The Suffolk New York Personnel Payroll Associate Checklist is a comprehensive document used by HR departments and payroll professionals to ensure accurate and efficient payroll processing for employees in Suffolk County, New York. This checklist contains a series of tasks and guidelines, enabling personnel payroll associates to systematically handle various payroll activities and maintain compliance with relevant policies and regulations. Key tasks covered in the Suffolk New York Personnel Payroll Associate Checklist may include: 1. Employee Information Management: — Collecting and accurately entering employee data such as personal details, contact information, and employment status. — Verifying that employee information is complete and up to date. — Maintaining strict confidentiality of employee records. 2. Timekeeping and Attendance: — Tracking employee work hours, including regular time, overtime, and leave. — Ensuring accuractimemcardsds and adherence to company policies. — Resolving discrepancies and reviewing any exceptions or fluctuations in attendance. 3. Compensation and Benefits: — Calculating and processing employee wages, salaries, bonuses, and commissions. — Deducting taxes, benefits contributions, and other withholding accurately. — Addressing inquiries related to compensation and benefits, such as adjustments and discrepancies. 4. Payroll Processing: — Validating and reconciling timesheets, payroll reports, and leave requests. — Calculating and preparing payroll accurately and in a timely manner, meeting designated pay periods. — Collaborating with finance or accounting departments to ensure proper allocation and distribution of funds. 5. Tax Compliance: — Managing payroll tax obligations, including federal, state, and local tax withholding. — Submitting accurate tax reports, forms, and payments in a timely fashion. — Staying updated with changing tax laws and regulations to ensure compliance. 6. Record-keeping and Reporting: — Maintaining organized payroll records and documentation. — Preparing and distributing payroll reports to various stakeholders. — Assisting with audits and providing necessary payroll-related information to auditors when required. Types of Suffolk New York Personnel Payroll Associate Checklists may include: 1. Monthly Payroll Processing Checklist: A checklist specifically designed to guide personnel payroll associates through the monthly payroll cycle, covering all essential tasks and deadlines for processing payroll accurately within each month. 2. Year-End Payroll Checklist: This checklist focuses on the year-end payroll process, covering activities such as issuing W-2 forms, reconciling payroll accounts, and ensuring compliance with annual tax reporting requirements. 3. New Hire Onboarding Checklist: A checklist specifically tailored to streamline the payroll-related onboarding process for new employees, including tasks such as setting up direct deposit, verifying tax withholding status, and explaining payroll policies. 4. Payroll Compliance Audit Checklist: Designed to aid in internal payroll audits, this checklist ensures that all payroll processes and documentation meet legal and regulatory requirements, highlighting potential areas of risk or non-compliance. By utilizing the Suffolk New York Personnel Payroll Associate Checklist, HR departments and payroll professionals can maintain accurate payroll records, ensure timely compensation delivery, and uphold compliance with relevant laws and regulations.

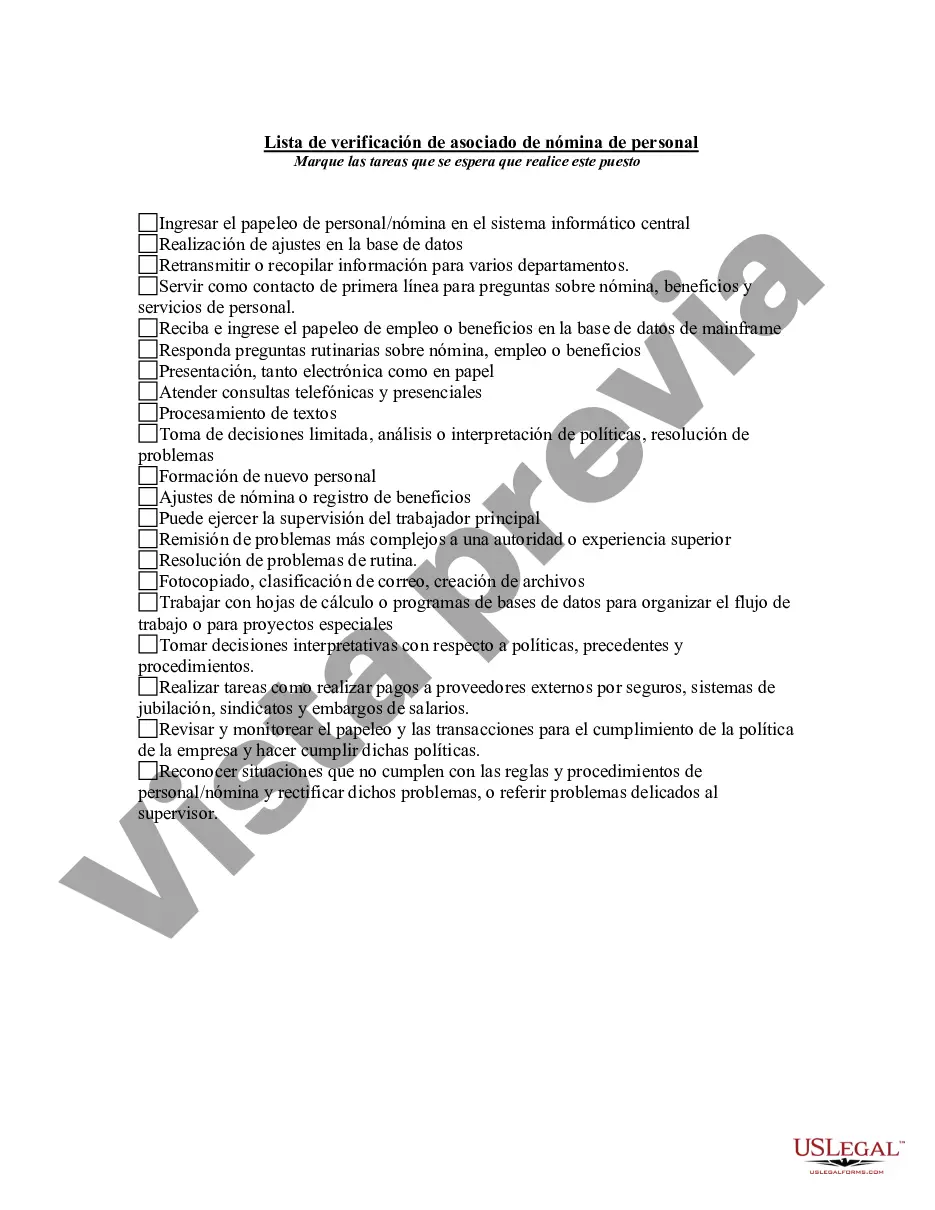

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Suffolk New York Lista De Verificación De Asociado De Nómina De Personal?

Drafting papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Suffolk Personnel Payroll Associate Checklist without professional help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Suffolk Personnel Payroll Associate Checklist on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Suffolk Personnel Payroll Associate Checklist:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!