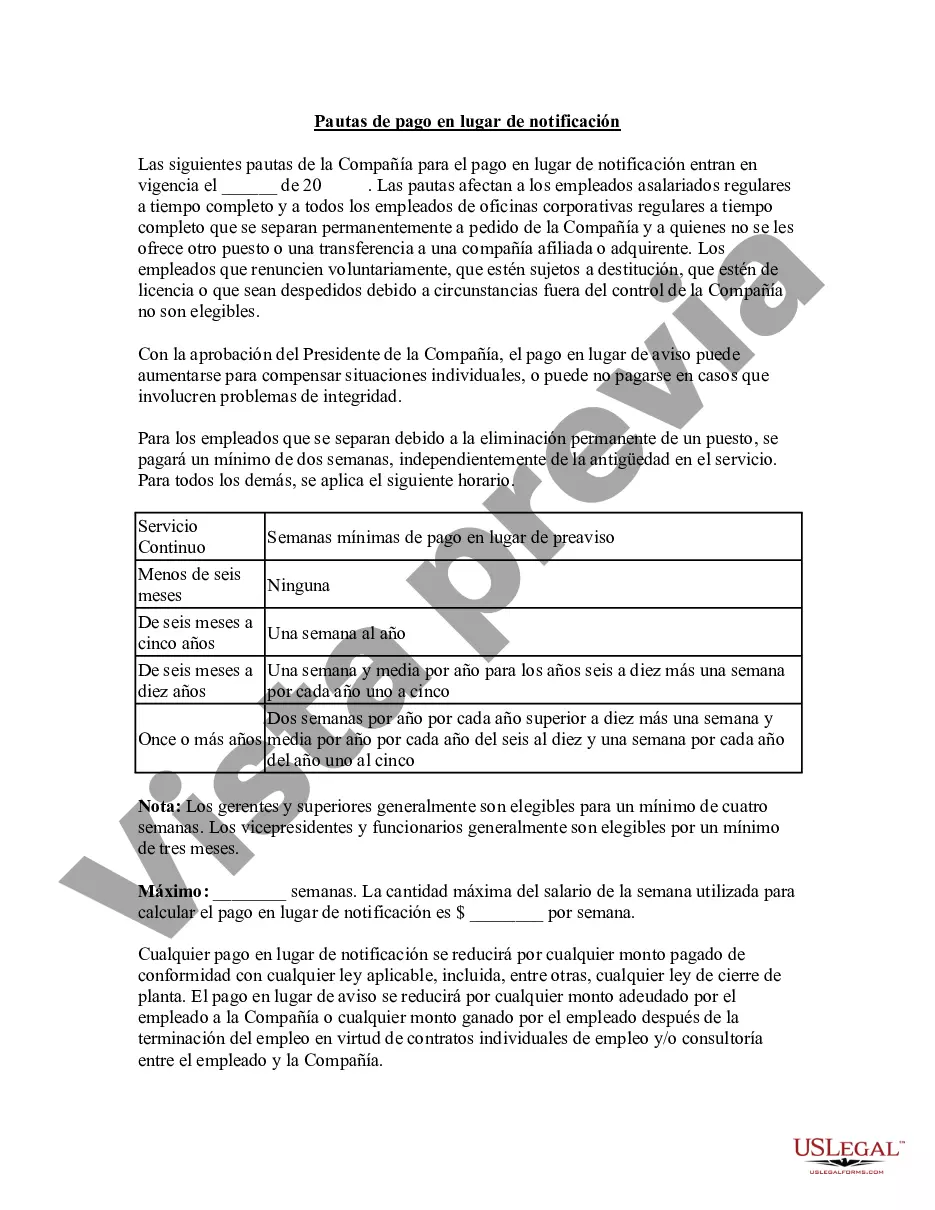

Oakland Michigan Pay in Lieu of Notice Guidelines are the regulations and provisions established by the county of Oakland, Michigan, regarding the compensation an employer is required to provide an employee who is terminated without receiving proper advanced notice. Pay in Lieu of Notice (PILOT) refers to the monetary amount an employee is entitled to receive instead of serving out their notice period. These guidelines are designed to protect the rights and financial well-being of employees who are faced with sudden termination or layoff. By enacting these guidelines, Oakland County ensures that employees are fairly compensated during the transition period and are not left financially stranded. Key provisions included in Oakland Michigan Pay in Lieu of Notice Guidelines may cover the following aspects: 1. Eligibility: The guidelines establish the eligibility criteria for employees to qualify for pay in lieu of notice. Factors such as length of employment, type of contract, and reason for termination are considered to determine entitlement. 2. Notice Period: The guidelines set out specific notice periods that an employer should provide to employees before termination. If proper notice is not given, the employer must provide pay in lieu of notice as compensation. 3. Calculation of Payment: The guidelines define the method of calculating the pay in lieu of notice. Typically, it is calculated based on the employee's regular wages, including any applicable benefits, bonuses, or allowances. 4. Exemptions: Certain categories of employees may be exempted from receiving pay in lieu of notice, such as those engaged in temporary or seasonal work, or individuals dismissed for gross misconduct. 5. Reporting Procedures: The guidelines stipulate the reporting procedures and timelines for both employers and employees to ensure transparent and efficient processing of pay in lieu of notice claims. It is essential to note that there may be variations or different types of Oakland Michigan Pay in Lieu of Notice Guidelines, depending on the specific sector or industry. For example, there might be separate guidelines for public sector employees, unionized workers, or employees covered under specific collective bargaining agreements. Understanding and adhering to Oakland Michigan Pay in Lieu of Notice Guidelines not only protects the rights of employees but also promotes fair and ethical employment practices within the county. Employers must familiarize themselves with these guidelines to avoid non-compliance and potential legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Pautas de pago en lugar de notificación - Pay in Lieu of Notice Guidelines

Description

How to fill out Oakland Michigan Pautas De Pago En Lugar De Notificación?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Oakland Pay in Lieu of Notice Guidelines without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Oakland Pay in Lieu of Notice Guidelines by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Oakland Pay in Lieu of Notice Guidelines:

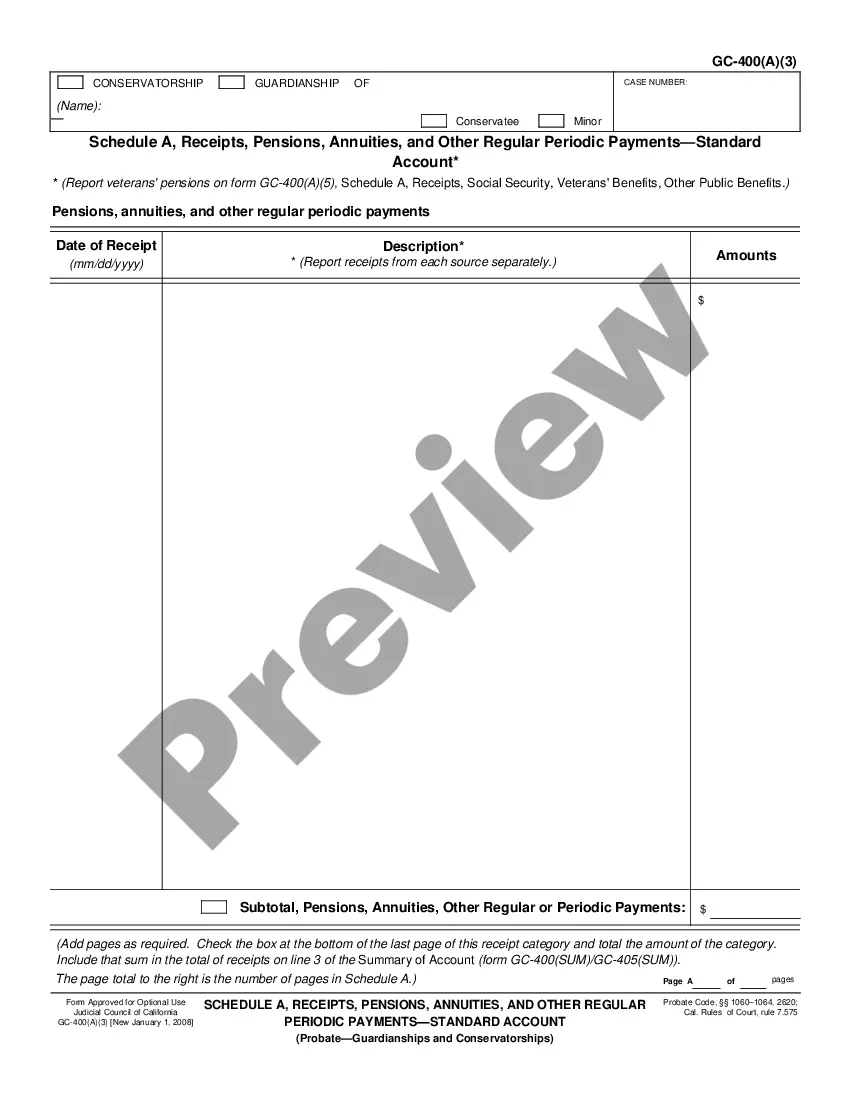

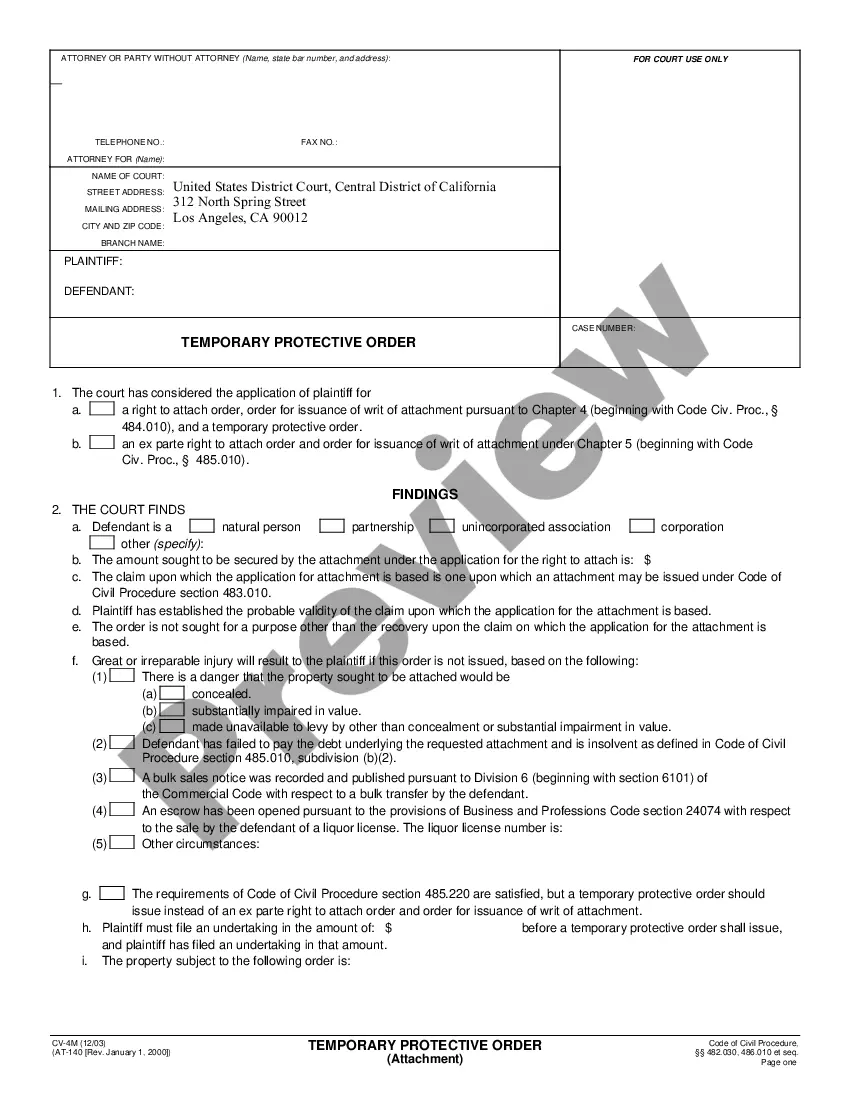

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!