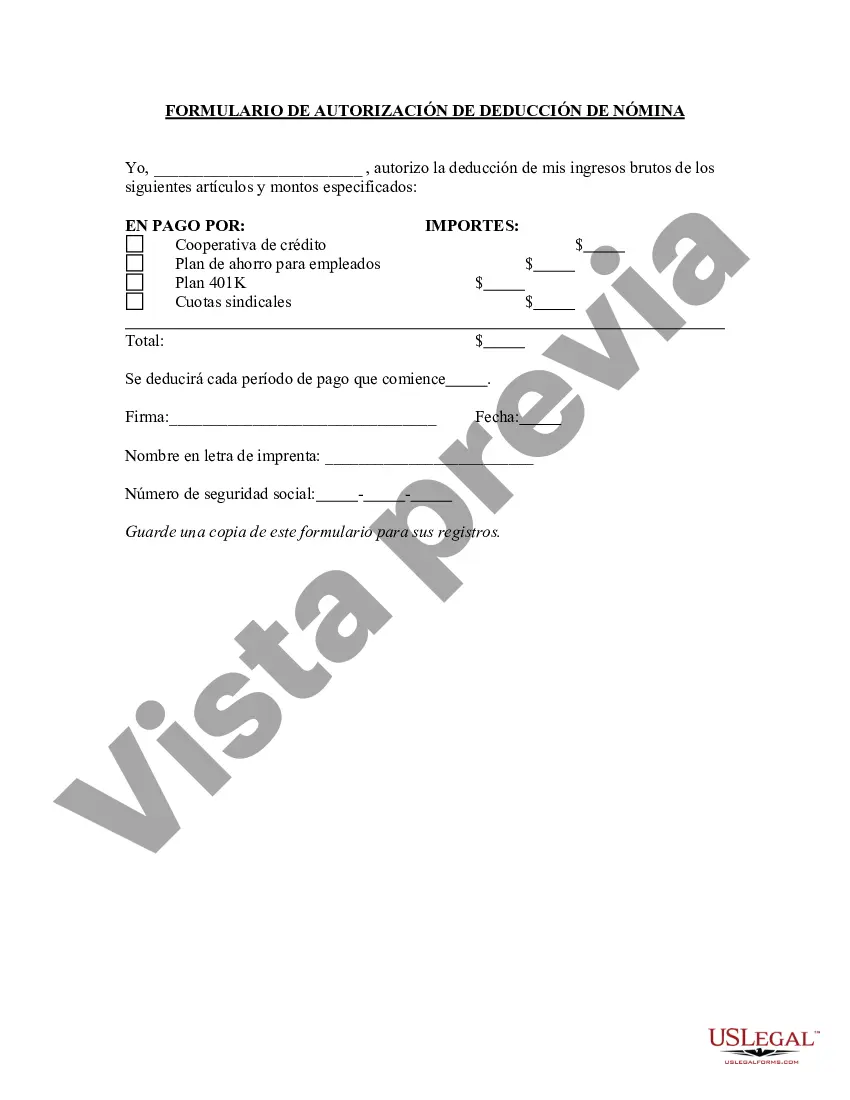

The Middlesex Massachusetts Payroll Deduction Authorization Form is a document that allows employees in Middlesex County, Massachusetts to authorize deductions from their paychecks for various purposes. This form is commonly used by employers and employees to easily facilitate payroll deductions. By completing this form, employees provide written consent to have certain amounts withheld from their wages on a regular basis. This Payroll Deduction Authorization Form is crucial for employers as it helps organize and manage deductions accurately and efficiently. It ensures that the right amounts are deducted from employee wages and allocated to the appropriate funds or recipients. Additionally, it helps employees save time by automating the deduction process, eliminating the need for manual intervention each pay period. Although the specific content might vary slightly from one form to another, commonly required details on the Middlesex Massachusetts Payroll Deduction Authorization Form include: 1. Employee Information: This section entails basic details such as the employee's full name, address, contact information, and employee identification number. 2. Employer Information: This part requires the name, address, and contact information of the employer or organization. 3. Deduction Details: An important segment where employees can specify the type of deduction they are authorizing. Some common types of deductions include health insurance premiums, retirement contributions, union dues, charitable donations, child support payments, or repayment of a loan or advance. 4. Deduction Amount: Employees need to indicate the specific dollar amount or percentage to be deducted from their paycheck for each authorized deduction. 5. Start and End Dates: This section allows employees to specify when the deductions will commence and conclude, ensuring clarity and transparency. 6. Signature and Date: The form must be signed and dated by the employee to authenticate their authorization and agreement. Different variations of the Middlesex Massachusetts Payroll Deduction Authorization Form may exist due to specific employer requirements or additional deductions provided by employers. For example, some forms may include deductions for employee benefits, such as dental or vision insurance premiums, while others may include deductions for employee loan repayments or employee assistance programs. In conclusion, the Middlesex Massachusetts Payroll Deduction Authorization Form is a valuable tool for employers and employees alike. It streamlines the process of deducting specific amounts from an employee's paycheck for various purposes, ensuring accuracy, efficiency, and convenience for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Middlesex Massachusetts Formulario De Autorización De Deducción De Nómina?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business objective utilized in your county, including the Middlesex Payroll Deduction Authorization Form.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Middlesex Payroll Deduction Authorization Form will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Middlesex Payroll Deduction Authorization Form:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Middlesex Payroll Deduction Authorization Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!