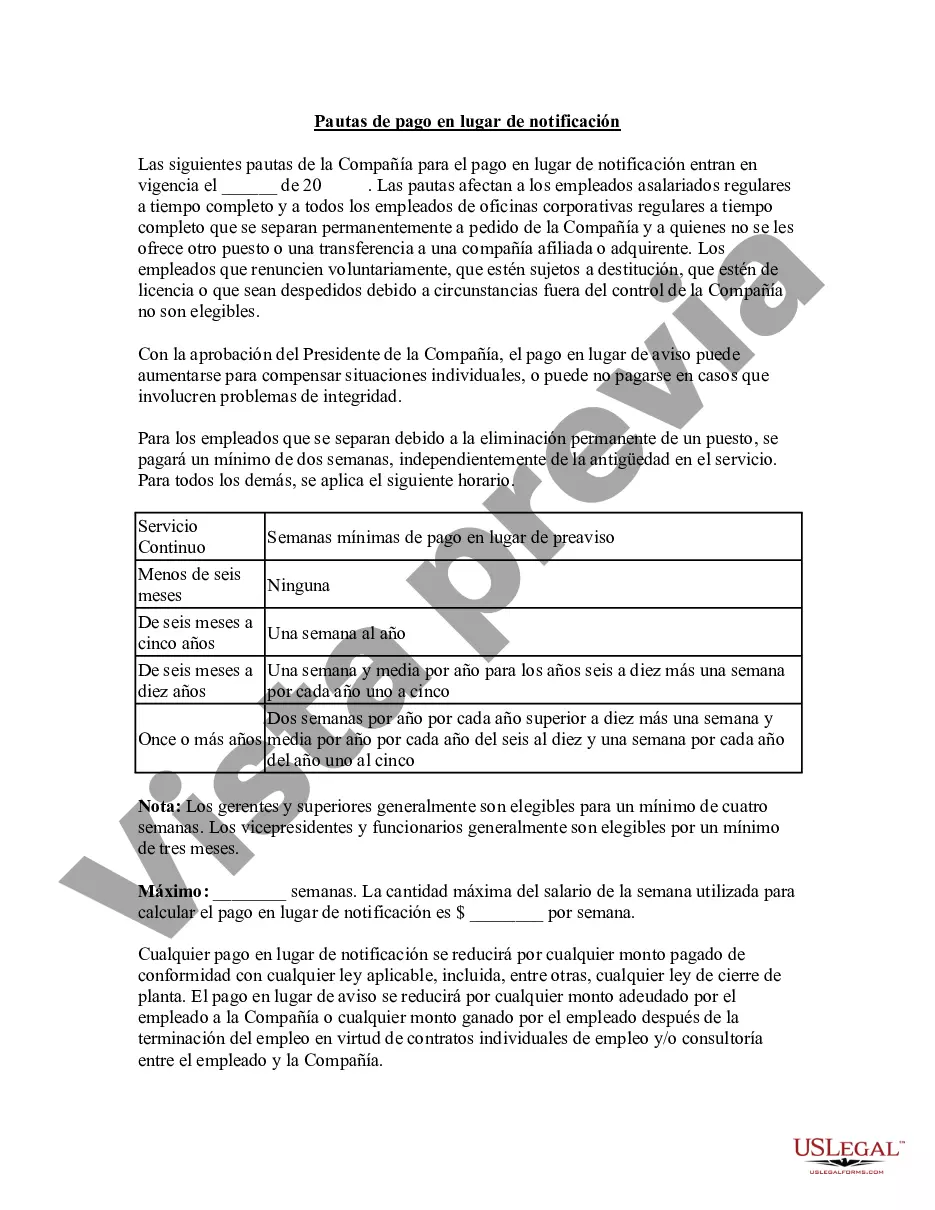

Dallas Texas Pay in Lieu of Notice Guidelines refer to the state-specific regulations and requirements that outline the compensation provided to employees when an employer terminates their employment without giving the required notice period. This legal provision allows the employer to pay the employee a certain amount of money as a substitute for the notice period they would have received if they were not terminated. In regard to the different types of Pay in Lieu of Notice Guidelines in Dallas, Texas, there are no specific variations within the region. However, it is essential to note that the guidelines may differ across different states in the US. The Pay in Lieu of Notice Guidelines are crucial in ensuring that terminated employees receive fair compensation for the loss of their employment without sufficient warning. By complying with these guidelines, employers avoid potential legal disputes and negative repercussions or damage to their reputation. Key factors to consider when understanding Dallas Texas Pay in Lieu of Notice Guidelines include: 1. Notice Period: The guidelines specify the minimum length of notice that employers are required to provide to employees before terminating their employment. If an employer fails to provide this notice, they must adhere to the pay in lieu of notice provision. 2. Calculation of Compensation: The specific calculation method to determine the pay in lieu of notice varies. However, it often involves considering factors such as the employee's length of service, position, and salary. 3. Wage Considerations: Employers must also calculate pay in lieu of notice while considering other wage-related aspects such as overtime, bonuses, commissions, and any benefits or entitlements that the employee would have received during the notice period. 4. Legal Compliance: Employers must ensure that their pay in lieu of notice practices align with both federal and state employment laws, including adherence to minimum wage requirements, taxes, and payroll regulations. 5. Employee Rights: It is imperative that employees understand their rights regarding pay in lieu of notice and should seek legal advice if they believe they have not received adequate compensation. Employers in Dallas, Texas, should familiarize themselves with the specific guidelines outlined by the Texas Workforce Commission (TWC) and consult legal professionals to ensure compliance with all the necessary regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Pautas de pago en lugar de notificación - Pay in Lieu of Notice Guidelines

Description

How to fill out Dallas Texas Pautas De Pago En Lugar De Notificación?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Dallas Pay in Lieu of Notice Guidelines without professional assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Dallas Pay in Lieu of Notice Guidelines on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Dallas Pay in Lieu of Notice Guidelines:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!