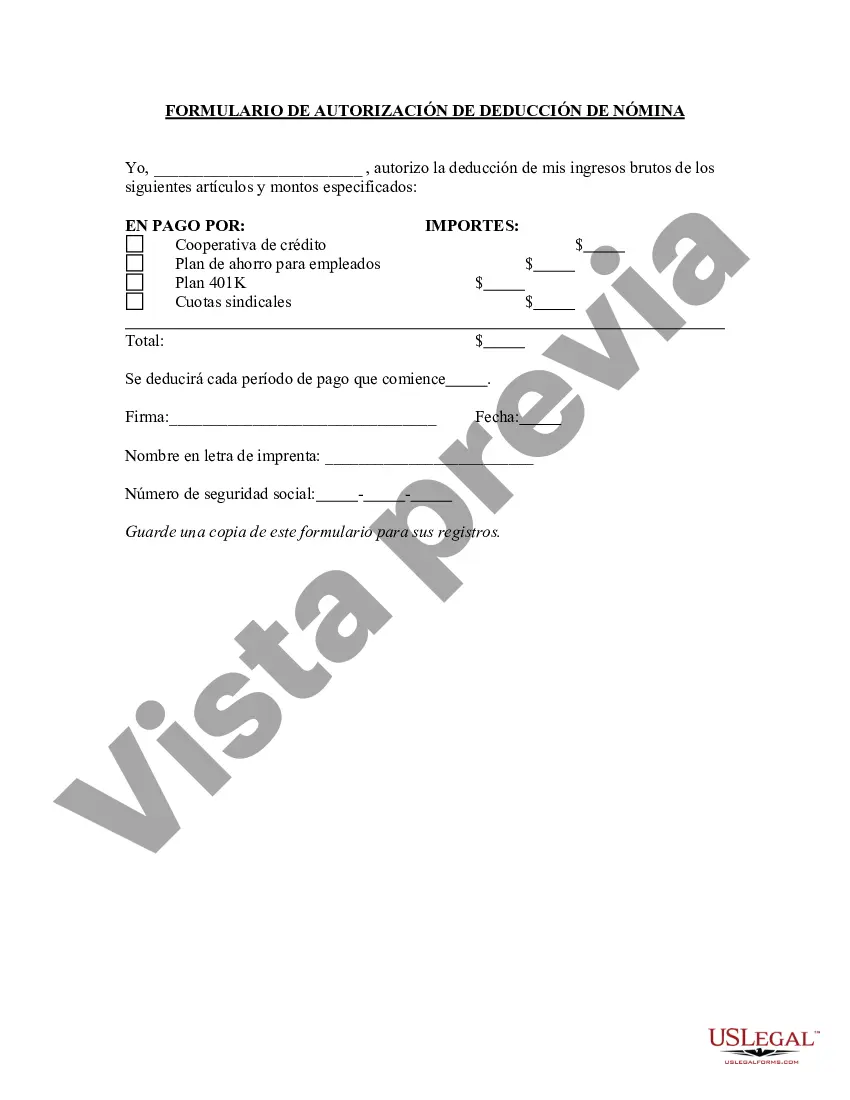

Houston Texas Payroll Deduction Authorization Form is a document used by employers and employees in Houston, Texas, to establish an agreement allowing the employer to deduct certain amounts from an employee's payroll. This form is an essential tool to handle various deductions such as taxes, insurance premiums, retirement contributions, or other authorized deductions from an employee's paycheck. By using a payroll deduction authorization form, both employers and employees ensure proper record-keeping and compliance with state and federal regulations. The Houston Texas Payroll Deduction Authorization Form typically includes important information such as the employee's name, address, Social Security number, and employee identification number. It also includes relevant details about the employer, including the company's name, address, and contact information. Additionally, the form outlines the purpose of the deduction, whether it is for taxes, insurance, or any other authorized deductions. There might be various types of Houston Texas Payroll Deduction Authorization Forms to cater to different deduction purposes. Here is a list of some commonly used forms: 1. Houston Texas Payroll Tax Deduction Authorization Form: This form is specifically designed for employees to authorize deductions related to federal, state, and local taxes. It ensures compliance with tax regulations and facilitates the accurate withholding and reporting of taxes. 2. Houston Texas Health Insurance Deduction Authorization Form: Employers offering health insurance benefits may use this form to authorize the deduction of insurance premiums from an employee's paycheck. It outlines the employee's insurance coverage, premium amount, and any additional details related to the insurance plan. 3. Houston Texas Retirement Contribution Deduction Authorization Form: Employees who participate in retirement plans such as a 401(k) or 403(b) may use this form to authorize the deduction of contributions from their wages. It specifies the retirement plan details and the percentage or fixed amount to be deducted. 4. Houston Texas Charitable Donation Deduction Authorization Form: Some employers offer employees the option to contribute a portion of their salary to charitable organizations. This form allows employees to authorize the deduction of a specific amount from their paycheck as a charitable donation. These are just a few examples of Houston Texas Payroll Deduction Authorization Forms. Depending on specific employer policies and employee benefits, there may be additional forms related to deductions such as loan repayments, union dues, or any other authorized deductions. Overall, the Houston Texas Payroll Deduction Authorization Form serves as a vital tool for managing and documenting various payroll deductions accurately and in compliance with relevant regulations. It ensures transparency, efficiency, and legal compliance in the payroll deduction process for both employers and employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Houston Texas Formulario De Autorización De Deducción De Nómina?

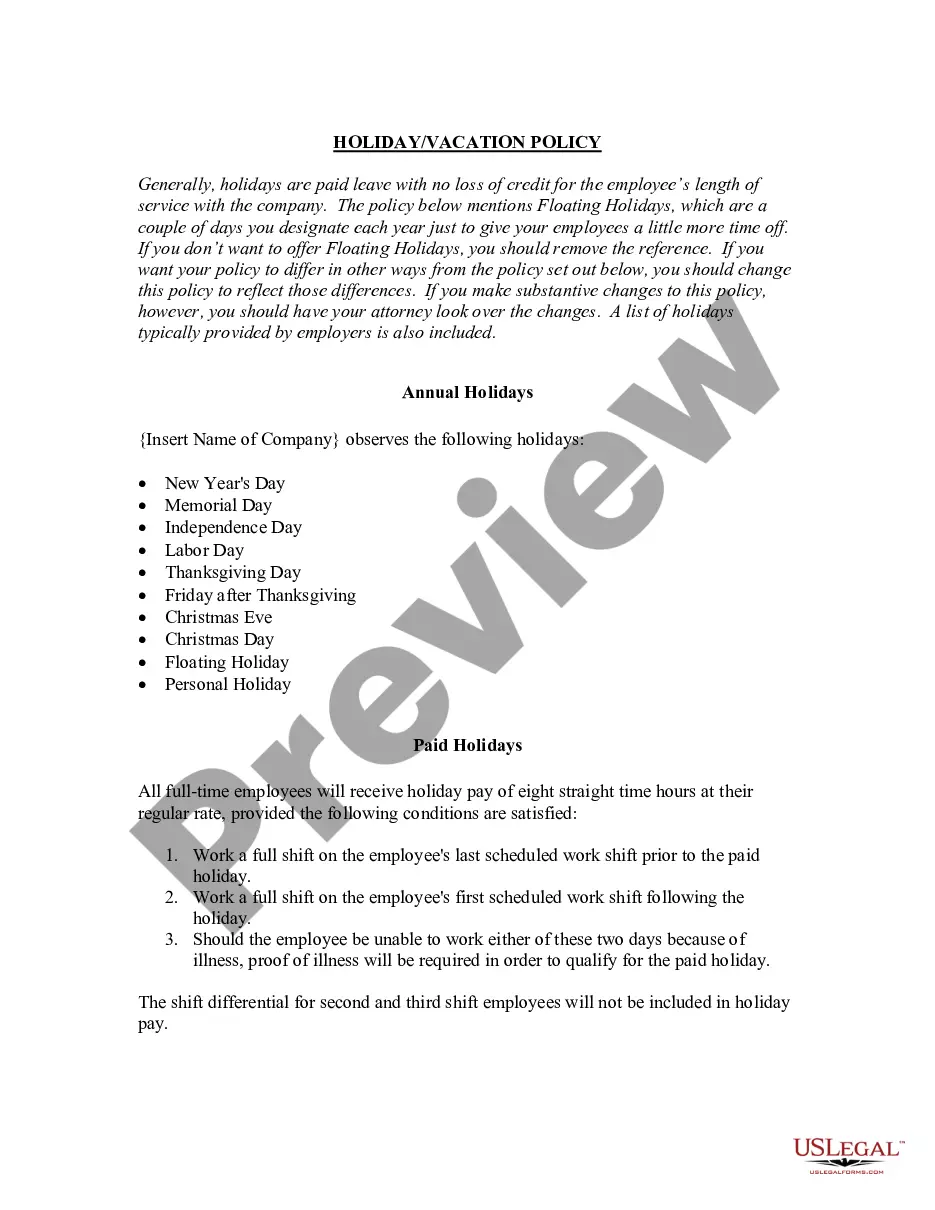

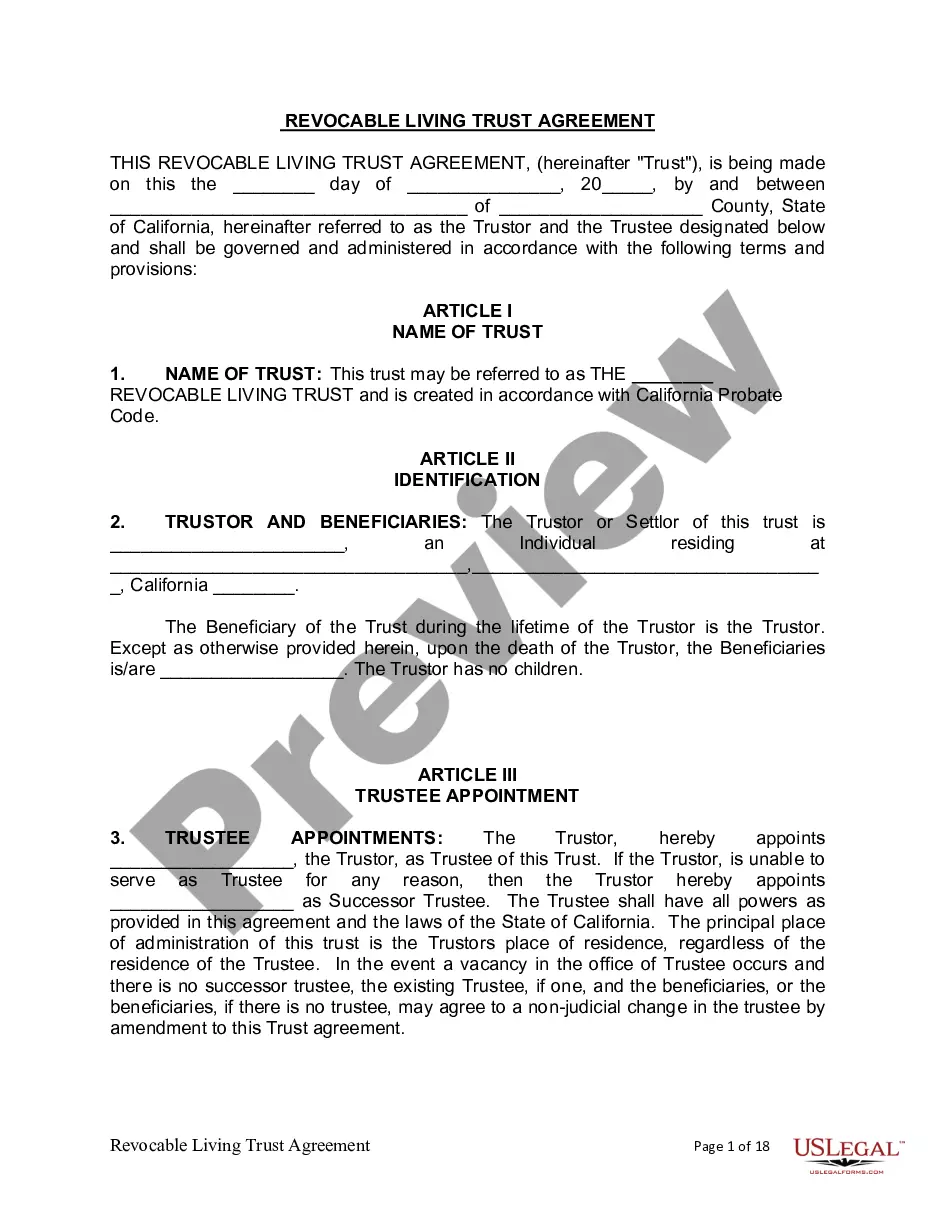

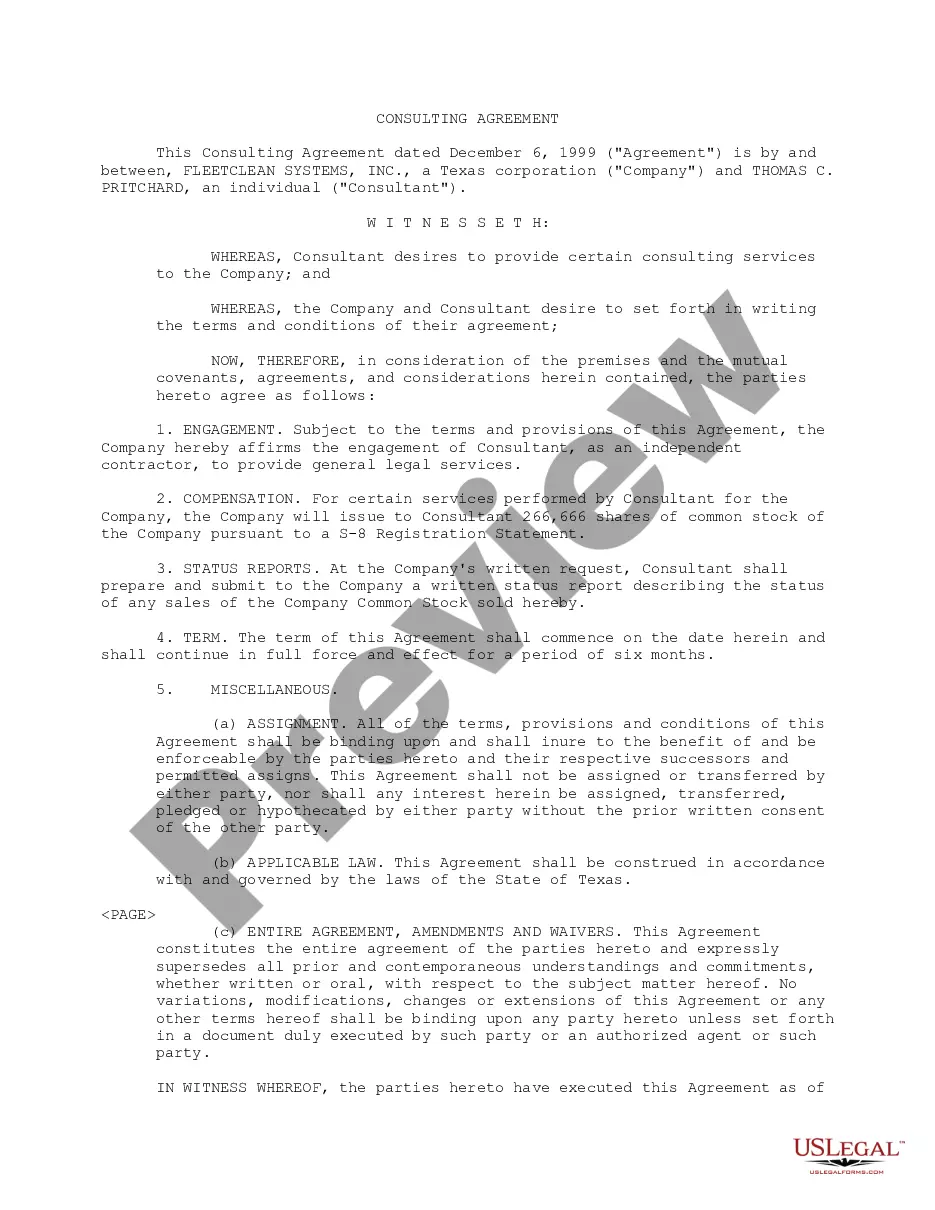

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Houston Payroll Deduction Authorization Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Houston Payroll Deduction Authorization Form from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Houston Payroll Deduction Authorization Form:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Los formatos de nomina suelen incluir secciones donde se muestra que recibe un empleado a cambio de sus horas de trabajo. Con el fin de dar claridad al tema, te contamos que incluye el formato de nomina.

A partir del 1 de julio de 2022, el sueldo minimo en D.C. es $16.10 la hora. La Ley del Sueldo Minimo del Distrito de Columbia es una de las mejores leyes del sueldo minimo en los Estados Unidos. Bajo la ley, el sueldo minimo de D.C. ha aumentado a $16.10 el 1 de julio de 2022.

La ley exige que los empleadores paguen el salario minimo y horas extra para casi todos los empleados. El salario minimo actual es de $7.25 la hora. Aplican reglas especiales a empleados que reciben propinas y a jovenes menores de 20 anos de edad.

El salario minimo en Texas no ha cambiado en mas de una decada y en realidad aplican la tarifa autorizada a nivel federal, que es de $7.25 dolares por hora.