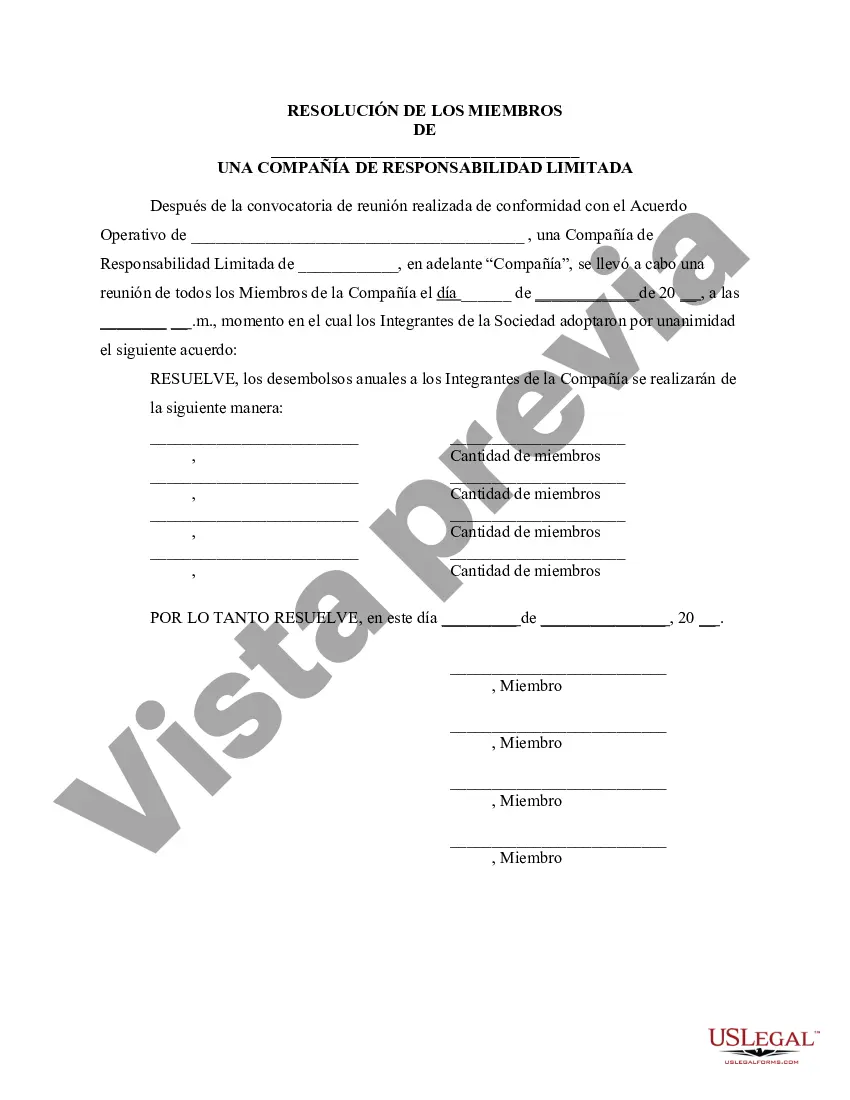

The Allegheny Pennsylvania Resolution of Meeting of LLC Members aims to establish and specify the annual disbursements that will be allocated to members of the company. This resolution is a crucial step in ensuring transparent and fair distribution of profits and financial resources within the LLC. By defining the amount of money that will be disbursed to members on an annual basis, this resolution provides a clear guideline for the company's financial management. The Allegheny Pennsylvania Resolution of Meeting of LLC Members demonstrates the commitment of the members to address financial matters in a structured and organized manner. This resolution is usually passed during a formal meeting of the LLC members, where the proposal for annual disbursements is presented and discussed. Through this resolution, the LLC members can collectively determine the amount of money that will be distributed among themselves. This may be influenced by factors such as the financial performance of the company, operational expenses, future growth plans, and individual contributions of the members to the company's success. Different variations of the Allegheny Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company may include: 1. Variation based on Profit-Sharing Model: In this type of resolution, the amount of annual disbursements is proportionate to the members' ownership interests or the shares they hold in the LLC. 2. Variation based on Flat or Fixed Amounts: This resolution may specify a fixed sum that will be distributed equally among all members, regardless of their ownership percentages or contributions to the company. 3. Variation based on Performance-Based Criteria: This resolution can be designed to distribute the annual disbursements based on predefined performance metrics, such as individual or departmental achievements, sales targets, or overall company profitability. 4. Variation based on Combination Approach: It is also possible to have a resolution that combines various factors to determine the amount of annual disbursements. This could include a base amount for equal distribution among members, with additional amounts based on ownership interests or performance-based criteria. In conclusion, the Allegheny Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a critical document that outlines the financial framework for distributing profits within an LLC. It ensures transparency, fairness, and provides clear guidelines for financial decision-making. The specific type of resolution adopted may vary depending on the unique characteristics and goals of the LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Allegheny Pennsylvania Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Allegheny Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Allegheny Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Allegheny Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company:

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!