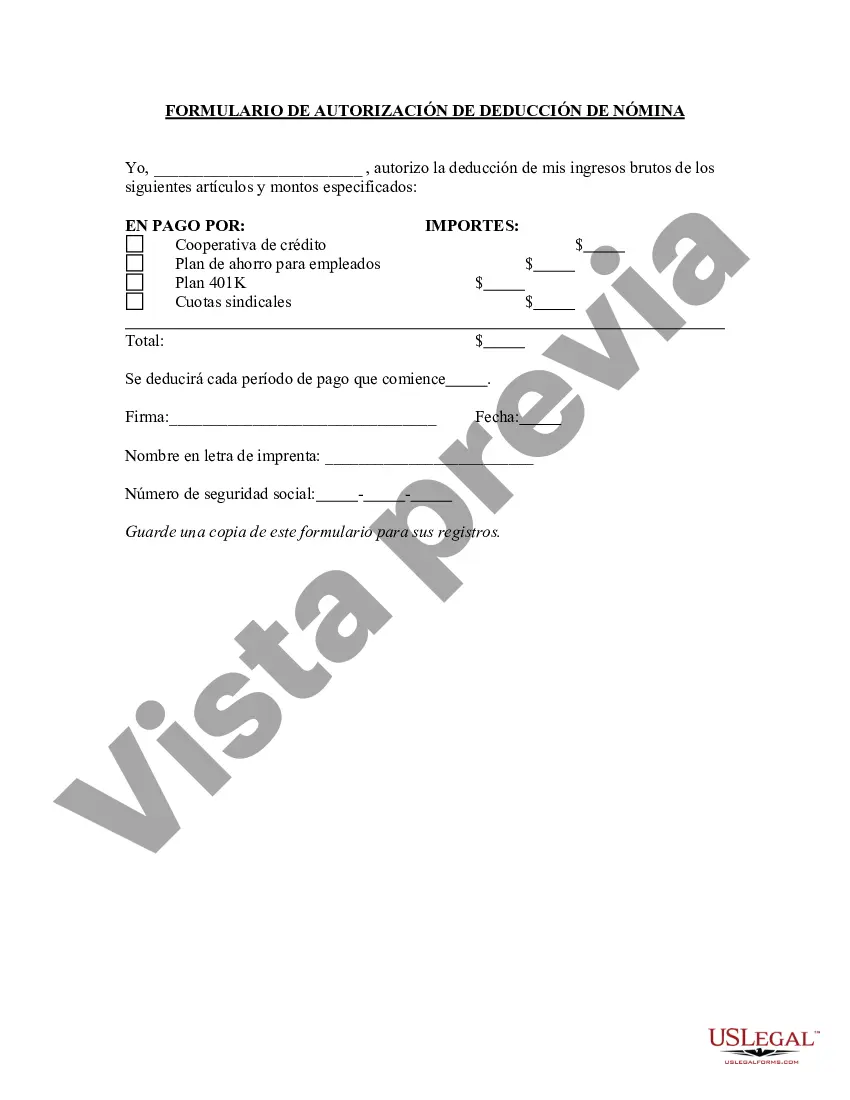

A Fairfax Virginia Payroll Deduction Authorization Form is a document used by employees residing or working in Fairfax, Virginia, to authorize deductions from their paychecks for a variety of purposes. This form enables employees to allocate a specific amount of their earnings for deductions, ensuring seamless processing and transparency between employers and employees. Payroll deduction authorization forms are essential tools in streamlining financial transactions within organizations, ensuring compliance with federal and state regulations. The Fairfax Virginia Payroll Deduction Authorization Form can be categorized into various types based on the nature of deductions authorized. Here are some common forms: 1. Health Insurance Deduction Form: This form allows employees to authorize deductions from their paychecks to cover health insurance premiums or contributions to health savings accounts (Has). By completing this form, employees ensure that their health insurance coverage remains current and premiums are promptly paid. 2. Retirement Savings Deduction Form: Employees can use this form to authorize deductions from their paychecks to contribute towards retirement savings plans such as 401(k), 403(b), or IRA. This form ensures that employees' retirement funds grow steadily and are securely managed. 3. Loan Repayment Deduction Form: Fairfax Virginia Payroll Deduction Authorization Form can also include a section for loan repayment. Employees who have taken loans from their employer, such as tuition reimbursement or emergency loans, can use this form to specify the repayment amount to be deducted from their paychecks. 4. Charitable Donations Deduction Form: Some organizations offer employees the option to make regular charitable donations deducted from their paychecks. With this form, employees can specify the charitable organization and the donation amount to be deducted per pay period. 5. Flexible Spending Account (FSA) Deduction Form: Employees who opt for FSA scan complete this form to authorize deductions towards their FSA accounts, which are used to cover eligible medical or dependent care expenses. This form ensures that employees' FSA contributions are deducted reliably and utilized effectively. The Fairfax Virginia Payroll Deduction Authorization Form is designed to protect the rights of both employees and employers, ensuring that deductions are accurately processed and comply with applicable laws. By completing this form, employees exercise control over their finances, contribute to savings or benefits, and support charitable causes. Employers, on the other hand, can efficiently manage and allocate these deductions while maintaining transparency and accurate record-keeping.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Fairfax Virginia Formulario De Autorización De Deducción De Nómina?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Fairfax Payroll Deduction Authorization Form is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to get the Fairfax Payroll Deduction Authorization Form. Adhere to the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax Payroll Deduction Authorization Form in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!