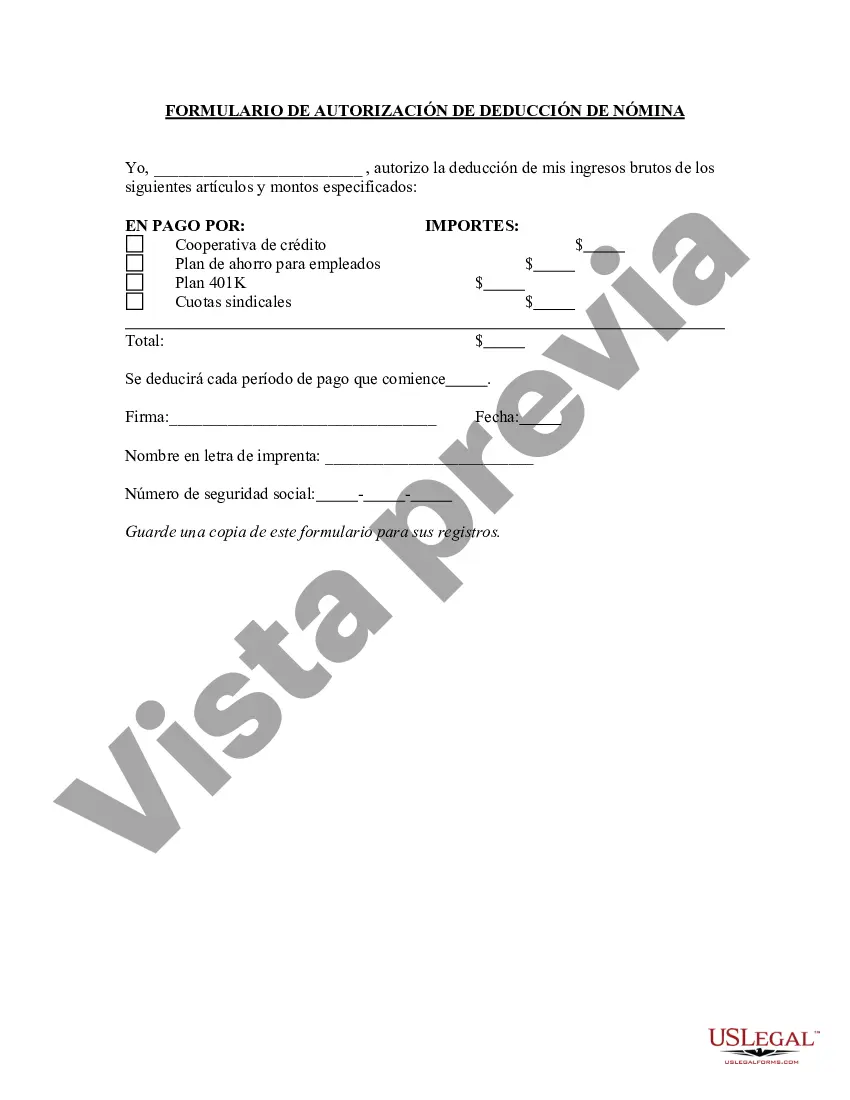

Cook Illinois Payroll Deduction Authorization Form is a crucial document used by employees to grant authorization to the employer to deduct specific amounts from their paycheck. This form outlines important details such as the purpose of the deduction, the amount to be deducted, and the duration of the authorization. The Cook Illinois Payroll Deduction Authorization Form is an essential tool for employees who wish to contribute to various programs or services offered by Cook Illinois. By completing this form, employees can participate in a range of voluntary deductions, including health insurance premiums, retirement savings plans, wellness programs, charitable donations, and more. Different types of Cook Illinois Payroll Deduction Authorization Forms exist to cater to the diverse needs and preferences of employees. These may include: 1. Health Insurance Deduction Authorization Form: This form allows employees to authorize the deduction of health insurance premiums from their paycheck, ensuring seamless coverage and hassle-free payments. 2. Retirement Savings Deduction Authorization Form: With this form, employees can set up regular deductions towards their retirement savings plan, such as a 401(k) or IRA account, ultimately securing their financial future. 3. Charitable Donation Deduction Authorization Form: Cook Illinois encourages employees to support charitable organizations of their choice. Through this form, individuals can specify the amount they wish to contribute, enabling effortless donations directly from their paycheck. 4. Wellness Program Deduction Authorization Form: Cook Illinois promotes employee wellness and offers various wellness programs. Employees can use this form to authorize deductions for fitness memberships, health coaching sessions, or participation fees in wellness activities. 5. Education Fund Deduction Authorization Form: To support employees pursuing higher education, Cook Illinois may offer education funds or reimbursement programs. This form allows employees to authorize deductions towards such programs, helping them finance their educational endeavors. By offering diverse options through these various Cook Illinois Payroll Deduction Authorization Forms, employees can conveniently manage their deductions, contribute to important programs, and enjoy the associated benefits. It is crucial for employees to carefully review and complete the form, ensuring accuracy and adherence to the established procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Cook Illinois Formulario De Autorización De Deducción De Nómina?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Cook Payroll Deduction Authorization Form, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the latest version of the Cook Payroll Deduction Authorization Form, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Payroll Deduction Authorization Form:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Cook Payroll Deduction Authorization Form and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!