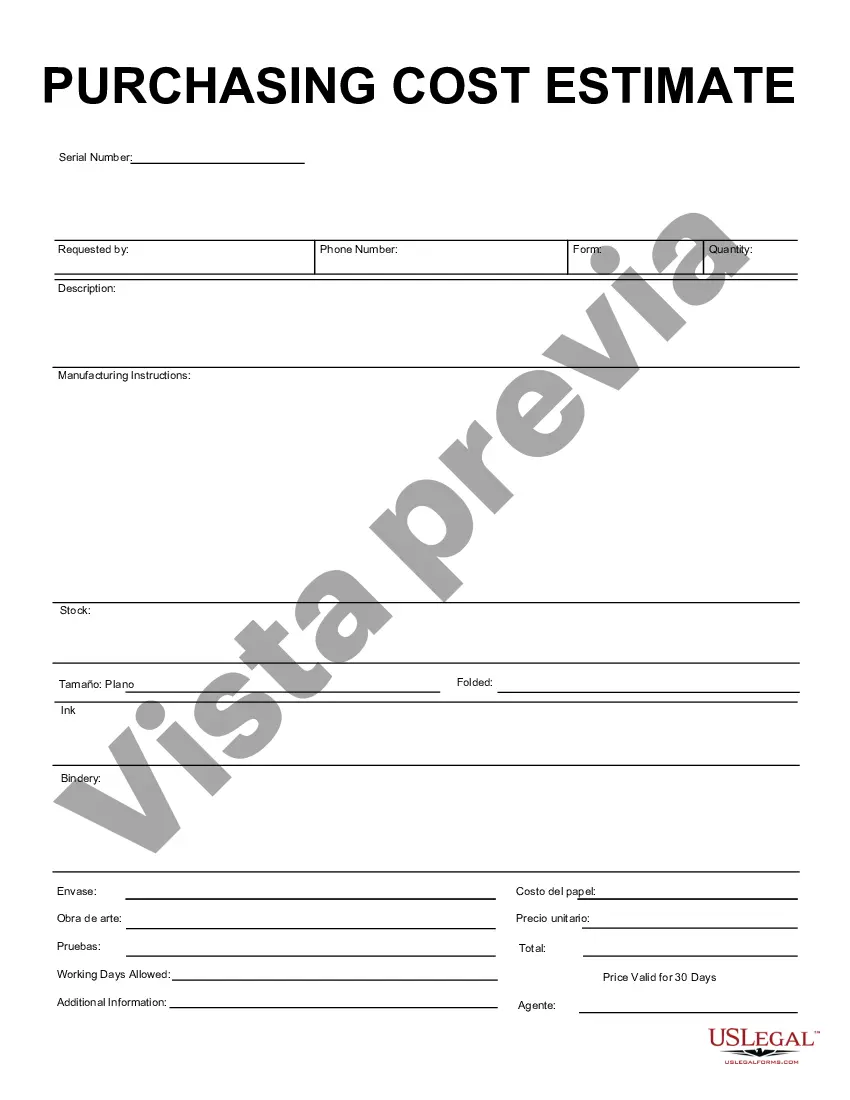

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Estimación del costo de compra - Purchasing Cost Estimate

Description

How to fill out Phoenix Arizona Estimación Del Costo De Compra?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business purpose utilized in your region, including the Phoenix Purchasing Cost Estimate.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Phoenix Purchasing Cost Estimate will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Phoenix Purchasing Cost Estimate:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Phoenix Purchasing Cost Estimate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!