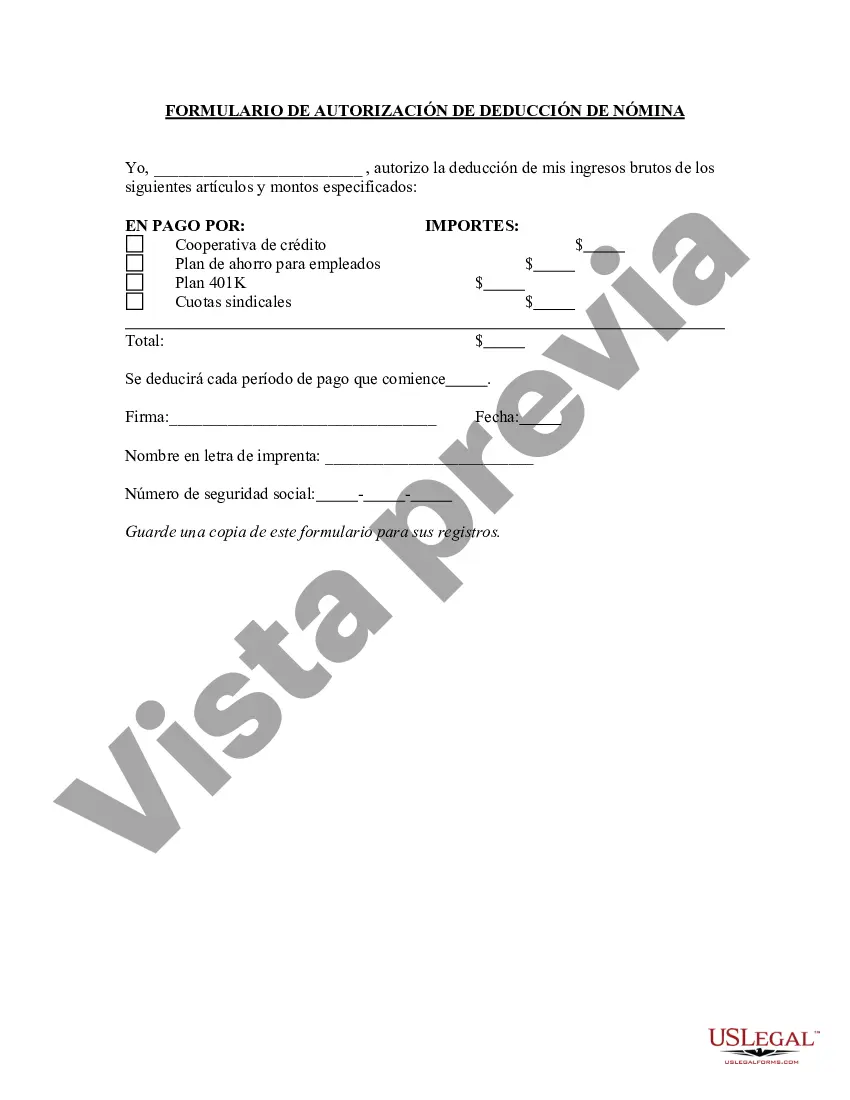

Montgomery Maryland Payroll Deduction Authorization Form is a document that allows employees in Montgomery County, Maryland, to request specific deductions be withheld from their paychecks. This form is crucial for employees who wish to contribute to various programs, benefits, or debts through regular automatic deductions. The Montgomery Maryland Payroll Deduction Authorization Form enables employees to have direct control over their finances by authorizing employers to deduct specific amounts from their wages for designated purposes. By completing this form, individuals can ensure timely and accurate payments towards obligations or benefits without the need for manual transfers or payments. Key elements that might be included in a typical Montgomery Maryland Payroll Deduction Authorization Form are: 1. Employee Information: This section requests the employee's name, job title, department, employee ID, contact details, and other relevant identification information. 2. Deduction Details: In this section, employees can specify the purpose of the deduction(s). Common types may include health insurance premiums, retirement contributions, charitable donations, union dues, loan repayments, or any other authorized payment. 3. Deduction Amount: Employees can specify the amount or percentage to be deducted from each paycheck. Some programs or benefits might have fixed contribution amounts, while others may vary based on the employee's preference. 4. Start and End Dates: This section allows employees to specify the desired duration for the deductions to be in effect. It could be a one-time occurrence or a recurring deduction until a certain date or event. 5. Employer Verification: To ensure accuracy, employers might require supervisors or designated personnel to review and verify the form. This step adds an extra layer of authorization to prevent errors or unauthorized deductions. Different types of Montgomery Maryland Payroll Deduction Authorization Forms may exist to accommodate specific purposes or programs. For instance, a distinct form might be utilized for health insurance deductions, retirement contributions, union dues, or other specific agreements made between employees and employers. These specialized forms serve to streamline and simplify the payroll deduction process, ensuring that the correct amounts are withheld and allocated appropriately. In conclusion, the Montgomery Maryland Payroll Deduction Authorization Form is a crucial tool that enables employees to take charge of their finances by authorizing employers to deduct specific amounts from their paychecks. By completing this form accurately and providing the necessary details, employees can ensure timely contributions towards various programs, benefits, and obligations, ultimately streamlining the payment process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Montgomery Maryland Formulario De Autorización De Deducción De Nómina?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Montgomery Payroll Deduction Authorization Form, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the latest version of the Montgomery Payroll Deduction Authorization Form, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Montgomery Payroll Deduction Authorization Form:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Montgomery Payroll Deduction Authorization Form and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Conoce que puedes deducir Gastos medicos, dentales, de enfermeras y gastos hospitalarios, incluido el alquiler o compra de aparatos para rehabilitacion, protesis, analisis y estudios clinicos. Lentes opticos graduados hasta por 2,500 pesos. Gastos funerarios. Pagos por primas de seguro de gastos medicos.

Conceptos o valores que se deducen de la nomina. Aportes a salud. Aportes a pension. Fondo de solidaridad pensional. Cuotas sindicales. Aportes a cooperativas. Embargos judiciales. Cuotas de creditos a entidades financieras: Deudas del empleado con la empresa.

Estados Unidos - Impuestos sobre la renta de los trabajadores FechaTipo medio: Individuo SMTipo maximo201923,9%46,0%201823,8%46,0%201726,1%48,6%201625,8%48,6%18 more rows

Las deducciones son los gastos que las autoridades tributarias han determinado que pueden disminuirse de los ingresos obtenidos para pagar menos impuestos.

De acuerdo a lo establecido en el articulo 28 de la LISR, la deduccion de pagos por ingresos exentos para trabajadores equivale al 53% del monto de dichos pagos, es decir, se debe pagar mas impuestos cuando se declare el ISR.

La nomina si es deducible pero bajo ciertos requisitos Si el monto supera los 2 mil pesos debera ser pagado por medio de transferencia electronica, cheque nominativo de la cuenta del contribuyente, tarjeta de credito, debito, servicios o los denominados monederos electronicos autorizados por el SAT.

La nomina si es deducible pero bajo ciertos requisitos Si el monto supera los 2 mil pesos debera ser pagado por medio de transferencia electronica, cheque nominativo de la cuenta del contribuyente, tarjeta de credito, debito, servicios o los denominados monederos electronicos autorizados por el SAT.

En este rubro se consideran los pagos obligatorios a instituciones como el Infonavit y el Fonacot, ademas de conceptos que incluyen el fondo de ahorro, el servicio de comedor o la habitacion, asi como descuentos por prestamos otorgados directamente por parte de la empresa.

Articulo 28 Pago provisional por importacion. Cuando se trate de bienes por los que no se este obligado al pago del impuesto general de importacion, los contribuyentes efectuaran el pago del impuesto que esta Ley establece, mediante declaracion que presentaran ante la aduana correspondiente.