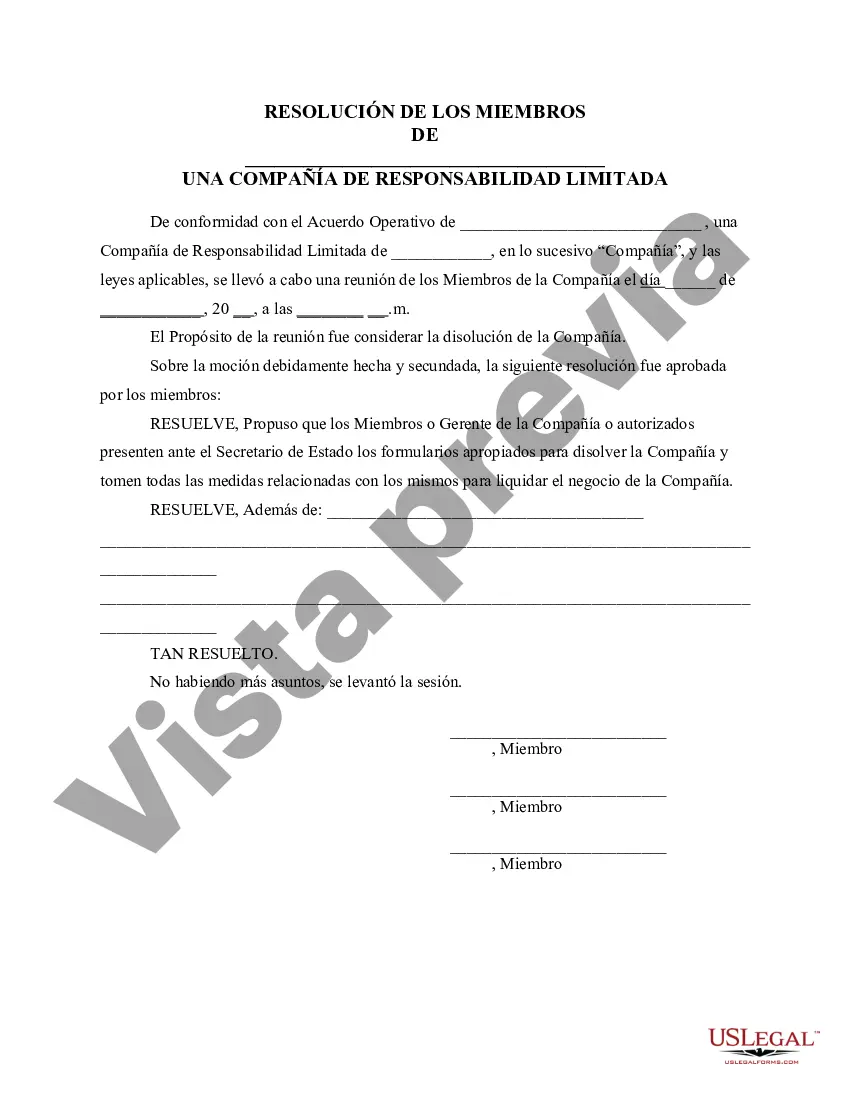

Cook Illinois Resolution of Meeting of LLC Members to Dissolve the Company is an important document that signifies the decision made by the members of a Limited Liability Company (LLC) to terminate its operations and wind up its affairs. This resolution serves as a formal agreement among the LLC members to dissolve the company in accordance with the laws and regulations governing such actions. The Cook Illinois Resolution of Meeting of LLC Members to Dissolve the Company outlines the specific details and steps required to dissolve the LLC, ensuring that all legal requirements are met during the process. It is crucial to follow the appropriate procedures to avoid any potential legal consequences or liabilities. Key elements that should be included in the resolution are: 1. Introduction: The resolution should begin with a clear statement indicating the intent to dissolve the LLC. This section should provide the name of the LLC, the date of the resolution, and the names of the members present at the meeting. 2. Reasons for Dissolution: The resolution should state the reasons behind the LLC's decision to dissolve. This can include various factors such as financial difficulties, changes in business strategies, or the successful completion of the company's objectives. 3. Approval of Dissolution: The resolution should include a provision for the LLC members to approve the dissolution. A majority or specified percentage of members' votes may be required to pass the resolution, as stated in the LLC's operating agreement or bylaws. 4. Dissolution Plan: The resolution should establish the plan for winding up the LLC's affairs. This plan typically includes the appointment of a designated person or committee to handle the liquidation process, legal obligations, and distribution of assets. 5. Notices and Obligations: The resolution should outline the requirements for notifying creditors, debtors, and other stakeholders about the company's dissolution. It should also specify the necessary steps to be taken to fulfill or settle any outstanding obligations or debts. 6. Distribution of Assets: The resolution should address the process and criteria for distributing the LLC's remaining assets among the members, taking into account each member's ownership interests and any relevant provisions in the operating agreement or applicable laws. 7. Dissolution Filing: The resolution should indicate the responsibility of the LLC members or the appointed liquidator to file the dissolution documents with the appropriate government agencies, such as the Secretary of State's office. Different types of Cook Illinois Resolution of Meeting of LLC Members to Dissolve the Company may include variations based on the unique circumstances or requirements of each LLC. For example: 1. Voluntary Dissolution: This type of resolution occurs when the members of the LLC voluntarily decide to dissolve the company due to various reasons, such as a change in personal circumstances, loss of interest, or the desire to pursue alternative ventures. 2. Dissolution by Court Order: In some cases, a Cook Illinois Resolution of Meeting of LLC Members to Dissolve the Company may be the result of a court order. This typically occurs when the court deems it necessary to dissolve the company due to legal violations, misconduct, or other compelling reasons. Overall, the Cook Illinois Resolution of Meeting of LLC Members to Dissolve the Company plays a crucial role in formalizing the decision to dissolve an LLC, establishing responsibilities, and ensuring a smooth and legal winding-up process. It is advisable to consult with a legal professional or review the relevant state laws to ensure compliance when creating or implementing this resolution.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Resolución de la reunión de miembros de la LLC para disolver la empresa - Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Cook Illinois Resolución De La Reunión De Miembros De La LLC Para Disolver La Empresa?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Cook Resolution of Meeting of LLC Members to Dissolve the Company, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Cook Resolution of Meeting of LLC Members to Dissolve the Company from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Cook Resolution of Meeting of LLC Members to Dissolve the Company:

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!