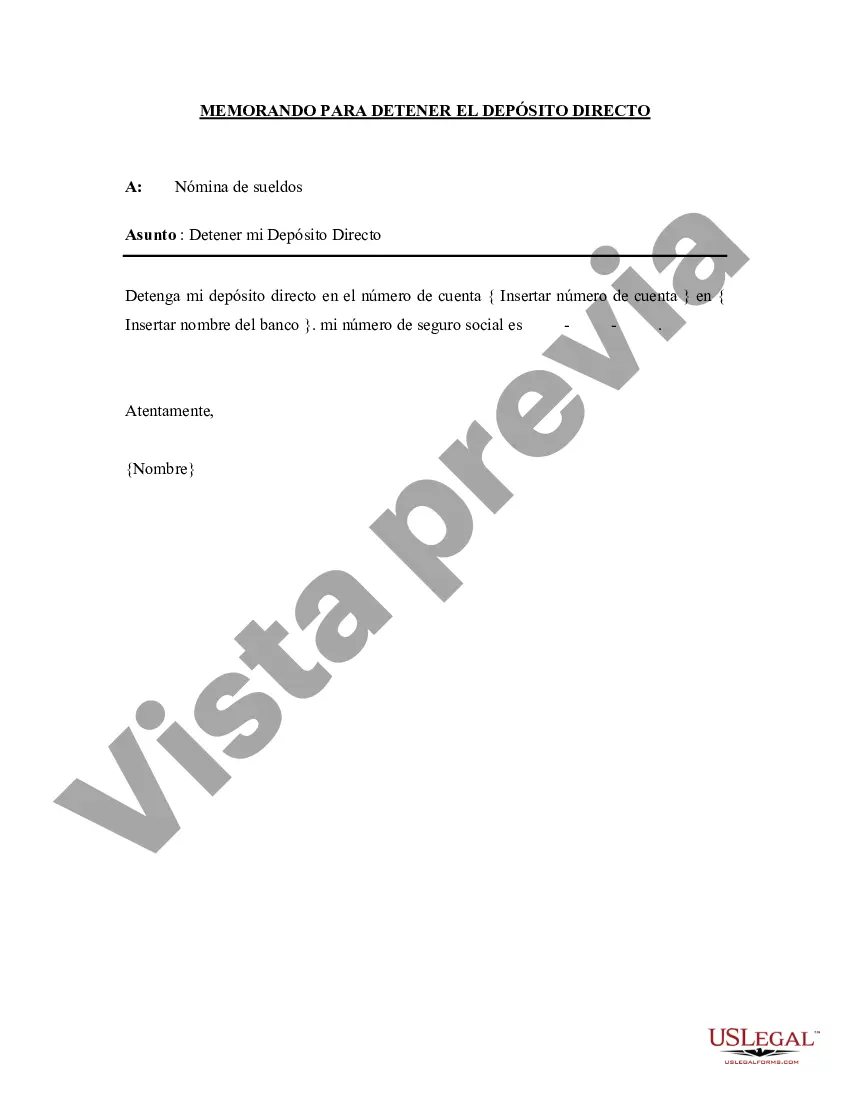

Title: Understanding the Clark Nevada Memorandum to Stop Direct Deposit: Types and Detailed Description Introduction: The Clark Nevada Memorandum to Stop Direct Deposit is an essential legal document that allows individuals to halt the direct deposit of their wages into a specific bank account. It offers flexibility by providing a method for employees and taxpayers to make changes to their payment arrangements. This detailed description will outline the different types of Clark Nevada Memorandums to Stop Direct Deposit and shed light on their significance. 1. Standard Clark Nevada Memorandum to Stop Direct Deposit: The standard type of Clark Nevada Memorandum to Stop Direct Deposit is the most commonly used document for individuals who wish to discontinue their direct deposit arrangements. It is typically dealt with by payroll or human resources departments and requires the employee's signature. By completing this memorandum, employees can switch to receiving physical paychecks if desired or update their banking information. 2. Clark Nevada Memorandum to Stop Direct Deposit for Tax Refunds: This specific type of memorandum pertains to taxpayers who want to stop having their tax refunds directly deposited into their bank accounts. It allows individuals to receive their tax refunds via other methods, such as paper checks, prepaid cards, or electronic fund transfers to alternative accounts. This memorandum is crucial for taxpayers looking to make changes to their refund delivery mechanism. 3. Clark Nevada Memorandum to Modify Direct Deposit: While not explicitly stopping direct deposit, this memorandum enables individuals to modify their existing direct deposit arrangements. It is commonly used when individuals want to change their banking information, such as the routing or account numbers, or shift funds between different accounts. By completing this memorandum, individuals can update their direct deposit instructions seamlessly. 4. Clark Nevada Memorandum to Temporarily Halt Direct Deposit: This memorandum grants individuals the option to temporarily stop their direct deposits. It is often utilized during time-sensitive situations like extended leaves of absence, medical emergencies, or other personal circumstances that require a temporary disruption of regular direct deposit processes. Once the situation resolves, individuals can ease back into their usual direct deposit arrangements. Conclusion: The Clark Nevada Memorandum to Stop Direct Deposit provides essential flexibility for individuals to manage their payment preferences effectively. Whether one wants to completely terminate direct deposit, modify existing arrangements, change tax refund preferences, or temporarily halt deposits, these different types of memorandums cater to varied needs. It is vital to understand the specific document required and complete it accurately to ensure desired changes to direct deposit arrangements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Memorándum para detener el depósito directo - Memorandum to Stop Direct Deposit

Description

How to fill out Clark Nevada Memorándum Para Detener El Depósito Directo?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Clark Memorandum to Stop Direct Deposit, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the Clark Memorandum to Stop Direct Deposit, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Clark Memorandum to Stop Direct Deposit:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Clark Memorandum to Stop Direct Deposit and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!