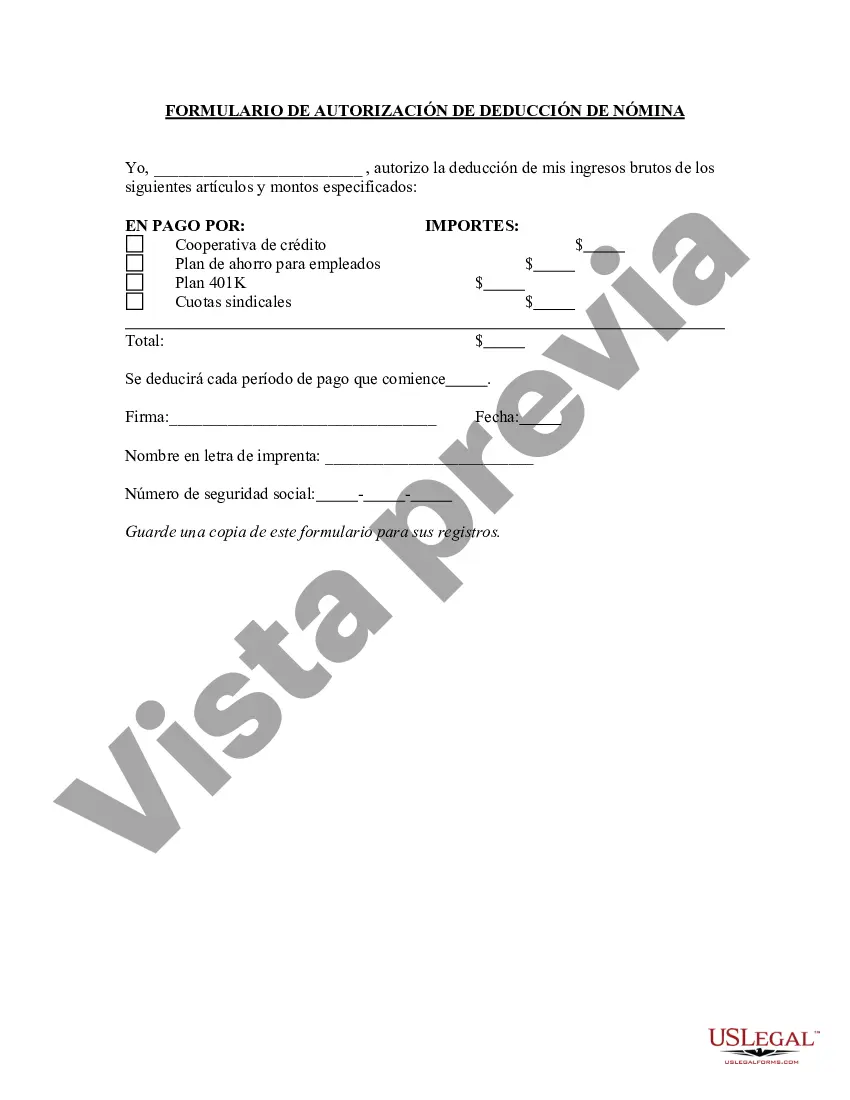

Hillsborough Florida Payroll Deduction Authorization Form is a document that allows employees in Hillsborough County, Florida to authorize deductions from their paycheck for various purposes. It is an essential tool used by employers and employees to ensure accurate and timely deductions. The Hillsborough Florida Payroll Deduction Authorization Form serves as a written agreement between the employer and employee, specifying the types of deductions to be made and the respective amounts. This document is crucial for maintaining transparency and compliance with labor laws. Some common types of Hillsborough Florida Payroll Deduction Authorization Forms include: 1. Health Insurance Deductions: This form allows employees to authorize deductions from their paycheck to cover the cost of health insurance premiums. It ensures that employees have access to health coverage conveniently and without financial burden. 2. Retirement Savings Plan Deductions: This form enables employees to contribute a portion of their salary towards a retirement savings plan such as a 401(k) or IRA. It helps individuals plan for their future financial security by setting aside funds on a regular basis. 3. Union Dues Deductions: This form permits employees who are members of a labor union to authorize deductions for union dues. It ensures the consistent funding of the union, allowing for collective bargaining and representation. 4. Charitable Contributions Deductions: This form facilitates employees to contribute to charitable organizations directly from their paychecks. Employees can choose to donate a specific amount, either as a one-time deduction or recurring deduction, supporting causes they believe in. 5. Repayment of Loans Deductions: This form authorizes deductions to be made from an employee's paycheck to repay outstanding loans provided by the employer, such as tuition reimbursement or employee loans. It ensures timely repayment and helps the employee manage their financial obligations. In conclusion, the Hillsborough Florida Payroll Deduction Authorization Form is a crucial document that allows employees and employers to establish clear deductions from an employee's paycheck. It ensures compliance with labor laws and enables employees to conveniently contribute to various programs such as health insurance, retirement savings, union dues, charitable donations, and loan repayments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Hillsborough Florida Formulario De Autorización De Deducción De Nómina?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Hillsborough Payroll Deduction Authorization Form, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any activities related to document execution straightforward.

Here's how to purchase and download Hillsborough Payroll Deduction Authorization Form.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related forms or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and purchase Hillsborough Payroll Deduction Authorization Form.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Hillsborough Payroll Deduction Authorization Form, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you need to deal with an extremely challenging case, we advise getting a lawyer to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-compliant documents effortlessly!