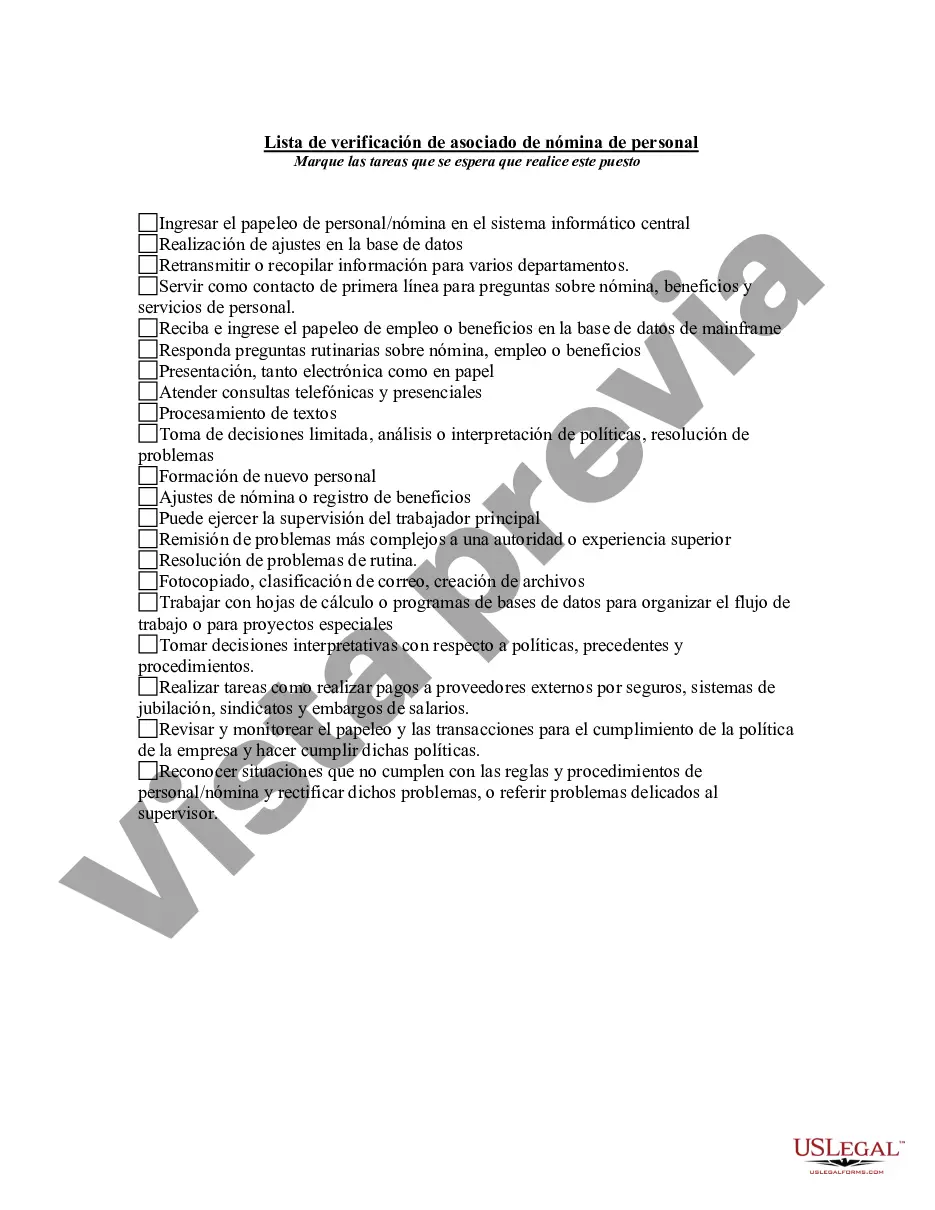

The Hennepin Minnesota Personnel Payroll Associate Checklist is a comprehensive document that serves as a guide for processing and managing employee payroll within the Hennepin County, Minnesota, personnel department. This checklist outlines the necessary steps and tasks that a Personnel Payroll Associate needs to complete to ensure accurate and timely payroll processing for county employees. Some essential keywords relevant to this checklist include: Hennepin County, Minnesota, personnel, payroll, associate, checklist, employee, processing, managing, accurate, timely. The Hennepin Minnesota Personnel Payroll Associate Checklist can be categorized into different types based on the specific requirements or stages of the payroll process. These types may include: 1. New Employee Onboarding Checklist: This sub-checklist focuses on tasks related to setting up payroll for newly hired employees. It includes steps such as verifying employee information, collecting required paperwork (like tax forms and direct deposit details), and entering their information into the payroll system. 2. Updating Employee Records Checklist: This checklist type helps personnel payroll associates keep employee records up to date. It may involve adding or removing dependents, updating tax information, adjusting salary changes, and addressing any pay-related changes requested by employees. 3. Attendance and Leave Tracking Checklist: This type of checklist ensures accurate and efficient tracking of employee attendance, time-off, and leaves. It involves monitoring time cards, recording absences, managing paid time off, and administering any additional benefits like sick leave or unpaid leave. 4. Payroll Processing Checklist: This checklist focuses on the actual payroll processing tasks, including calculating hours, overtime, and deductions, verifying accuracy, generating pay stubs, distributing paychecks or initiating direct deposits, and preparing necessary payroll reports. 5. Compliance and Tax Filing Checklist: This important checklist type ensures compliance with federal, state, and local tax laws and regulations. It involves tasks such as verifying tax withholding amounts, submitting required tax forms to government agencies, and addressing any tax-related inquiries or audits. 6. Year-End Payroll Checklist: This checklist is specifically designed to guide personnel payroll associates through the year-end process, including generating W-2 forms for employees, reconciling payroll records, conducting audits, and preparing tax filings related to annual payroll activities. By following the Hennepin Minnesota Personnel Payroll Associate Checklist, personnel payroll associates can effectively manage and process employee payroll while ensuring accuracy, compliance, and timely financial transactions for Hennepin County employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Hennepin Minnesota Lista De Verificación De Asociado De Nómina De Personal?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your region, including the Hennepin Personnel Payroll Associate Checklist.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Hennepin Personnel Payroll Associate Checklist will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Hennepin Personnel Payroll Associate Checklist:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Hennepin Personnel Payroll Associate Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!