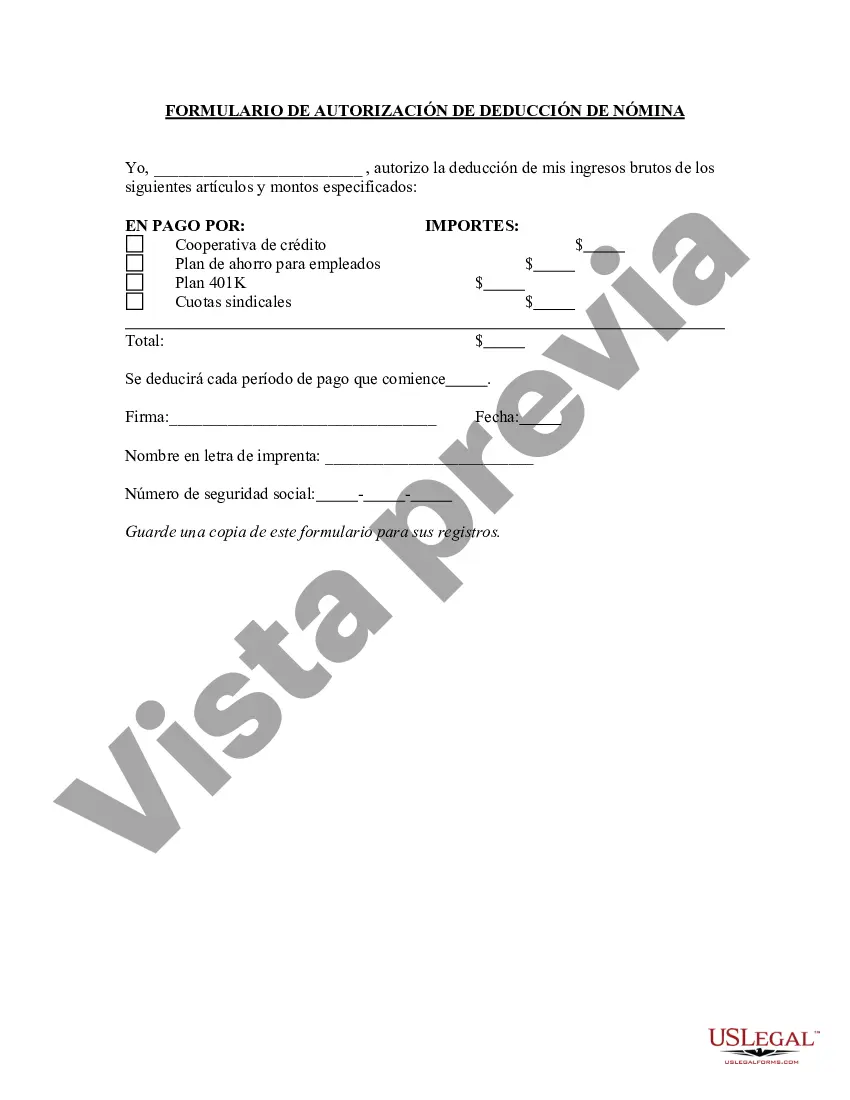

Wayne Michigan Payroll Deduction Authorization Form is a crucial document utilized by employees in Wayne, Michigan to specify their elected deductions from their payroll. This form allows employees to authorize their employer to deduct specific amounts from their wages for various purposes. The way the deduction is facilitated will depend on the type of deduction chosen by the employee. There are different types of Wayne Michigan Payroll Deduction Authorization Forms that cater to specific purposes. Here are a few notable examples: 1. Health Insurance Deduction Form: This type of form allows employees to authorize deductions from their payroll specifically for health insurance premiums. By using this form, employees in Wayne, Michigan can ensure that a predetermined amount is automatically deducted from their wages to cover their health insurance costs. 2. Union Dues Deduction Form: Employees who are members of a union and wish to contribute to their union's funds can utilize this form. The Wayne Michigan Payroll Deduction Authorization Form for union dues allows employees to specify the agreed-upon amount to be deducted from their wages and forwarded to the union. 3. Retirement Savings Deduction Form: To plan for their future retirement, employees in Wayne, Michigan have the option to authorize deductions from their payroll for retirement savings. By completing this form, employees can regularly contribute a specific sum to their retirement savings account, ensuring a hassle-free and convenient way of building their financial security. 4. Charitable Contributions Deduction Form: Wayne, Michigan employees can choose to contribute to charitable organizations using their payroll deductions. Through this type of authorization form, employees can specify the amount they wish to donate, allowing it to be deducted before they receive their wages. 5. Loan Repayment Deduction Form: In cases where an employee has taken a loan from their employer, they can use this form to authorize periodic deductions from their payroll to repay the loan. By doing so, employees can ensure timely, automated payments towards their outstanding loans. Completing the appropriate Wayne Michigan Payroll Deduction Authorization Form is essential to accurately specify an employee's desired deductions. These forms streamline the process, reducing the administrative burden on both employees and employers while ensuring compliance and transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Wayne Michigan Formulario De Autorización De Deducción De Nómina?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Wayne Payroll Deduction Authorization Form meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Aside from the Wayne Payroll Deduction Authorization Form, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Wayne Payroll Deduction Authorization Form:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Payroll Deduction Authorization Form.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!