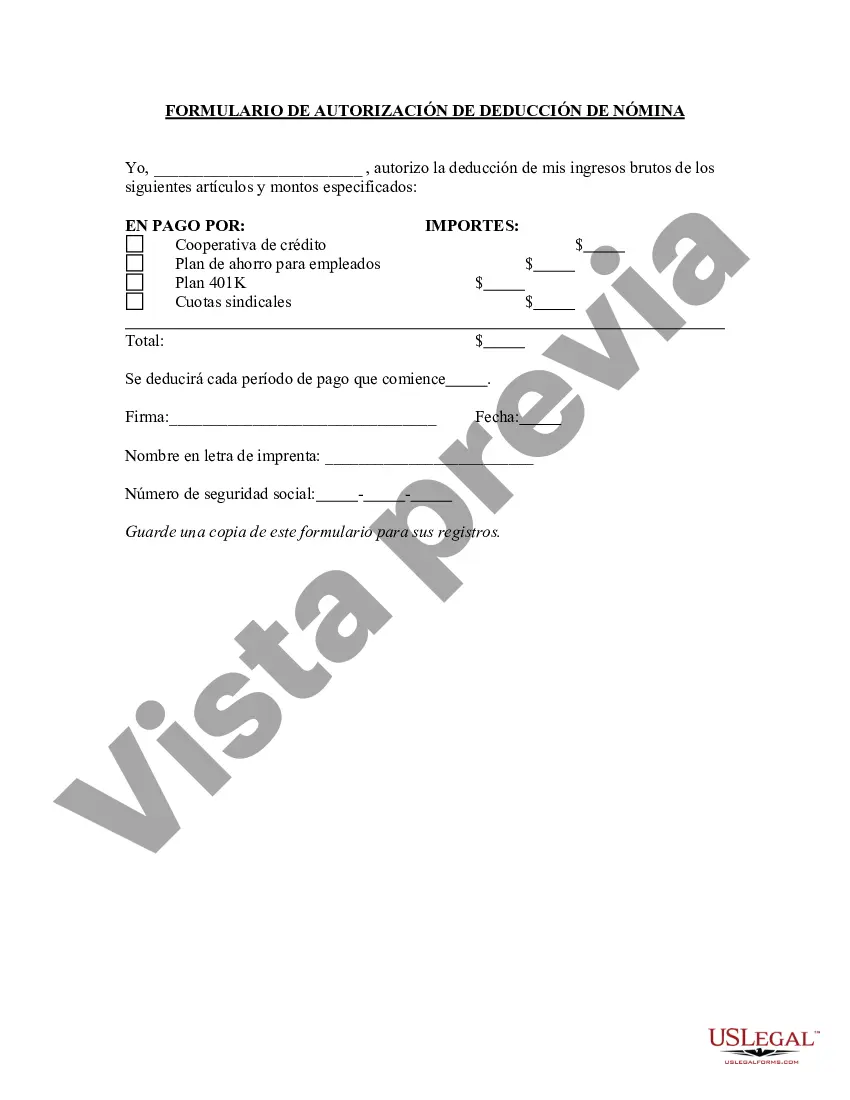

San Jose California Payroll Deduction Authorization Form is a legal document that allows employees in the city of San Jose, California, to authorize deductions from their regular wages or salary. It provides an official mechanism for employees to allocate a portion of their earnings to various deductions authorized by the employer. This form is an essential tool for employers and employees as it ensures accurate and timely processing of payroll deductions. By using this form, employees can conveniently request deductions from their salaries to cover various expenses, such as healthcare plans, retirement contributions, charitable donations, union fees, insurance premiums, or even loan repayments. The San Jose California Payroll Deduction Authorization Form may vary depending on the organization and the specific purposes for which the deductions are requested. Some types of these authorization forms may include: 1. Health Insurance Deduction Form: This form allows employees to allocate a portion of their wages to cover health insurance premiums offered by their employer. 2. Retirement Plan Deduction Form: With this form, employees can authorize deductions to contribute a portion of their earnings towards a retirement plan, such as a 401(k) or pension fund. 3. Charitable Donation Deduction Form: This authorization form enables employees to contribute a deduction from their salary to various registered charitable organizations. 4. Union Dues Deduction Form: For unionized employees, this form allows them to authorize deductions from their wages to pay for union membership fees or contributions. 5. Wage Garnishment Deduction Form: In cases where an employee faces a legal obligation to repay certain debts, a wage garnishment deduction form can be used to authorize deductions towards the repayment of these debts. These are just a few examples of the different types of San Jose California Payroll Deduction Authorization Forms that may exist. The specific form required will depend on the purpose of the deduction and the employer's policies and procedures. It is crucial for both employers and employees to understand and comply with the applicable laws and regulations related to payroll deductions to ensure legal compliance and accurate record keeping.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out San Jose California Formulario De Autorización De Deducción De Nómina?

If you need to get a trustworthy legal paperwork provider to get the San Jose Payroll Deduction Authorization Form, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse San Jose Payroll Deduction Authorization Form, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the San Jose Payroll Deduction Authorization Form template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the San Jose Payroll Deduction Authorization Form - all from the convenience of your home.

Join US Legal Forms now!