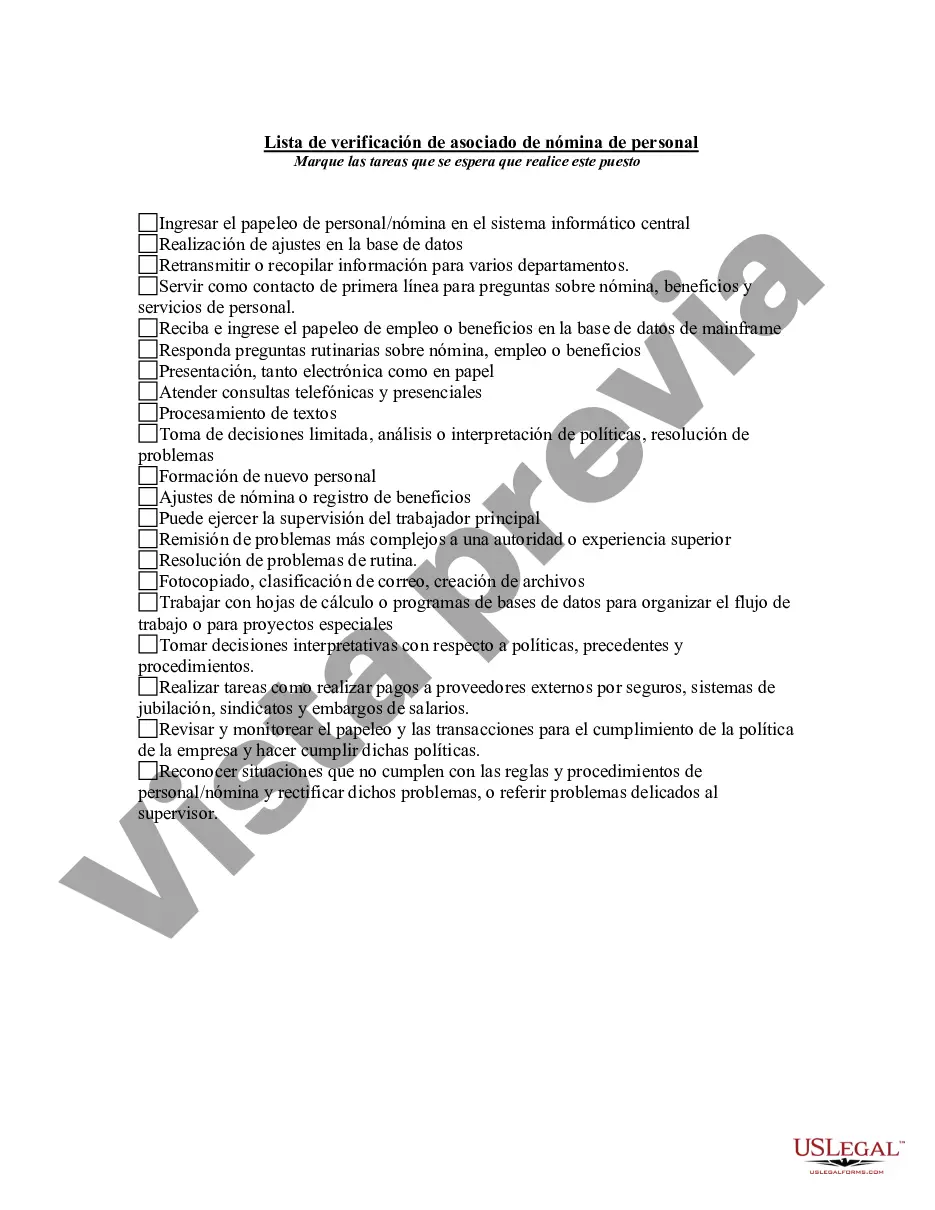

The Tarrant Texas Personnel Payroll Associate Checklist is a comprehensive tool designed specifically for personnel payroll associates in the Tarrant County area of Texas. This checklist serves as a guide to ensure accuracy, compliance, and efficiency in handling various payroll tasks and responsibilities. Key tasks covered in the checklist include: 1. Employee Information Management: This section focuses on maintaining accurate and up-to-date employee information, including personal details, job positions, tax withholding allowances, and other relevant data. 2. Time and Attendance Tracking: This component covers tracking and recording employee hours worked, including regular hours, overtime, vacation, sick leave, and any other time off. It also includes monitoring attendance and managing exceptions like tardiness and leave requests. 3. Payroll Processing: This itemizes the steps needed to successfully process payroll, such as reviewing time and attendance records, calculating wages, factoring in special payments (bonuses, commissions, etc.), and ensuring all deductions and tax withholding are accurately applied. 4. Benefits Administration: This section outlines procedures for managing employee benefits, including health insurance, retirement plans, paid time off accruals, and other related tasks like open enrollment and coordinating with benefits providers. 5. Payroll Taxes and Reporting: This part focuses on meeting tax obligations and reporting requirements. It includes accurately calculating and withholding federal, state, and local taxes, preparing quarterly and annual tax filings, and producing W-2 and 1099 forms for employees. 6. Record Keeping and Compliance: This component emphasizes the importance of maintaining proper documentation, records, and audit trails. It covers ensuring compliance with labor laws, privacy regulations, and internal policies, retaining records for specified periods, and conducting regular audits to identify and rectify any discrepancies. 7. Communication and Customer Service: This section emphasizes effective communication with employees, answering their payroll-related queries, resolving issues, and providing excellent customer service. It may involve regularly updating employees on payroll-related matters, addressing concerns promptly, and assisting them with any payroll-related paperwork. Different types of Tarrant Texas Personnel Payroll Associate Checklists may be tailored for specific industries or organizations, incorporating additional requirements or standards unique to those sectors. For example, there could be variants specific to healthcare, educational institutions, government agencies, or non-profit organizations. These specialized checklists may further break down the payroll process and compliance requirements specific to those industries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Tarrant Texas Lista De Verificación De Asociado De Nómina De Personal?

Draftwing documents, like Tarrant Personnel Payroll Associate Checklist, to take care of your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for different scenarios and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Tarrant Personnel Payroll Associate Checklist template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Tarrant Personnel Payroll Associate Checklist:

- Ensure that your template is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Tarrant Personnel Payroll Associate Checklist isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our service and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!