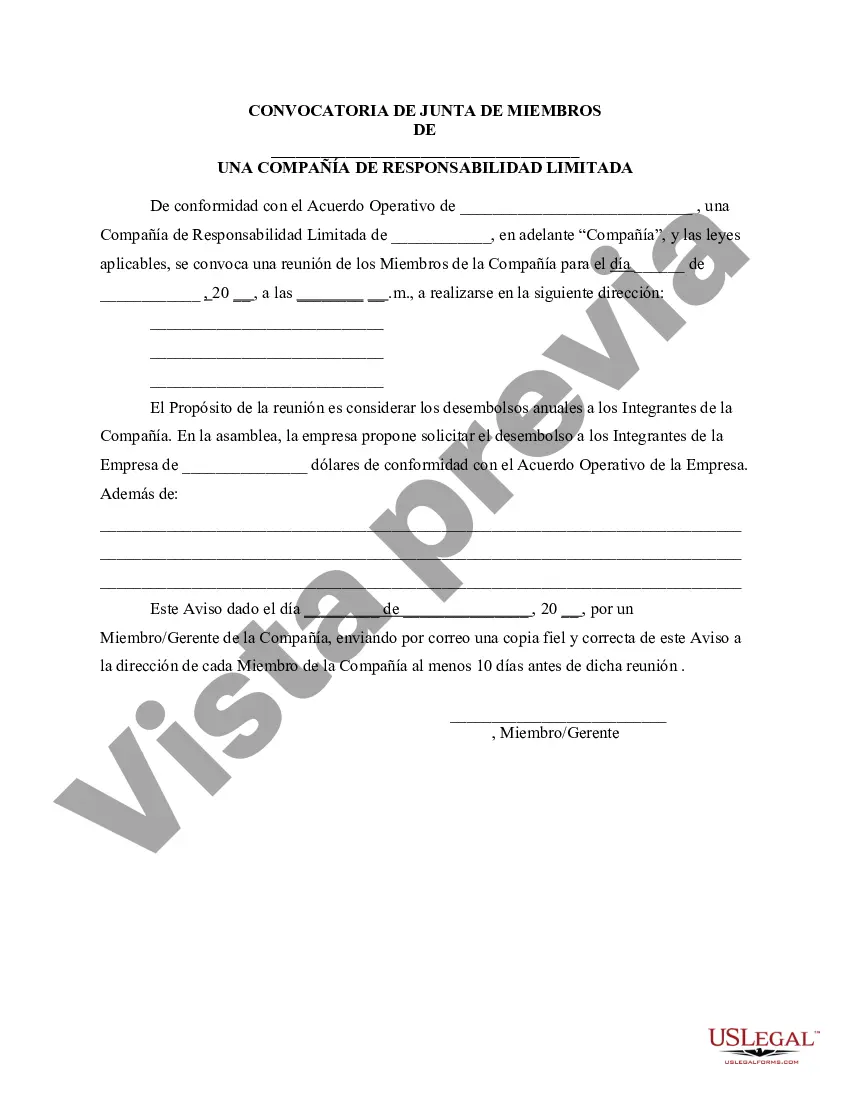

San Jose, California is a vibrant city situated in the heart of Silicon Valley. Known for its thriving tech industry, diverse culture, and stunning landscapes, San Jose offers a plethora of opportunities and attractions for residents and visitors alike. A San Jose California Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company is a formal communication sent to all members of a limited liability company (LLC) based in San Jose. This notice serves as an official invitation for members to convene and discuss the allocation of annual disbursements to the company's stakeholders. This meeting holds significance for the LLC's members as it provides them with a platform to voice their opinions and collectively decide on the disbursement strategy. Considered an essential part of maintaining transparency and ensuring fair distribution of profits, this meeting guarantees that all members are actively involved in financial decision-making processes. During the San Jose California Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company, various important points are discussed, such as: 1. Profit Allocation: Members engage in discussions to determine the proportion of annual profits to be allocated among themselves. This involves considering factors such as performance, contribution, and equity. 2. Reserves and Reinvestment: The meeting allows members to evaluate whether a portion of profits should be retained as reserves for future business operations or reinvested into the company for growth and expansion. 3. Tax Implications: Members must assess the tax consequences of the disbursements, ensuring compliance with San Jose and California tax laws and regulations. 4. Reporting and Documentation: The meeting provides an opportunity to review financial reports, verify disbursement calculations, and ensure accurate documentation for record-keeping and audit purposes. Different types of San Jose California Notices of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company could include: 1. Regular Annual Meeting: Held annually, this meeting allows members to discuss and decide on the disbursements for the respective fiscal year. 2. Special Meeting: Sometimes, unforeseen circumstances or extraordinary situations may require an additional meeting to be called. This could include unexpected windfalls, changes in ownership structure, or significant business developments impacting disbursement plans. 3. Emergency Meeting: In urgent cases where immediate disbursement decisions are necessary or time-sensitive matters arise, an emergency meeting can be convened. This ensures swift action is taken, maintaining the company's financial stability. Overall, the San Jose California Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company plays a vital role in fostering collaboration, fairness, and financial prudence within the LLC. By involving all members in the decision-making process, this meeting ensures transparency and accountability, creating a strong foundation for the company's continued success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Aviso de reunión de miembros de la LLC para considerar los desembolsos anuales a los miembros de la empresa - Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company

Description

How to fill out San Jose California Aviso De Reunión De Miembros De La LLC Para Considerar Los Desembolsos Anuales A Los Miembros De La Empresa?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like San Jose Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the San Jose Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Para que la LLC declare impuestos como una empresa unipersonal, debes presentar el Anexo C. Los propietarios unicos pagan impuestos sobre las ganancias y perdidas comerciales de la empresa. Para declarar impuestos como una LLC/sociedad, presenta el Formulario 1065, Retorno de los ingresos de la sociedad.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

Para mantener una LLC en Texas, no necesita pagar una tarifa anual. Sin embargo, se cobran impuestos sobre las ventas y el uso de 6.25%, impuestos estatales de franquicia e impuestos federales.