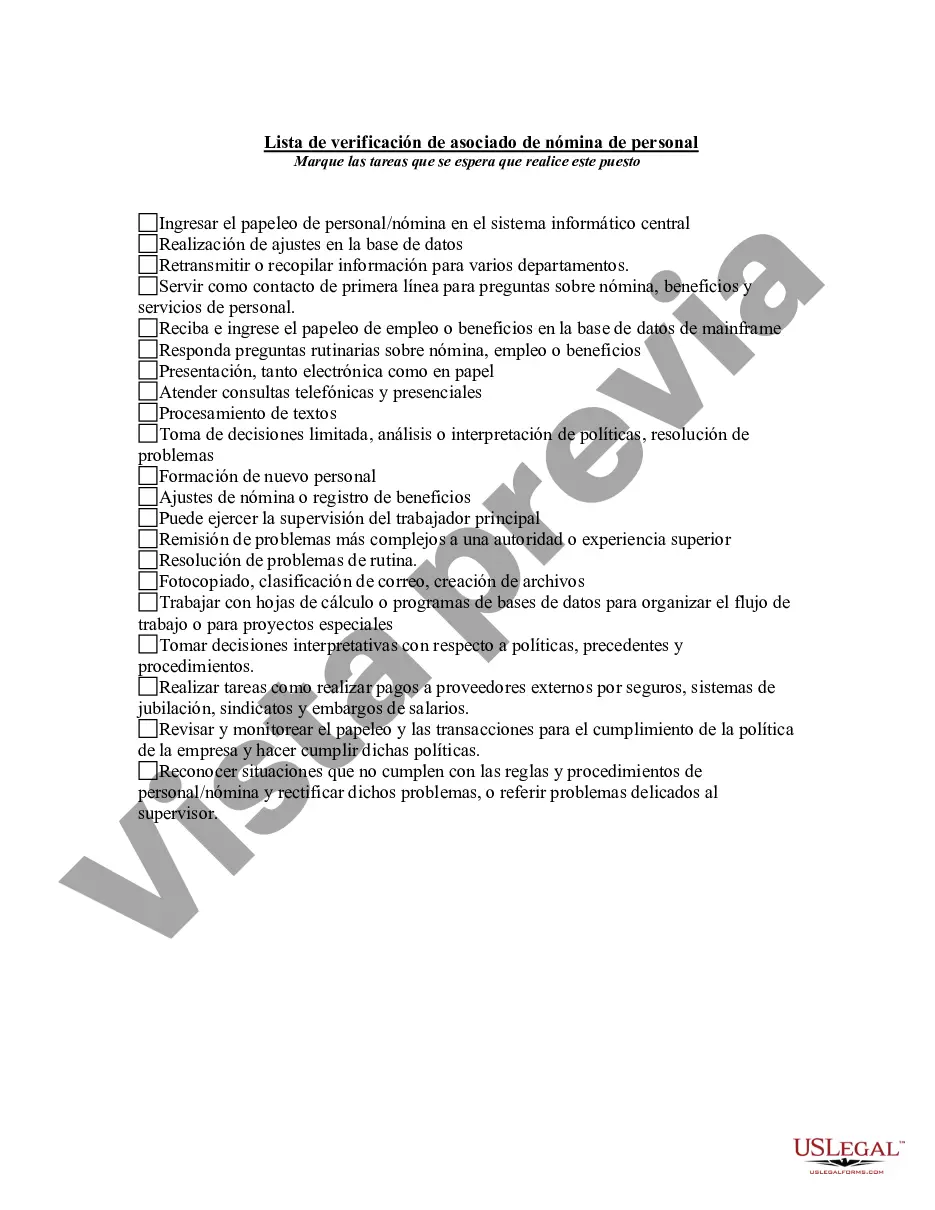

San Jose California Personnel Payroll Associate Checklist is a comprehensive tool used by organizations and companies based in San Jose, California, to ensure accuracy and compliance in payroll processing and HR functions. This checklist helps Personnel Payroll Associates to efficiently manage employee payroll tasks, benefits administration, tax filings, and other related processes. Here is a list of relevant keywords to describe the San Jose California Personnel Payroll Associate Checklist: 1. Payroll processing: This checklist includes steps and guidelines for accurately calculating and processing employee pay, considering factors such as hours worked, overtime, bonuses, commissions, and deductions. 2. Benefits administration: It covers managing employee benefits programs such as health insurance, retirement plans, paid time off, and ensuring proper deductions and contributions. 3. Tax compliance: The checklist outlines procedures for maintaining compliance with federal, state, and local tax laws, regulations, and reporting requirements, including payroll taxes, W-2 filings, and quarterly reporting. 4. Employee record management: It includes maintaining accurate and up-to-date employee records regarding personal information, employment contracts, pay rates, tax exemptions, and other relevant details. 5. Onboarding and off boarding: The checklist assists in the smooth onboarding process for new hires, including collecting required documents, completing forms, setting up payroll profiles, and also ensures proper termination procedures for employees leaving the company. 6. Time and attendance: It covers the accurate tracking of employee attendance, hours worked, vacation, sick days, and other leaves to ensure precise payroll calculations. 7. Compliance and legal requirements: The checklist ensures adherence to labor laws, employment regulations, industry-specific requirements, and internal policies regarding personnel payroll procedures. Types of San Jose California Personnel Payroll Associate Checklists: 1. Monthly payroll processing checklist: Specifically designed for monthly payroll cycles, this checklist includes unique steps and considerations related to monthly pay periods and mid-month adjustments. 2. Year-end payroll processing checklist: This checklist covers all the necessary tasks associated with year-end processing, such as generating W-2 forms, reconciling payroll records, preparing annual reports, and meeting tax-related requirements. 3. Tax season checklist: Focused on specific tax preparation, this checklist helps ensure all necessary documents and information are gathered accurately and submitted within deadlines. 4. Exception handling checklist: This type of checklist provides guidelines for addressing payroll errors, discrepancies, and exceptions, including corrections, adjustments, and communication with employees to resolve any issues. 5. Compliance audit checklist: Mainly used for internal or external audits, this checklist ensures that all processes, documentation, and records related to personnel payroll comply with legal and regulatory requirements. The San Jose California Personnel Payroll Associate Checklist is a vital tool in streamlining and documenting the payroll operations, enhancing accuracy, reducing mistakes, and ensuring compliance within the dynamic HR and payroll landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out San Jose California Lista De Verificación De Asociado De Nómina De Personal?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including San Jose Personnel Payroll Associate Checklist, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to purchase and download San Jose Personnel Payroll Associate Checklist.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the related document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase San Jose Personnel Payroll Associate Checklist.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed San Jose Personnel Payroll Associate Checklist, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you need to cope with an exceptionally complicated case, we advise using the services of an attorney to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!