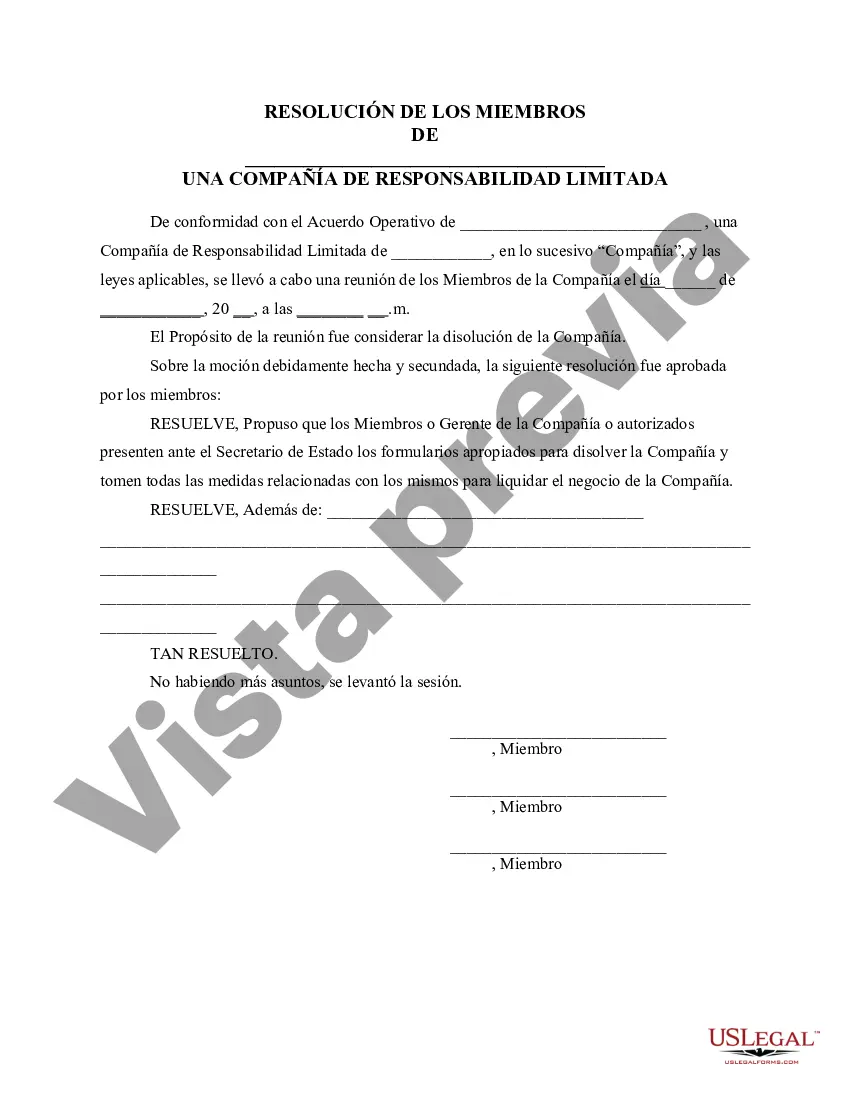

Los Angeles California Resolución de la reunión de miembros de la LLC para disolver la empresa - Resolution of Meeting of LLC Members to Dissolve the Company

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Resolución De La Reunión De Miembros De La LLC Para Disolver La Empresa?

Legal statutes and guidelines differ across the nation.

If you are not a lawyer, navigating the various standards involved in formulating legal documents can be perplexing.

To prevent expensive legal fees when preparing the Los Angeles Resolution of Meeting of LLC Members to Dissolve the Company, it is essential to have a verified template that is applicable to your locality.

That's the easiest and most cost-effective way to obtain current templates for any legal situations. Access them with just a few clicks and keep your documentation organized with US Legal Forms!

- That’s when utilizing the US Legal Forms platform becomes so beneficial.

- US Legal Forms is trusted by millions and features a web collection of over 85,000 state-specific legal templates.

- It serves as an excellent resource for both professionals and individuals seeking self-service templates for diverse personal and business situations.

- All documents are reusable: once a sample is selected, it remains available in your profile for future access.

- Therefore, if you have an account with an active subscription, you can simply Log In and re-download the Los Angeles Resolution of Meeting of LLC Members to Dissolve the Company from the My documents section.

- For newcomers, a few additional steps are necessary to acquire the Los Angeles Resolution of Meeting of LLC Members to Dissolve the Company.

- Review the page content to ensure you have located the correct sample.

- Use the Preview feature or examine the form description if provided.

Form popularity

FAQ

After the resolution to dissolve your S corporation has been approved, you must cease all business operations. The exception is creditor notification of the upcoming distribution. You must also pay your creditors, then distribute assets that remain to shareholders if applicable. This is known as the winding-up process.

Liquidar una empresa es un proceso economico posterior a la disolucion de la sociedad, consistente en la reparticion del patrimonio de los socios y el fin de la actividad comercial. Es indispensable el nombramiento de un liquidador, quien se encargara de adelantar todo el tramite de la liquidacion de la sociedad.

Probablemente el paso mas critico para disolver exitosamente su LLC es pagar sus impuestos. Usted debe cerrar las cuentas de impuesto de la LLC con el IRS y el estado. Pague cualquier deuda que tenga y cerciorese de financiar correctamente su retencion de nomina, asi como sus impuestos sobre las ventas.

Para disolver una LLC en Florida, debe presentar los Articulos de disolucion ante la Division de Corporaciones de Florida por correo o en linea y pagar una tarifa de presentacion de $25. Los costos involucrados en la disolucion de una LLC varian segun el estado.

More In File The IRS cannot cancel your EIN. Once an EIN has been assigned to a business entity, it becomes the permanent Federal taxpayer identification number for that entity. Regardless of whether the EIN is ever used to file Federal tax returns, the EIN is never reused or reassigned to another business entity.

To close a business account with the IRS, a written letter must be sent to: Internal Revenue Service, Cincinnati, OH 45999. The letter must state the reason for closing the account and include the federal identification number, the complete legal name of the entity, and the business address.

Pasos a seguir para cerrar su negocio Presente una declaracion final y formularios relacionados. Cuide a sus empleados. Pague los impuestos que adeuda. Informe los pagos a los trabajadores subcontratados. Cancele su EIN y cierre su cuenta de negocio del IRS. Guarde sus registros.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

Las etapas para el cierre de una empresa por extincion son tres: disolucion, liquidacion y extincion. Disolucion de la sociedad. La disolucion de la sociedad se da por acuerdo de la Junta General de Accionistas para terminar la actividad de una empresa. Liquidacion.Extincion.

Pasos Para Pasar de Propietario Unico a una LLC Nombrar Tu LLC. Elegir un Agente Registrado de LLC. Presentar el Acta Constitutiva de Tu LLC. Crear un Acuerdo Operativo de LLC. Obtener un EIN.