Miami-Dade Florida Lost Receipt Form is a document utilized by the residents and visitors of Miami-Dade County to report lost receipts for various purposes, such as reimbursement, tax deductions, or record-keeping. This form is crucial in ensuring transparency and accountability in financial transactions, as it allows individuals to maintain accurate documentation of their expenses. The Miami-Dade Florida Lost Receipt Form serves as a legal record, providing detailed information about the lost receipt, including the date of the transaction, the name and address of the business or establishment, the total amount, and a brief description of the purchased items or services. Additionally, the form requires the claimant's personal information, including their name, contact details, and relevant identification numbers. This form is commonly used in different situations, and understanding its variations can be beneficial. Some types of Miami-Dade Florida Lost Receipt Forms include: 1. Miami-Dade Florida Lost Receipt for Expense Reimbursement Form: This form is used when individuals need to provide proof of expenses to their employers or organizations for reimbursement. It ensures that all lost receipts are documented, allowing claimants to maintain accurate expense records. 2. Miami-Dade Florida Lost Receipt for Tax Purposes Form: This form is essential when claiming tax deductions for business or personal expenses. It provides evidence of the expenditure and helps taxpayers justify their deduction claims to the tax authorities. 3. Miami-Dade Florida Lost Receipt for Business Expenses Form: This form is commonly used by business owners and self-employed individuals to track and record their business-related expenses. It plays a pivotal role during tax audits or financial assessments, enabling them to document their legitimate business costs. Regardless of the specific type, the Miami-Dade Florida Lost Receipt Form is a crucial tool in maintaining financial transparency and integrity. It ensures accurate record-keeping, facilitates reimbursement processes, supports tax deductions, and validates legitimate business expenses. By promptly filling out and submitting the form, individuals can mitigate the impact of lost receipts and safeguard their financial interests.

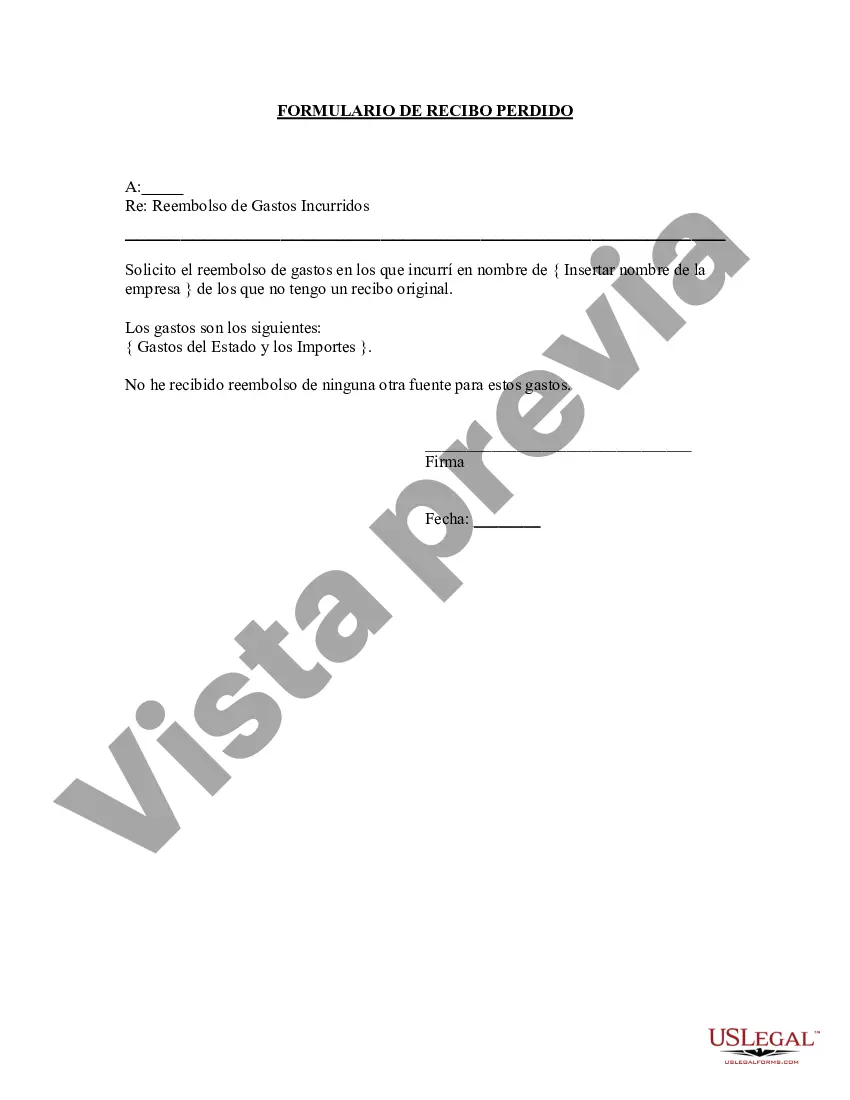

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Formulario de recibo perdido - Lost Receipt Form

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-190EM

Format:

Word

Instant download

Description

Este formulario puede enviarse a la nómina para recibir el reembolso de los gastos incurridos en el manejo de negocios de la compañía.

Miami-Dade Florida Lost Receipt Form is a document utilized by the residents and visitors of Miami-Dade County to report lost receipts for various purposes, such as reimbursement, tax deductions, or record-keeping. This form is crucial in ensuring transparency and accountability in financial transactions, as it allows individuals to maintain accurate documentation of their expenses. The Miami-Dade Florida Lost Receipt Form serves as a legal record, providing detailed information about the lost receipt, including the date of the transaction, the name and address of the business or establishment, the total amount, and a brief description of the purchased items or services. Additionally, the form requires the claimant's personal information, including their name, contact details, and relevant identification numbers. This form is commonly used in different situations, and understanding its variations can be beneficial. Some types of Miami-Dade Florida Lost Receipt Forms include: 1. Miami-Dade Florida Lost Receipt for Expense Reimbursement Form: This form is used when individuals need to provide proof of expenses to their employers or organizations for reimbursement. It ensures that all lost receipts are documented, allowing claimants to maintain accurate expense records. 2. Miami-Dade Florida Lost Receipt for Tax Purposes Form: This form is essential when claiming tax deductions for business or personal expenses. It provides evidence of the expenditure and helps taxpayers justify their deduction claims to the tax authorities. 3. Miami-Dade Florida Lost Receipt for Business Expenses Form: This form is commonly used by business owners and self-employed individuals to track and record their business-related expenses. It plays a pivotal role during tax audits or financial assessments, enabling them to document their legitimate business costs. Regardless of the specific type, the Miami-Dade Florida Lost Receipt Form is a crucial tool in maintaining financial transparency and integrity. It ensures accurate record-keeping, facilitates reimbursement processes, supports tax deductions, and validates legitimate business expenses. By promptly filling out and submitting the form, individuals can mitigate the impact of lost receipts and safeguard their financial interests.