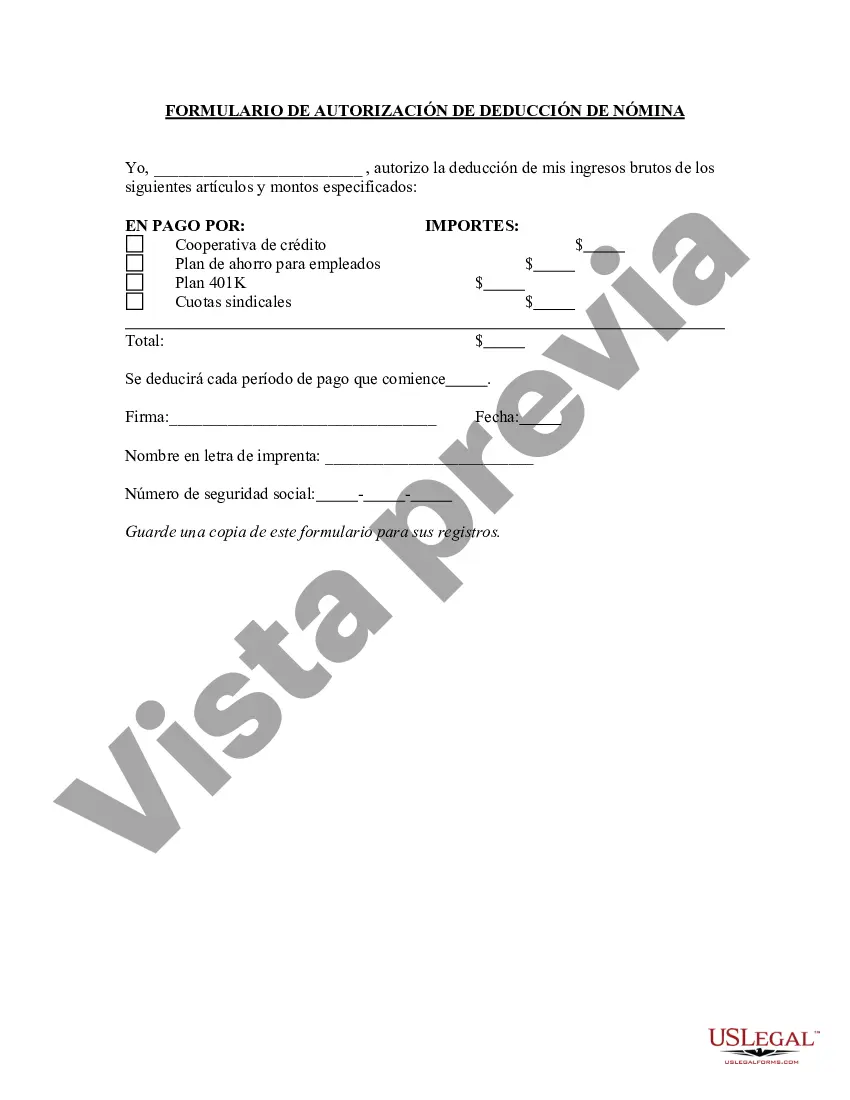

Allegheny Pennsylvania Payroll Deduction Authorization Form is a document used by employers in Allegheny County, Pennsylvania to request permission from their employees to deduct specific amounts of money from their wages or salary. This form grants consent for various reasons such as health insurance premiums, retirement contributions, union dues, charitable donations, or any other authorized deductions. The purpose of the Allegheny Pennsylvania Payroll Deduction Authorization Form is to ensure that both the employer and the employee are in agreement regarding the deductions made from the employee's paycheck. This form serves as a legal agreement between the two parties, outlining the specific details of the authorized deduction. Some relevant keywords associated with Allegheny Pennsylvania Payroll Deduction Authorization Form include: 1. Allegheny Pennsylvania: Referring to the specific geographic location where the form is applicable, Allegheny County in Pennsylvania. 2. Payroll Deduction: The act of deducting specific amounts of money from an employee's wages or salary. 3. Authorization Form: The document that grants permission for deductions to be made from the employee's paycheck. 4. Employer: The individual or organization that hires and pays employees. 5. Employee: The individual who works for the employer and receives wages or salary. 6. Deductions: The specific amounts of money taken from the employee's paycheck for various purposes. 7. Health Insurance Premiums: The payments required by employees for coverage under a health insurance plan. 8. Retirement Contributions: The funds deducted from an employee's wages or salary to contribute towards their retirement savings account. 9. Union Dues: Financial obligations paid to a labor union by its members. 10. Charitable Donations: Voluntary contributions made by employees to charitable organizations. While there may not be different types of Allegheny Pennsylvania Payroll Deduction Authorization Forms, the specific deductions authorized on the form may vary depending on the employer's policies and the employee's individual choices. Therefore, employees may need to fill out separate forms for different types of deductions such as health insurance, retirement contributions, or charitable donations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Allegheny Pennsylvania Formulario De Autorización De Deducción De Nómina?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Allegheny Payroll Deduction Authorization Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how you can find and download Allegheny Payroll Deduction Authorization Form.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Allegheny Payroll Deduction Authorization Form.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Allegheny Payroll Deduction Authorization Form, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you need to deal with an exceptionally difficult case, we advise getting a lawyer to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!