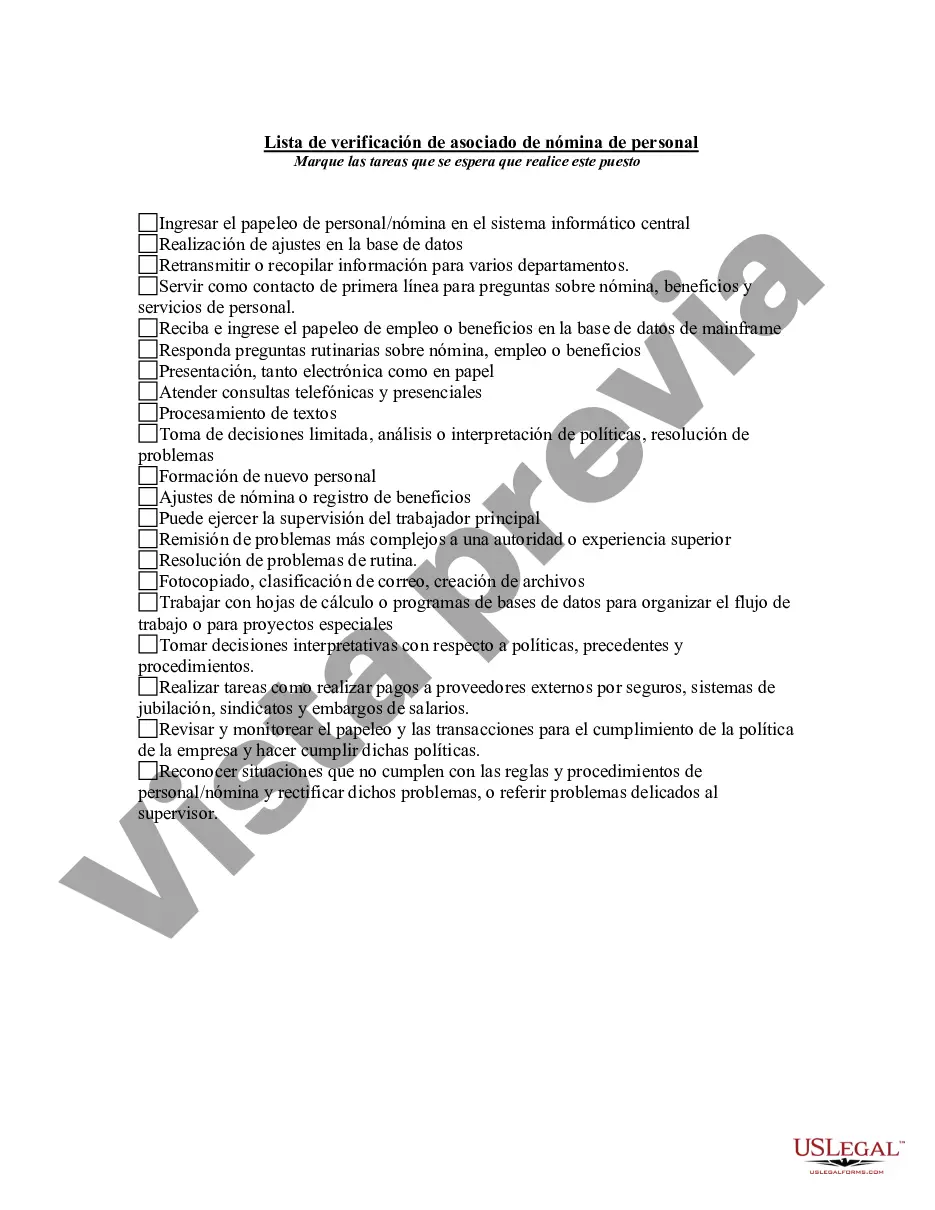

Bronx New York Personnel Payroll Associate Checklist: A Comprehensive Guide for Efficient Payroll Management Keywords: Bronx New York, personnel, payroll, associate, checklist, efficient payroll management. Introduction: The Bronx New York Personnel Payroll Associate Checklist is a comprehensive tool designed to streamline payroll management processes for businesses, organizations, and government agencies in the Bronx, New York area. This detailed checklist ensures accurate and timely processing of personnel payroll, guaranteeing compliance with all local, state, and federal regulations. Key Tasks and Responsibilities: 1. Employee Data Management: — Collect and maintain accurate employee information such as name, address, contact details, and tax withholding status. — Update employee records with relevant changes, like new hires, terminations, promotions, and salary adjustments. — Ensure the confidentiality and security of sensitive employee data. 2. Timekeeping and Attendance: — Monitor and record employees' regular and overtime hours worked accurately. — Follow established procedures for handling exceptions, such as sick leave, vacations, and other time-off requests. — Ensure compliance with labor laws regarding breaks, meal periods, and overtime. 3. Payroll Calculations and Deductions: — Calculate accurate gross wages for each employee based on their agreed-upon salary rate and hours worked. — Deduct appropriate taxes (federal, state, and local), social security, Medicare, and other authorized deductions. — Handle voluntary deductions like retirement contributions, health insurance premiums, and wage garnishments if applicable. 4. Payroll Processing: — Prepare the payroll, ensuring all calculations and deductions are accurate. — Verify payroll information before finalizing for payment. — Generate pay stubs or direct deposit statements for each employee. 5. Payroll Taxes and Reporting: — File payroll tax reports accurately and in a timely manner, adhering to federal, state, and local deadlines. — Submit required tax payments and reconcile variances if any. — Maintain detailed records of all payroll tax filings and payments made. Types of Bronx New York Personnel Payroll Associate Checklists: 1. Basic Personnel Payroll Associate Checklist: — Designed for small businesses or organizations with straightforward payroll requirements. — Includes essential payroll functions such as employee data management, timekeeping, basic payroll calculations, and tax reporting. 2. Advanced Personnel Payroll Associate Checklist: — Suitable for medium to large businesses or organizations with complex payroll structures. — Incorporates advanced features like tracking multiple pay rates, shift differentials, bonuses, and commissions. — Requires proficiency in using payroll software systems and understanding intricate tax regulations. 3. Government Agency Personnel Payroll Associate Checklist: — Tailored for government agencies operating in Bronx, New York. — Focuses on specific payroll regulations applicable to government employees, including union contracts, pension plans, and specialized deductions. By utilizing the Bronx New York Personnel Payroll Associate Checklist, businesses and organizations in the Bronx can efficiently manage their payroll processes, ensuring accurate and on-time payments to employees while maintaining compliance with all relevant regulations and laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Bronx New York Lista De Verificación De Asociado De Nómina De Personal?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Bronx Personnel Payroll Associate Checklist suiting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Bronx Personnel Payroll Associate Checklist, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Bronx Personnel Payroll Associate Checklist:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Bronx Personnel Payroll Associate Checklist.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!