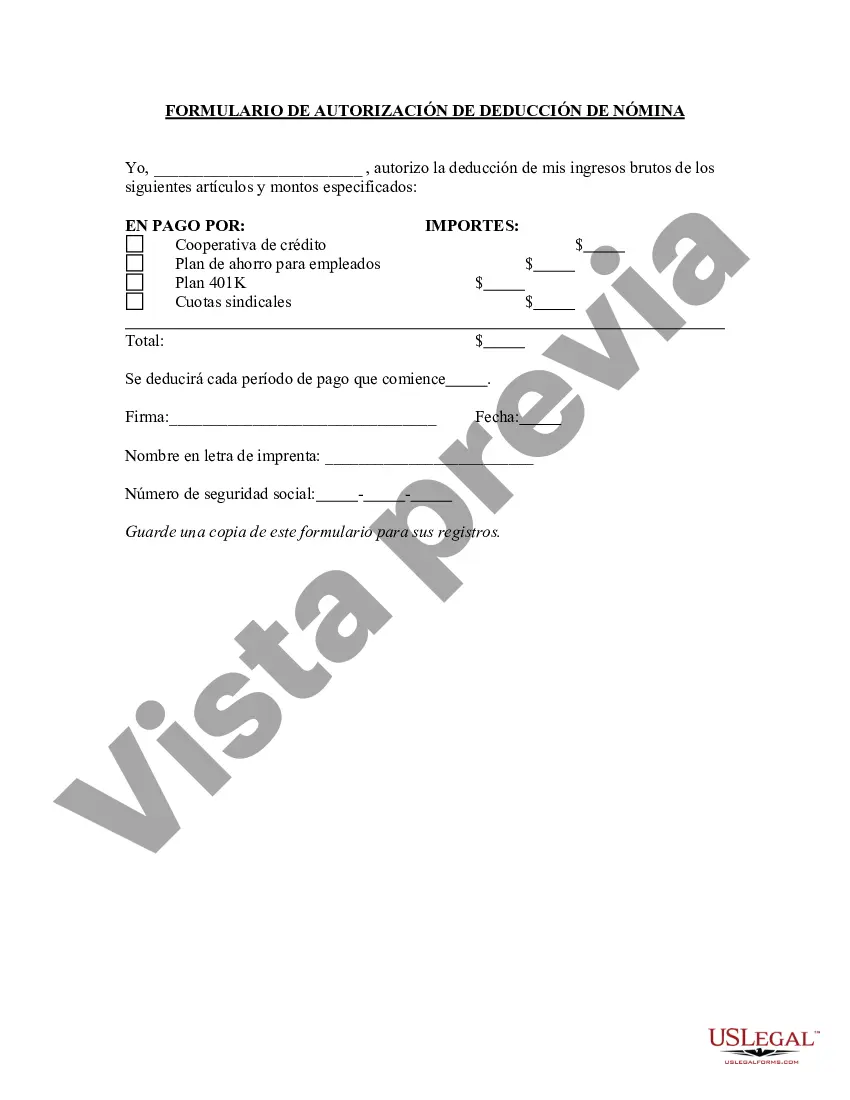

Kings New York Payroll Deduction Authorization Form is a crucial document used by employees to authorize their employer to deduct certain amounts from their paychecks for various purposes. This form ensures seamless deduction procedures and provides legal protection for both parties involved. It serves as a written agreement outlining the terms and conditions of the authorized deductions. Keywords: Kings New York, payroll deduction, authorization form, employee, employer, paychecks, deduction procedures, legal protection, written agreement, authorized deductions. There might be different types of Kings New York Payroll Deduction Authorization Forms based on the specific deductions and purposes. Some commonly found variations include: 1. Kings New York Payroll Deduction Authorization Form for Health Insurance: This form allows employees to authorize their employer to deduct a specified amount from their paycheck to cover health insurance premiums. 2. Kings New York Payroll Deduction Authorization Form for Retirement Contributions: This form enables employees to authorize deductions from their earnings for retirement contributions, such as 401(k) or pension plans. 3. Kings New York Payroll Deduction Authorization Form for Charitable Donations: This form permits employees to designate a portion of their pay to be deducted regularly for charitable purposes or donations. 4. Kings New York Payroll Deduction Authorization Form for Wage Garnishments: This form is used when an employee's wages need to be garnished to satisfy a debt or legal obligation, such as child support or tax liens. It authorizes the employer to make deductions as required by law. 5. Kings New York Payroll Deduction Authorization Form for Loan Repayments: This form allows employees to authorize their employer to deduct a specific amount from their paycheck to repay outstanding loans or advances provided by the company. 6. Kings New York Payroll Deduction Authorization Form for Uniform Expenses: Used in certain industries, this form permits employees to authorize deductions for uniform or work-related attire expenses, ensuring compliance with company policies. It's important to note that the specific types of Kings New York Payroll Deduction Authorization Forms may vary depending on the organization's policies and the state's regulations. Employers should provide clear and accurate forms tailored to their employees' needs, ensuring proper documentation and adherence to legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Kings New York Formulario De Autorización De Deducción De Nómina?

Creating paperwork, like Kings Payroll Deduction Authorization Form, to take care of your legal matters is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for various cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Kings Payroll Deduction Authorization Form form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Kings Payroll Deduction Authorization Form:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Kings Payroll Deduction Authorization Form isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!