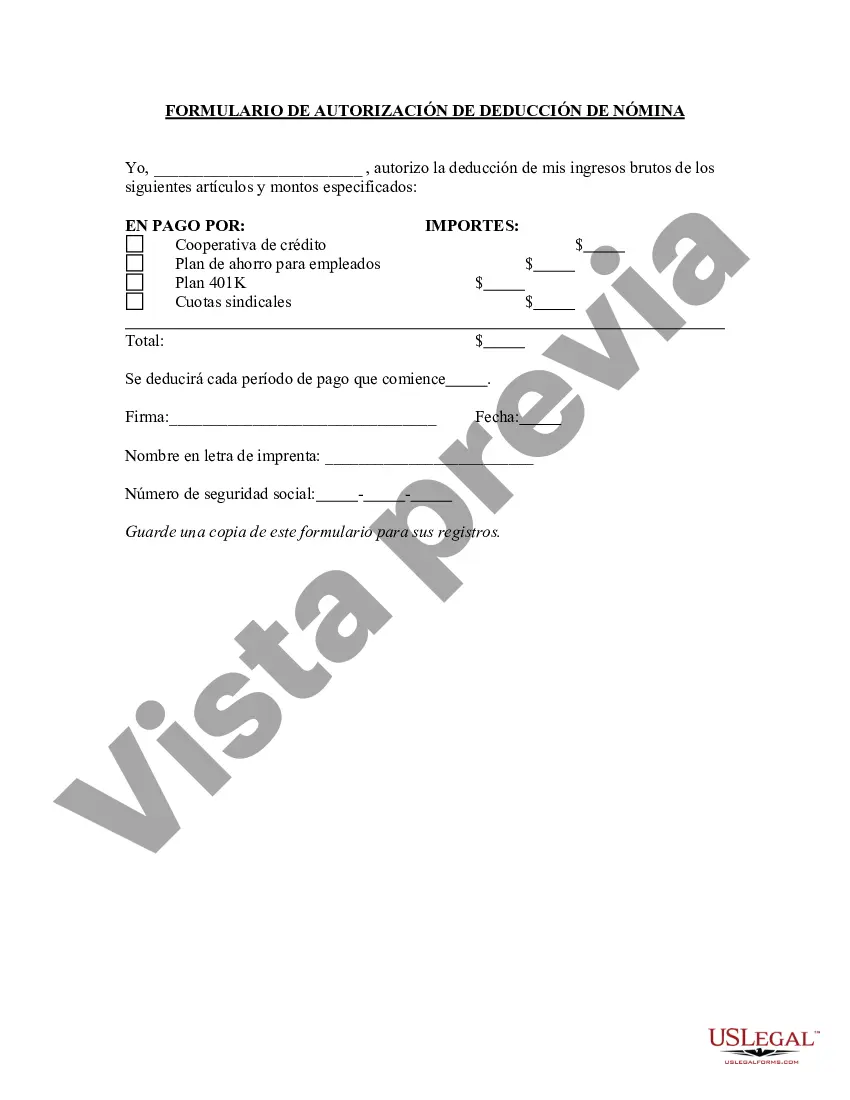

Oakland Michigan Payroll Deduction Authorization Form is a crucial document utilized by employers in Oakland County, Michigan, to administer payroll deductions accurately and efficiently. The form grants employees the opportunity to authorize specific deductions from their paychecks, including but not limited to taxes, insurance premiums, retirement contributions, and voluntary contributions like charitable donations or savings plans. The Oakland Michigan Payroll Deduction Authorization Form ensures that employees' desired payroll deductions are correctly implemented and recorded by the employer. It acts as a written agreement between the employee and employer, outlining the details of the deductions and protecting both parties' interests. Some common types of Oakland Michigan Payroll Deduction Authorization Forms may include: 1. Tax Deduction Authorization Form: This form enables employees to authorize the employer to deduct federal, state, and local taxes from their paychecks as required by law. 2. Insurance Deduction Authorization Form: Employees can utilize this form to authorize deductions for insurance premiums such as health, dental, vision, life, or disability insurance. 3. Retirement Contribution Authorization Form: For employees participating in retirement plans like 401(k)s or pension plans, this form allows the employer to deduct the predetermined contribution amount from each paycheck. 4. Charitable Donation Authorization Form: This form permits employees to contribute a portion of their salary as charitable donations to eligible organizations, often through programs like the United Way campaign. 5. Savings Plan Deduction Authorization Form: Employees who participate in employer-sponsored savings plans, such as flexible spending accounts (FSA) or health savings accounts (HSA), may use this form to authorize deductions for these accounts. 6. Loan Repayment Authorization Form: If an employee has outstanding loans, such as student loans or employee loans, this form allows the employer to deduct the agreed-upon repayment amount from each paycheck. Each type of Oakland Michigan Payroll Deduction Authorization Form focuses on specific deductions, intending to streamline payroll processes, maintain accuracy, and ensure compliance with legal requirements. It is crucial for both employers and employees to complete these forms accurately to avoid any discrepancies or misunderstandings regarding payroll deductions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Oakland Michigan Formulario De Autorización De Deducción De Nómina?

Creating paperwork, like Oakland Payroll Deduction Authorization Form, to manage your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for various cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Oakland Payroll Deduction Authorization Form form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Oakland Payroll Deduction Authorization Form:

- Make sure that your document is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Oakland Payroll Deduction Authorization Form isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our service and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!