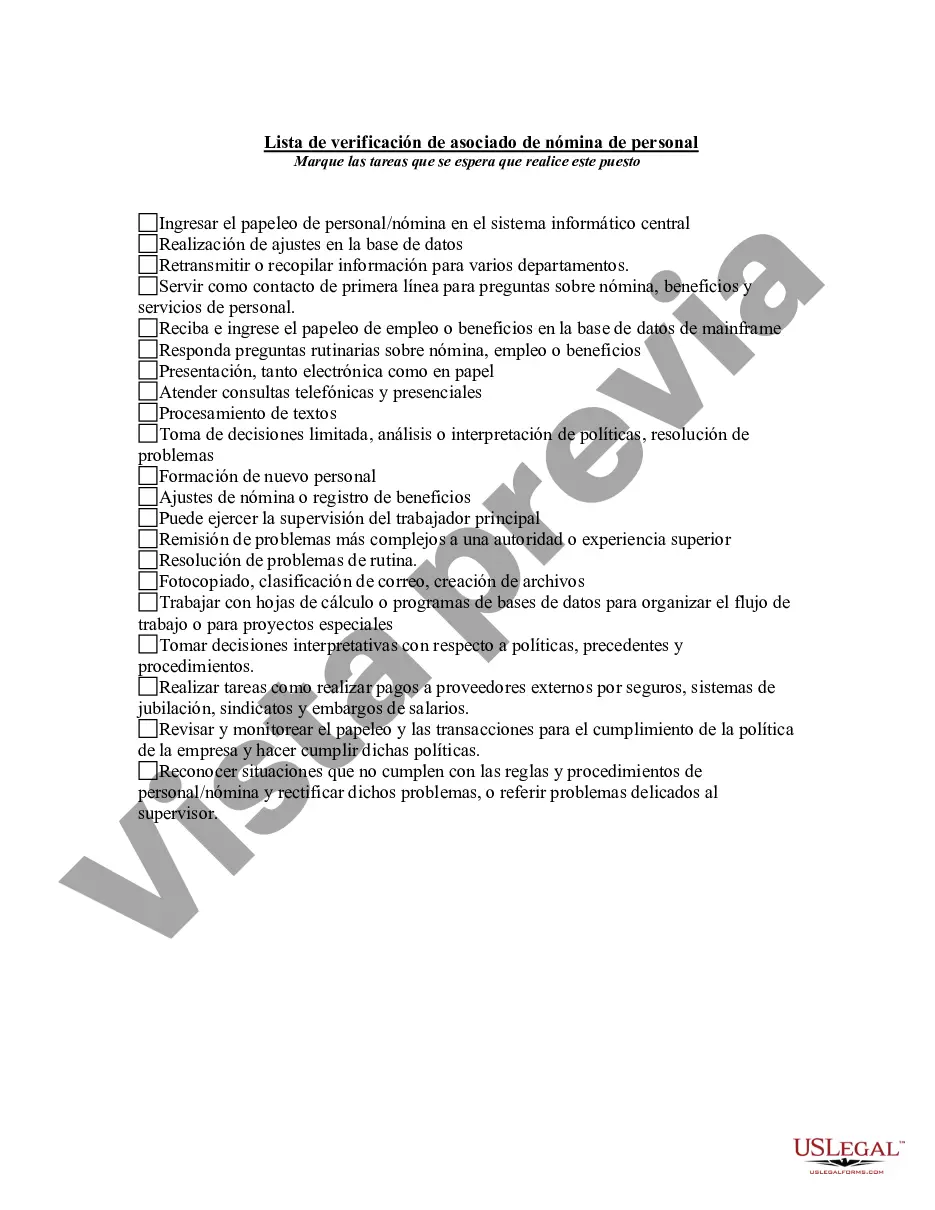

The San Bernardino California Personnel Payroll Associate Checklist is an essential tool used by professionals in the field to ensure accurate and efficient payroll management within an organization. This comprehensive checklist includes a series of tasks and steps that a personnel payroll associate needs to undertake during the payroll process. By following this checklist, the associate can ensure compliance with labor laws, accurately calculate wages, and distribute payments to employees in a timely manner. Keywords: San Bernardino California, personnel payroll associate, checklist, accurate, efficient, payroll management, organization, tasks, steps, compliance, labor laws, calculate wages, distribute payments, timely manner. Different types of San Bernardino California Personnel Payroll Associate Checklists: 1. New Hire Checklist: This checklist includes tasks related to onboarding new employees into the payroll system, such as gathering necessary documentation, verifying personal details, setting up tax withholding, and inputting relevant employment information. 2. Timekeeping Checklist: This checklist focuses on tracking and verifying employee attendance, hours worked, breaks, and any exceptions or overtime. It ensures accurate recording of the hours worked for accurate wage calculation. 3. Deduction Checklist: This checklist covers the necessary steps to deduct employee benefits, taxes, and other authorized deductions from their wages. It ensures compliance with legal requirements and guarantees proper deductions are made. 4. Payroll Processing Checklist: This checklist outlines the steps to process payroll accurately and timely. It includes tasks such as verifying hours worked, calculating wages, accounting for overtime and other wage adjustments, confirming data integrity, and generating payroll reports. 5. Compliance Checklist: This checklist is designed to identify and address compliance-related matters in payroll processing. It includes tasks such as ensuring proper classification of employees, adhering to labor laws regarding minimum wage, overtime, and tax regulations, and maintaining accurate records and reporting. 6. Year-end Checklist: This checklist includes tasks related to the closure of the fiscal year, such as reconciling payroll accounts, generating W-2 forms for employees, preparing reports for tax purposes, and any necessary adjustments or audits. By utilizing these various types of San Bernardino California Personnel Payroll Associate Checklists, professionals can ensure accurate, efficient, and compliant payroll management within organizations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out San Bernardino California Lista De Verificación De Asociado De Nómina De Personal?

Do you need to quickly draft a legally-binding San Bernardino Personnel Payroll Associate Checklist or maybe any other document to manage your personal or corporate affairs? You can go with two options: hire a legal advisor to draft a legal paper for you or create it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant document templates, including San Bernardino Personnel Payroll Associate Checklist and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the San Bernardino Personnel Payroll Associate Checklist is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Bernardino Personnel Payroll Associate Checklist template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!