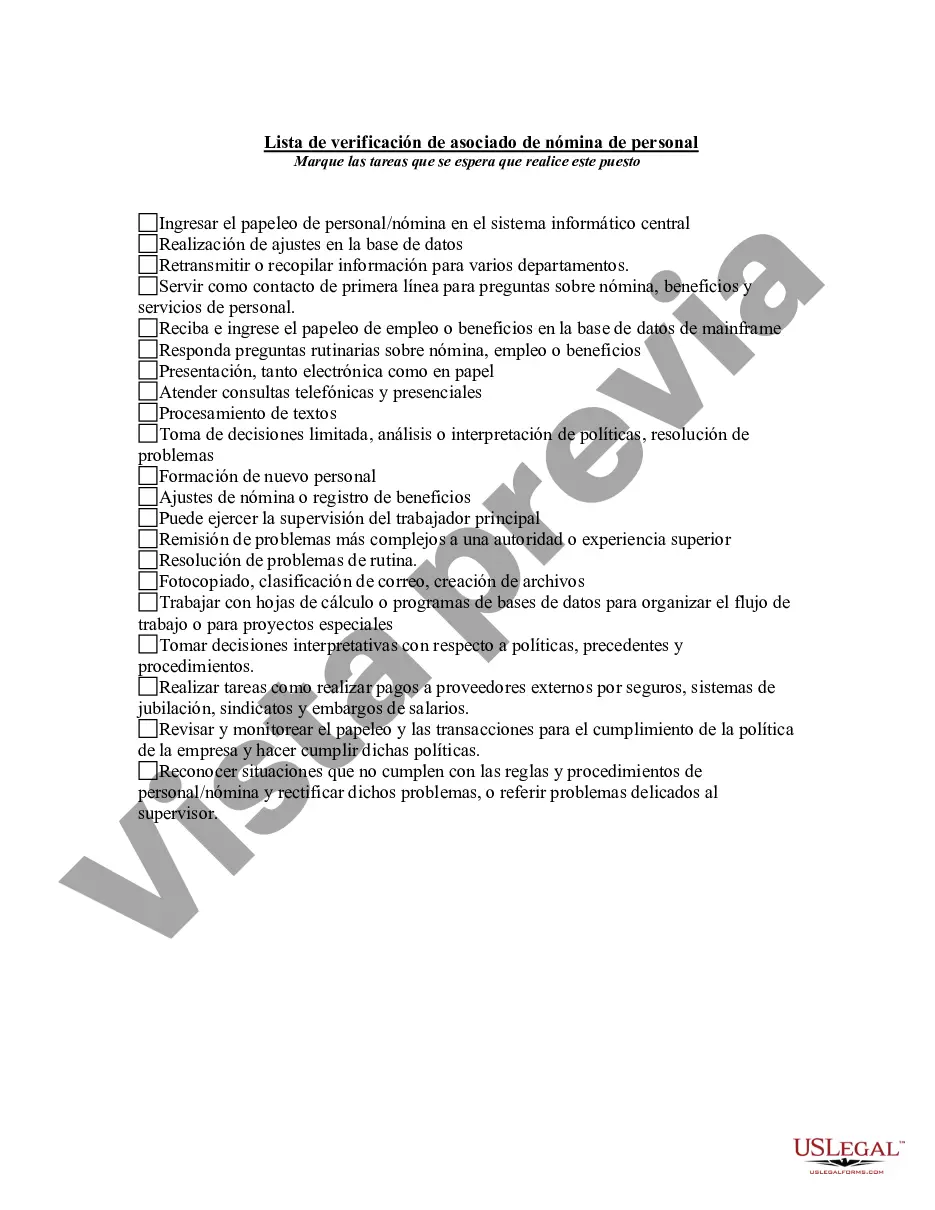

San Antonio Texas Personnel Payroll Associate Checklist serves as a comprehensive tool to ensure that all necessary tasks associated with personnel payroll processing are completed accurately and efficiently. This checklist is designed specifically for personnel payroll associates working in San Antonio, Texas, and includes various key tasks and considerations specific to this geographical location. Employing relevant keywords, here is a detailed description of what the San Antonio Texas Personnel Payroll Associate Checklist entails: 1. Employee Information Management: The checklist includes a thorough examination of employee information management, which involves maintaining accurate records of employee demographics, personal details, tax information, and employment contracts. This ensures compliance with local and federal laws and regulations. 2. Time and Attendance Management: The checklist covers the effective management of time and attendance records to ensure accurate calculation of employee working hours, breaks, overtime, and leaves. Compliance with San Antonio-specific labor laws is emphasized, such as local ordinances related to sick leave or paid time off. 3. Payroll Processing: This section focuses on the precise execution of payroll processing tasks, such as collecting and verifying timesheets, calculating wages, salary adjustments, and any bonuses or commissions due. It also includes considerations for adhering to San Antonio's minimum wage laws and ensuring accurate withholding of taxes and other deductions. 4. Benefits Administration: The checklist incorporates the management of employee benefits, including health insurance, retirement plans, and other voluntary deductions. Compliance with San Antonio's state and local regulations regarding employee benefits, such as medical leave, is crucial. 5. Payroll Taxes and Reporting: This section encompasses compliance with San Antonio's specific tax regulations, including local sales taxes, property taxes, and any other municipality taxes that may affect payroll processing. The checklist includes steps to accurately report and remit payroll taxes to the relevant local and state agencies. 6. Legal Compliance: The personnel payroll associate checklist emphasizes strict adherence to San Antonio's employment laws and regulations. It covers areas such as employee classification, anti-discrimination laws, worker's compensation, and any industry-specific employment regulations required within the city. Different types of San Antonio Texas Personnel Payroll Associate Checklists may exist depending on specific industry requirements or organizational preferences. For example, there could be variations for different sectors such as healthcare, education, hospitality, or manufacturing. Additionally, specialized checklists might be created to address unique elements that come into play during certain periods, such as annual tax filing season or auditing processes. Overall, the San Antonio Texas Personnel Payroll Associate Checklist serves as a comprehensive guide for professionals responsible for personnel payroll processing in the San Antonio area, ensuring accurate and compliant handling of employee compensation in accordance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out San Antonio Texas Lista De Verificación De Asociado De Nómina De Personal?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Antonio Personnel Payroll Associate Checklist, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the recent version of the San Antonio Personnel Payroll Associate Checklist, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Personnel Payroll Associate Checklist:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your San Antonio Personnel Payroll Associate Checklist and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!