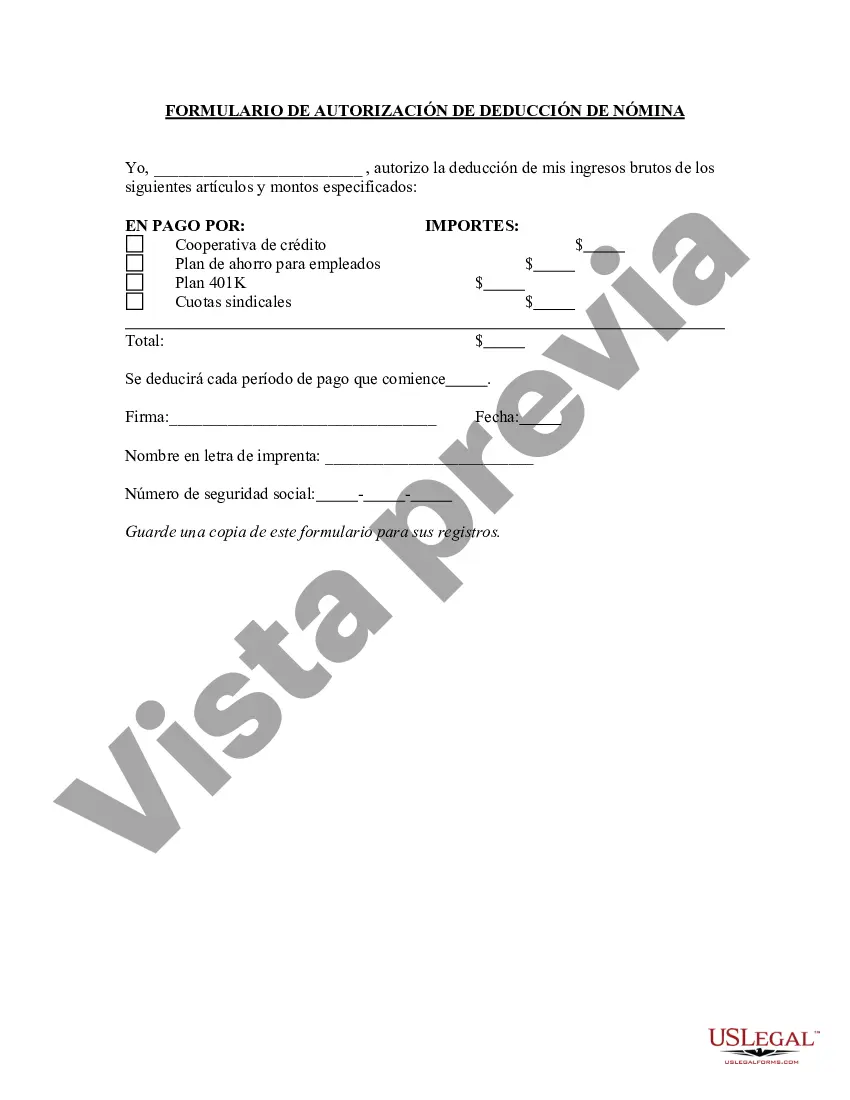

The Chicago Illinois Payroll Deduction Authorization Form is a crucial document used in the city of Chicago to authorize deductions from an employee's paycheck. This form grants an employer the authority to deduct certain amounts directly from an employee's wages, allowing for convenient and automated payments towards various obligations. Keywords: Chicago Illinois, Payroll Deduction Authorization Form, deductions, employee, paycheck, employer, wages, automated payments, obligations. There are different types of Chicago Illinois Payroll Deduction Authorization Forms, varying based on the purpose of the deduction. Here are a few examples: 1. Chicago Illinois Payroll Deduction Authorization Form for Taxes: This form authorizes the employer to deduct federal, state, or local taxes directly from an employee's wages, ensuring accurate and timely tax payments. 2. Chicago Illinois Payroll Deduction Authorization Form for Retirement Contributions: This form allows employees to authorize their employer to deduct a specific amount from their paycheck as a contribution towards their retirement fund, such as a 401(k) or pension plan. 3. Chicago Illinois Payroll Deduction Authorization Form for Health Insurance Premiums: This form enables employees to authorize their employer to deduct a predetermined portion of their wages to cover health insurance premiums, ensuring consistent and hassle-free premium payments. 4. Chicago Illinois Payroll Deduction Authorization Form for Loan Repayments: This form allows employees to authorize their employer to deduct loan repayments, such as student loans or other personal loans, directly from their paycheck, ensuring regular payments and avoiding any missed deadlines. 5. Chicago Illinois Payroll Deduction Authorization Form for Union Dues: This form gives employees the ability to authorize their employer to deduct union dues from their wages, ensuring seamless payment to the respective union and maintaining good standing with the organization. 6. Chicago Illinois Payroll Deduction Authorization Form for Charitable Contributions: This form offers employees the option to authorize deductions from their paycheck towards charitable organizations or non-profit entities, allowing for easy and consistent contributions to their chosen causes. These various types of Chicago Illinois Payroll Deduction Authorization Forms ensure transparency, efficiency, and compliance with regulations in facilitating different types of deductions from employee wages. It is essential for employees to carefully review and complete the appropriate form that aligns with their deduction needs, ensuring accurate processing and avoiding any complications or misunderstandings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Chicago Illinois Formulario De Autorización De Deducción De Nómina?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Chicago Payroll Deduction Authorization Form, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Chicago Payroll Deduction Authorization Form from the My Forms tab.

For new users, it's necessary to make several more steps to get the Chicago Payroll Deduction Authorization Form:

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Como llenar un W4 Completa tu informacion personal. La primera seccion te pide que completes tu informacion personal.Agrega otros ingresos. En esta seccion del W4 es donde agregas la informacion sobre otros ingresos que llegan a tu hogar.Estimado de deducciones. La seccion 4 es opcional.Firmar y colocar la fecha.

El Formulario W-4 (SP) le indica a usted, como empleador, el estado civil, los ajustes por multiples empleos, las cantidades de creditos, otros ingresos y deducciones del empleado, ademas de toda cantidad adicional a retener de la paga del empleado.

De ahi, el 8,5 % lo paga el empleador y el 4 % el trabajador. En el caso del salario minimo, el porcentaje del trabajador corresponde a $40.000. En otras palabras, el descuento por pension y salud es del 8 % de su salario.

El Formulario W-2 contiene informacion importante sobre el ingreso que ganaste a traves de tu empleador, cantidad de impuestos retenidos de tu cheque salarial, beneficios provistos y otra informacion para el ano. Utilizaras este formulario para presentar tus impuestos federales y estatales.

W2 vs W4: Comparacion W2 vs W4W4PropositoAyuda al empleador a determinar cuanto retener de los cheques de pago de los empleados para fines fiscales.Llenado y envioLo llena el empleado y se lo presenta al empleador.2 more rows

Conceptos o valores que se deducen de la nomina. Aportes a salud. El trabajador debe estar afiliado al sistema de salud.Aportes a pension.Fondo de solidaridad pensional.Cuotas sindicales.Aportes a cooperativas.Embargos judiciales.Cuotas de creditos a entidades financieras:Deudas del empleado con la empresa.

Dichas deducciones se dividen en: contingencias comunes (4,70%), desempleo (1,55% si el contrato es de tipo indefinido o 1,60% si el contrato es de duracion determinada), formacion profesional (0,10%), horas extraordinarias normales (4,70%) y horas extraordinarias de fuerza mayor (2%).

Cuales son las deducciones de la Seguridad Social ContingenciasEmpresarioTotalDesempleo contrato general5,50 %7,05 %Contrato de duracion determinada a tiempo completo6,70 %8,30 %Contrato de duracion determinada a tiempo parcial6,70 %8,30 %Fogasa0,20 %0,20 %7 more rows ?

Formulario W-2 Este formulario muestra los salarios pagados e impuestos retenidos durante el ano para cada empleado. Ya que los beneficios de Seguro Social y de Medicare de los empleados se calculan segun la informacion en el Formulario W-2, es muy importante preparar el Formulario W-2 de manera correcta y puntual.

En el caso de la salud, el aporte total es del 12,5 %, de este porcentaje el 8,5 % lo paga el empleador y el 4 % el trabajador. Asi las cosas, el descuento por pension y salud es del 8 % de su salario si es empleado y la ARL y el pago a cajas de compensacion lo asume el empleador.