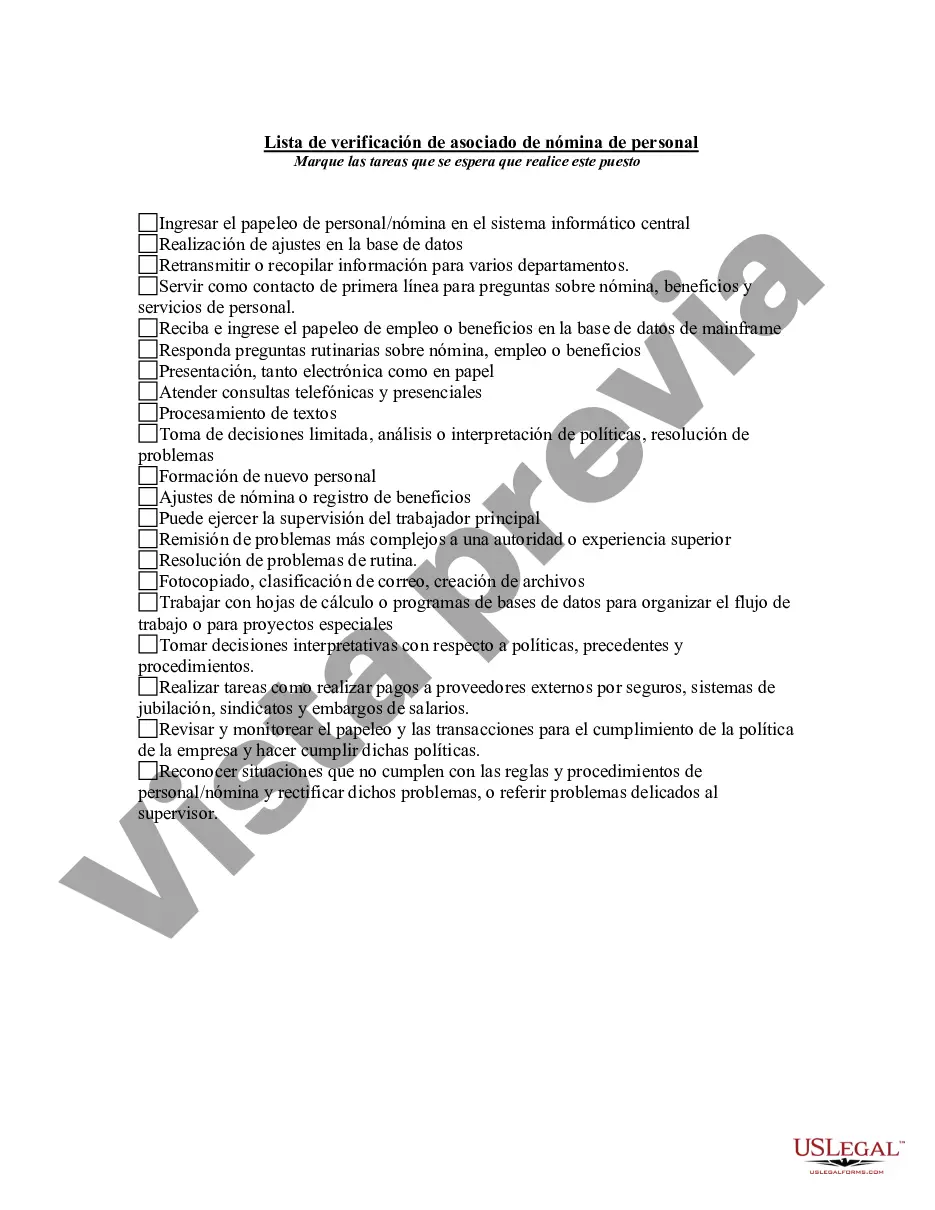

The Harris Texas Personnel Payroll Associate Checklist is a comprehensive and essential tool used by HR professionals and payroll associates in Harris, Texas. This detailed checklist ensures that all necessary tasks and procedures are followed accurately and efficiently, helping to streamline the payroll process and ensure compliance with relevant laws and regulations. Key Tasks: The checklist includes a variety of key tasks that need to be completed by the payroll associate. These tasks may include: 1. Employee Information: Updating and verifying employee information such as personal details, job title, employment status, and department. 2. Time and Attendance: Reviewing and reconciling employee time cards or attendance records, ensuring accurate recording of working hours, overtime, and leave. 3. Payroll Calculations: Accurately calculating and processing employee wages, salaries, bonuses, commissions, and benefits as per company policies and applicable state and federal laws. 4. Deductions and Withholding: Confirming proper deductions for taxes, insurance premiums, retirement contributions, and other voluntary or involuntary withholding. 5. Tax Compliance: Ensuring compliance with all federal, state, and local tax laws, including accurate withholding and reporting of payroll taxes, filing necessary tax forms, and staying up-to-date with any tax law changes. 6. Benefits Administration: Coordinating and ensuring proper administration of employee benefits such as health insurance, retirement plans, flexible spending accounts, and others. 7. Wage Garnishments and Deductions: Handling wage garnishments, child support orders, and any other legally mandated deductions from employee wages. 8. Payroll Record Keeping: Maintaining accurate and up-to-date payroll records, including employee contracts, timesheets, tax forms, and any other relevant documentation. Types of Harris Texas Personnel Payroll Associate Checklists: 1. Monthly Payroll Processing Checklist: This checklist outlines the monthly tasks that need to be completed by the payroll associate, including updating employee data, processing payroll, and generating relevant reports. 2. Quarterly and Year-End Reporting Checklist: As the name suggests, this checklist focuses on quarterly and annual tasks related to tax reporting, W-2 forms generation, and other year-end reconciliation processes. 3. New Hire Onboarding Checklist: This checklist helps ensure a smooth onboarding process for new employees, covering tasks such as gathering essential documents, inputting their details into the payroll system, and setting up direct deposit or payroll cards. 4. Termination Checklist: When an employee leaves the company, this checklist assists in managing the necessary payroll and benefits tasks, including final paycheck calculation, benefits termination, and COBRA administration if applicable. The Harris Texas Personnel Payroll Associate Checklist serves as a vital guide to ensure accuracy, efficiency, and compliance in payroll operations. By following this detailed checklist, payroll associates can effectively manage the diverse responsibilities associated with processing employee compensation and maintaining payroll records.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Harris Texas Lista De Verificación De Asociado De Nómina De Personal?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Harris Personnel Payroll Associate Checklist is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Harris Personnel Payroll Associate Checklist. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Personnel Payroll Associate Checklist in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!