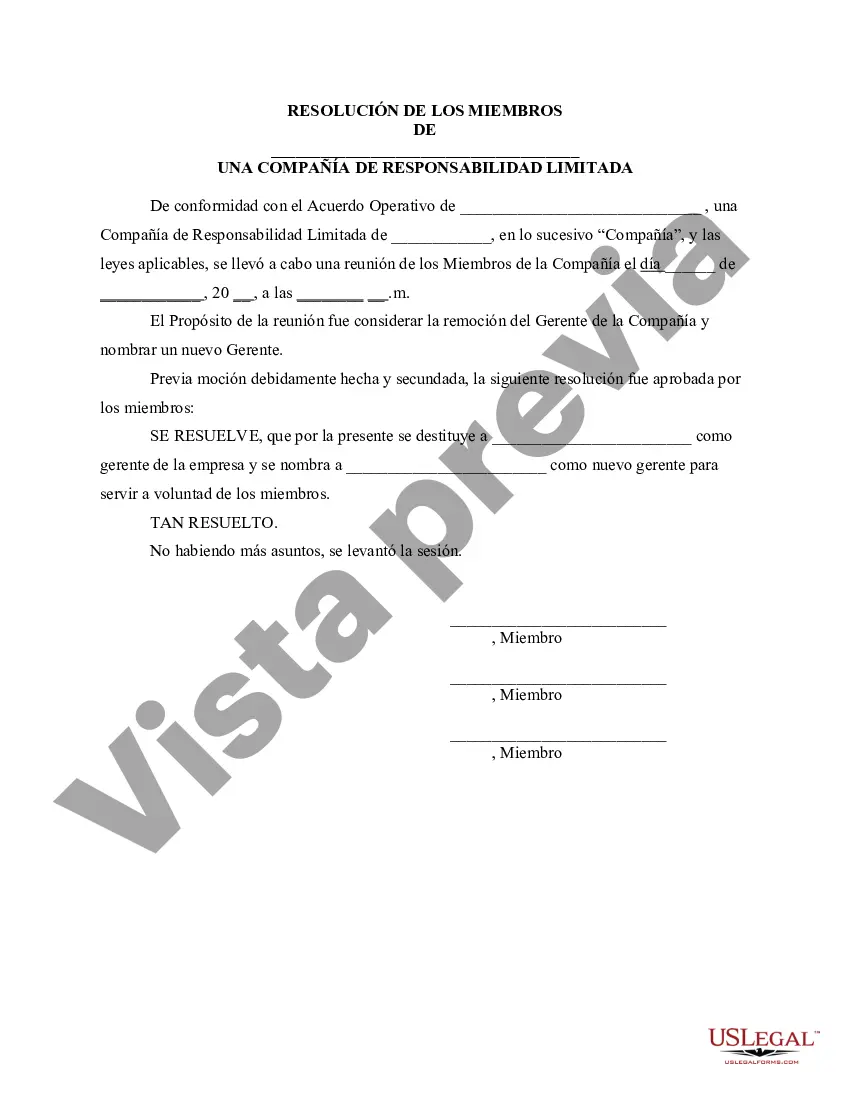

Franklin Ohio Resolution of Meeting of LLC Members to Remove the Manager of the Company and Appoint a New Manager: In the state of Ohio, a Limited Liability Company (LLC) operates under specific guidelines outlined in the Ohio Revised Code. If a situation arises where the LLC members feel the need to remove the current manager of the company and appoint a new manager, a resolution of the meeting needs to be organized. This resolution outlines the process and requirements to properly remove the existing manager and select a successor. Keywords: Franklin Ohio, Resolution of Meeting, LLC Members, Remove Manager, Appoint New Manager There are two main types of resolutions that can be invoked by LLC members in Franklin, Ohio, to remove the manager and appoint a new one: an informal resolution and a formal resolution. 1. Informal Resolution: An informal resolution refers to a scenario where the LLC members can mutually agree to remove the current manager and select a new manager without following any specific formalities. This type of resolution is possible if there is no requirement for a written agreement or if the LLC's operating agreement permits such an informal removal and appointment process. However, it is advisable to have a written record of the decision and the consent of all involved parties to avoid any potential disputes in the future. 2. Formal Resolution: A formal resolution is employed when the LLC members wish to follow a structured process and ensure legal compliance while removing the manager and appointing a new one. This type of resolution requires a meeting of the LLC members, with proper notice provided to all members as stipulated in the LLC's operating agreement. During the meeting, a formal vote is held to determine whether the current manager should be removed. The resolution must clearly state the reasons for the removal or non-performance by the manager. The LLC members should ensure that the vote is conducted in accordance with the requirements specified in the operating agreement. Typically, these provisions outline the required majority percentage for the resolution to be deemed valid. Upon the successful removal of the manager, the LLC members proceed with the appointment of a new manager. This decision must also be made through a formal vote during the meeting. The resolution should include details about the qualifications and responsibilities of the newly appointed manager. Once the formal resolution is adopted, it is crucial to update any relevant documents, including the LLC's operating agreement and state filings, to reflect the changes made. It is essential to adhere to all legal obligations and ensure that all necessary documentation is properly filed with the appropriate state authorities. In conclusion, when a situation arises in Franklin, Ohio, where the LLC members believe it is necessary to remove the current manager of the company and appoint a new one, a resolution of the meeting is crucial. Whether an informal or formal resolution is pursued, it is vital to follow the guidelines outlined in the LLC's operating agreement and comply with the relevant laws and regulations of the state to ensure a smooth transition and avoid any potential legal complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Resolución de la reunión de miembros de la LLC para destituir al gerente de la empresa y nombrar un nuevo gerente - Resolution of Meeting of LLC Members to Remove the Manager of the Company and Appoint a New Manager

Description

How to fill out Franklin Ohio Resolución De La Reunión De Miembros De La LLC Para Destituir Al Gerente De La Empresa Y Nombrar Un Nuevo Gerente?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Franklin Resolution of Meeting of LLC Members to Remove the Manager of the Company and Appoint a New Manager.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Franklin Resolution of Meeting of LLC Members to Remove the Manager of the Company and Appoint a New Manager will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Franklin Resolution of Meeting of LLC Members to Remove the Manager of the Company and Appoint a New Manager:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Franklin Resolution of Meeting of LLC Members to Remove the Manager of the Company and Appoint a New Manager on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

No hay un limite maximo de miembros. La mayoria de los estados tambien permiten las LLC de un miembro unico, las que tienen un solo dueno.

Siga estos pasos para cerrar su negocio: Decida el cierre.Presente los documentos para la disolucion.Cancele registros, permisos, licencias y nombres de la empresa.Cumpla con las leyes de empleo y trabajo.Resuelva las obligaciones financieras.Mantenga sus registros.

Asociacion General (Partnership). Asociacion con Responsabilidad Limitada (Limited Liability Partnership). Sociedad Limitada (Limited Partnership). Corporacion C (C Corporation).

Al contrario de las LLC, los socios de las C Corps no necesitan realizar declaraciones de impuestos en Estados Unidos. Esto solo es necesario cuando existe distribucion de ganancia para los accionistas. Es por esto que muchos extranjeros optan por una Corporation al momento de crear una empresa en Estados Unidos.

Para disolver una LLC en Florida, debe presentar un articulo de disolucion completo al Secretario de Estado. Antes de presentar el articulo de disolucion, uno debe seguir las acuerdo de operacion. Si tienes un Florida LLC (nacional o extranjero) debe tener un acuerdo operativo.

Una corporacion es una buena opcion para una compania que va a obtener financiamiento de capital de riesgo o quiere establecer un plan de opciones sobre acciones para empleados. Pero una LLC es mas facil de mantener, mas flexible que una corporacion y puede convertirse facilmente en una corporacion.

Probablemente el paso mas critico para disolver exitosamente su LLC es pagar sus impuestos. Usted debe cerrar las cuentas de impuesto de la LLC con el IRS y el estado. Pague cualquier deuda que tenga y cerciorese de financiar correctamente su retencion de nomina, asi como sus impuestos sobre las ventas.

More In File The IRS cannot cancel your EIN. Once an EIN has been assigned to a business entity, it becomes the permanent Federal taxpayer identification number for that entity. Regardless of whether the EIN is ever used to file Federal tax returns, the EIN is never reused or reassigned to another business entity.