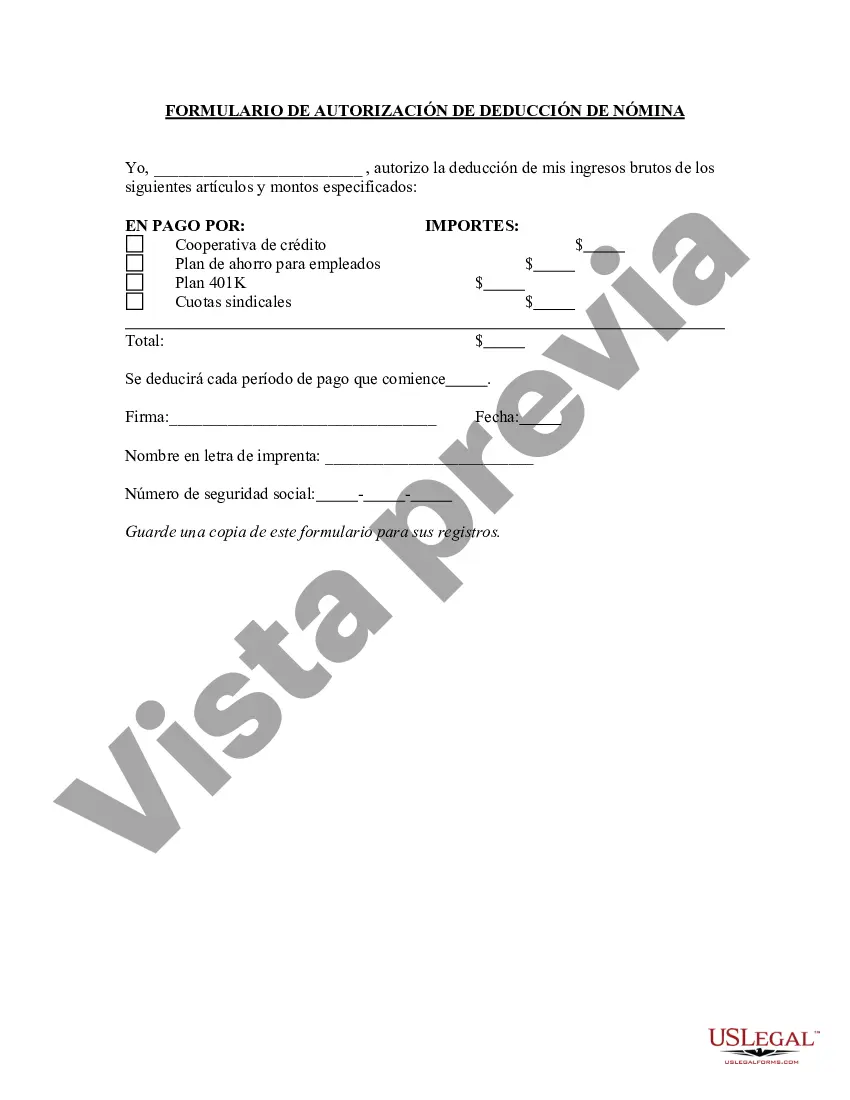

The Bronx New York Payroll Deduction Authorization Form is a document used by employers and employees in the Bronx, New York, to establish and authorize payroll deductions for various purposes. This form allows employees to consent to having specific amounts deducted from their paychecks, which are then allocated towards designated expenses or contributions. By completing this form, employees grant permission to their employers to deduct the specified amounts directly from their wages. The Bronx New York Payroll Deduction Authorization Form is crucial for employees who wish to manage their financial obligations conveniently and securely. It simplifies the process of automatic deductions, ensuring that the designated funds are consistently and accurately deducted from each paycheck. This form helps employees save time and effort by eliminating the need for manual payments or transfers. There are various types of Bronx New York Payroll Deduction Authorization Forms catering to different purposes. Some common types include: 1. Retirement Savings Contributions: This form authorizes employers to deduct specific amounts from an employee's paycheck and contribute them towards retirement savings plans, such as 401(k) or 403(b) accounts. It enables individuals to invest in their future and build a secure financial foundation. 2. Health Insurance Premiums: This form allows employees to authorize deductions from their wages to cover health insurance premiums. These deductions ensure that employees maintain continuous coverage and alleviate the burden of making separate monthly payments for their health insurance plans. 3. Union Dues: Employees who are part of a union may need to complete a Payroll Deduction Authorization Form to allow their employers to deduct union dues directly from their paychecks. This form ensures timely and accurate payments towards union membership fees, supporting the collective efforts and representation of the union. 4. Charitable Contributions: Certain employers provide their employees with the option to contribute a portion of their earnings to charitable organizations. By completing the Payroll Deduction Authorization Form, employees can specify the amount they wish to donate from each paycheck. This form streamlines the process and encourages philanthropy among employees. It is important for both employers and employees to ensure the accuracy and completeness of the Bronx New York Payroll Deduction Authorization Form. Employers must handle these forms securely and adhere to legal guidelines while processing payroll deductions. Employees should carefully review the form, understand the deductions being authorized, and seek clarification if needed before submitting it to their employers. In summary, the Bronx New York Payroll Deduction Authorization Form is a significant document that facilitates efficient payroll management. It offers employees the convenience and control to allocate their wages towards retirement savings, healthcare, union dues, and charitable contributions. By simplifying the process of deductions, this form assists in meeting financial obligations while ensuring accuracy and consistency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Bronx New York Formulario De Autorización De Deducción De Nómina?

If you need to find a reliable legal form supplier to obtain the Bronx Payroll Deduction Authorization Form, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it simple to get and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Bronx Payroll Deduction Authorization Form, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

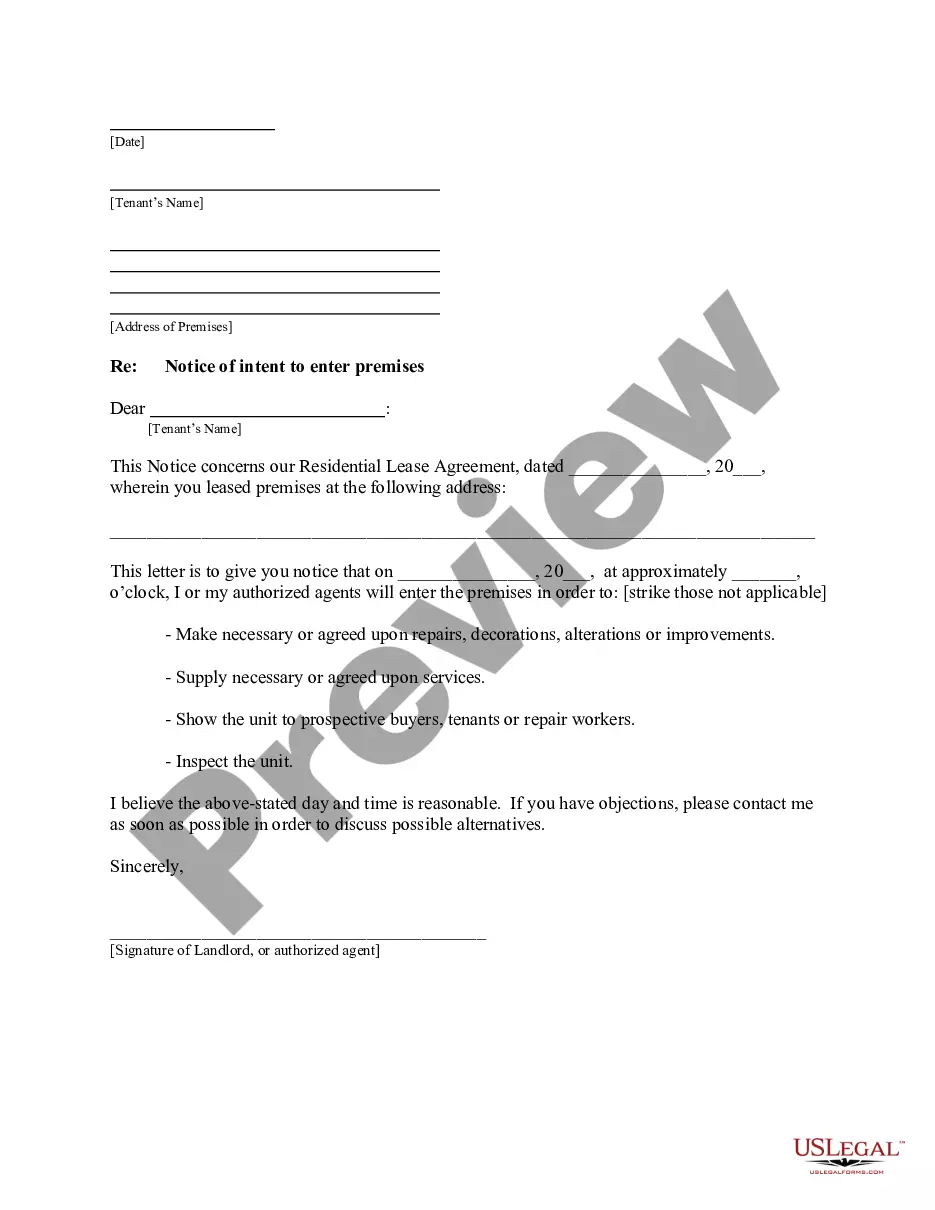

Don't have an account? It's effortless to get started! Simply find the Bronx Payroll Deduction Authorization Form template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Bronx Payroll Deduction Authorization Form - all from the convenience of your home.

Sign up for US Legal Forms now!