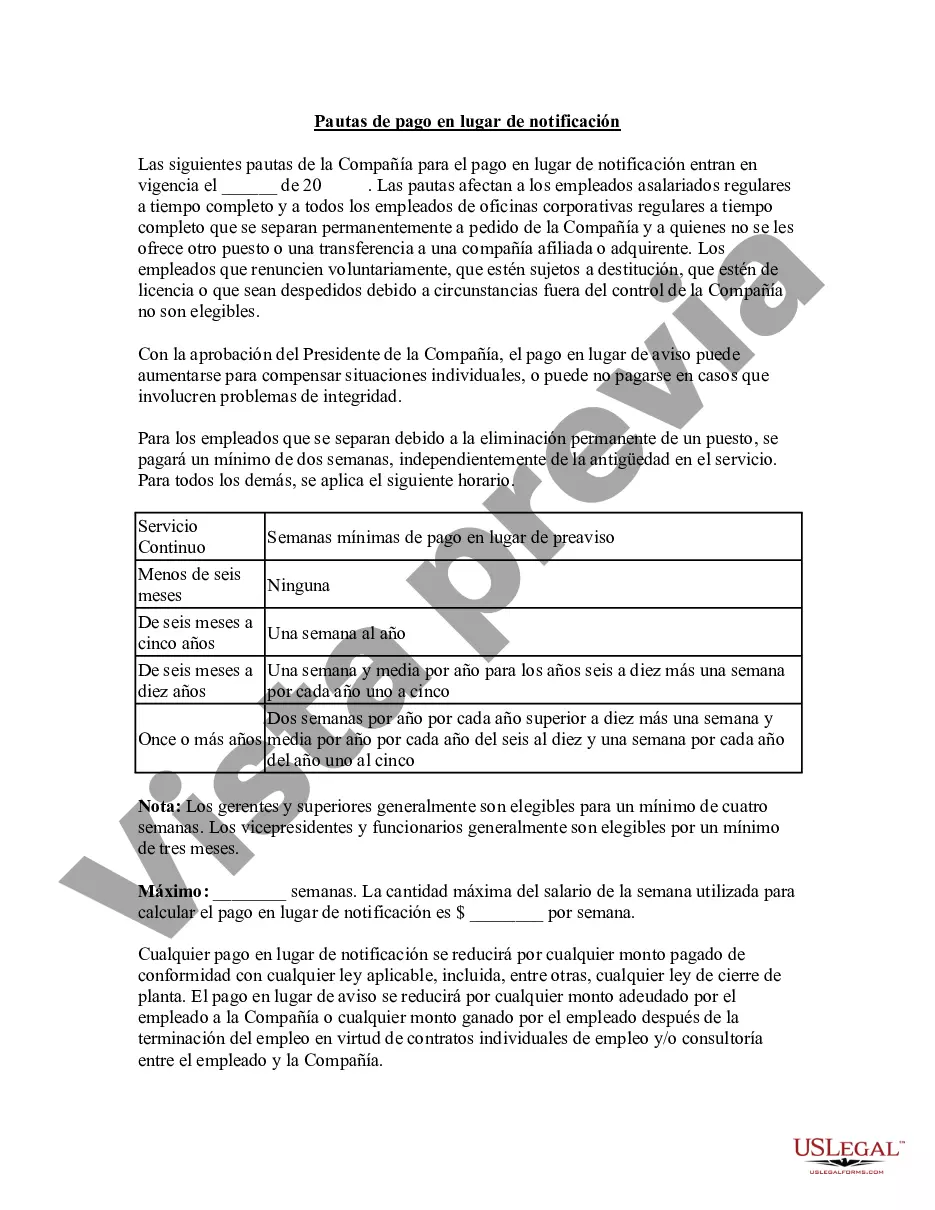

Bronx New York Pay in Lieu of Notice Guidelines, also known as the Bronx Pilot Guidelines, refer to the regulations governing the compensation an employer must provide to employees when terminating their employment without providing the mandated notice period. These guidelines are crucial in ensuring fair treatment and remuneration during job transitions in the Bronx, New York. The Bronx Pilot Guidelines outline the specific requirements that employers must adhere to when terminating employees without prior notice. It is important to note that different scenarios might warrant various guidelines, which include: 1. Collective Bargaining Agreements (CBA): In cases where employees are covered by collective bargaining agreements, the Bronx Pilot Guidelines serve as a framework to establish pay in lieu of notice. Such agreements typically detail the provisions for job termination and the corresponding compensation. 2. Employment Contracts: Employees with individual employment contracts may stipulate specific terms and conditions regarding pay in lieu of notice. These contracts should align with the Bronx Pilot Guidelines while also factoring in any unique provisions within the agreement. 3. Minimum Wage and Labor Laws: All Bronx employers must comply with federal, state, and local labor laws, including minimum wage requirements. The Bronx Pilot Guidelines ensure that employees receive proper pay in lieu of notice, irrespective of their position or remuneration. Under the Bronx Pilot Guidelines, employers are obligated to compensate employees for the notice period they were entitled to receive. This compensation should correspond to the average regular wages earned by the employee, including overtime or any other additional pay received. To calculate the pay in lieu of notice, the Bronx Pilot Guidelines typically rely on the following factors: 1. Base Pay Rate: The regular hourly wage or salary an employee was earning at the time of termination serves as the foundation for calculating pay in lieu of notice. 2. Average Regular Hours Worked: If an employee has consistently worked a set number of hours, this average is used to determine the payment for the notice period. 3. Additional Compensation: Overtime pay, bonuses, commissions, or any other regular compensation received by the employee should be included in the pay in lieu of notice calculation. 4. Accrued Benefits: In addition to wages, employers may need to consider accrued benefits such as vacation days or sick leave, ensuring their inclusion in the overall compensation package. It is essential for employers in the Bronx to familiarize themselves with the specific Bronx New York Pay in Lieu of Notice Guidelines relevant to their particular circumstances. Ensuring compliance with these guidelines not only protects employees' rights but also safeguards employers from potential legal issues related to improper compensation during termination. Employers should seek professional advice or consult the New York State Department of Labor for comprehensive information on Bronx Pilot Guidelines.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Pautas de pago en lugar de notificación - Pay in Lieu of Notice Guidelines

Description

How to fill out Bronx New York Pautas De Pago En Lugar De Notificación?

Do you need to quickly draft a legally-binding Bronx Pay in Lieu of Notice Guidelines or probably any other form to manage your personal or corporate affairs? You can go with two options: hire a legal advisor to write a valid document for you or draft it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including Bronx Pay in Lieu of Notice Guidelines and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, carefully verify if the Bronx Pay in Lieu of Notice Guidelines is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the form isn’t what you were seeking by using the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Bronx Pay in Lieu of Notice Guidelines template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!