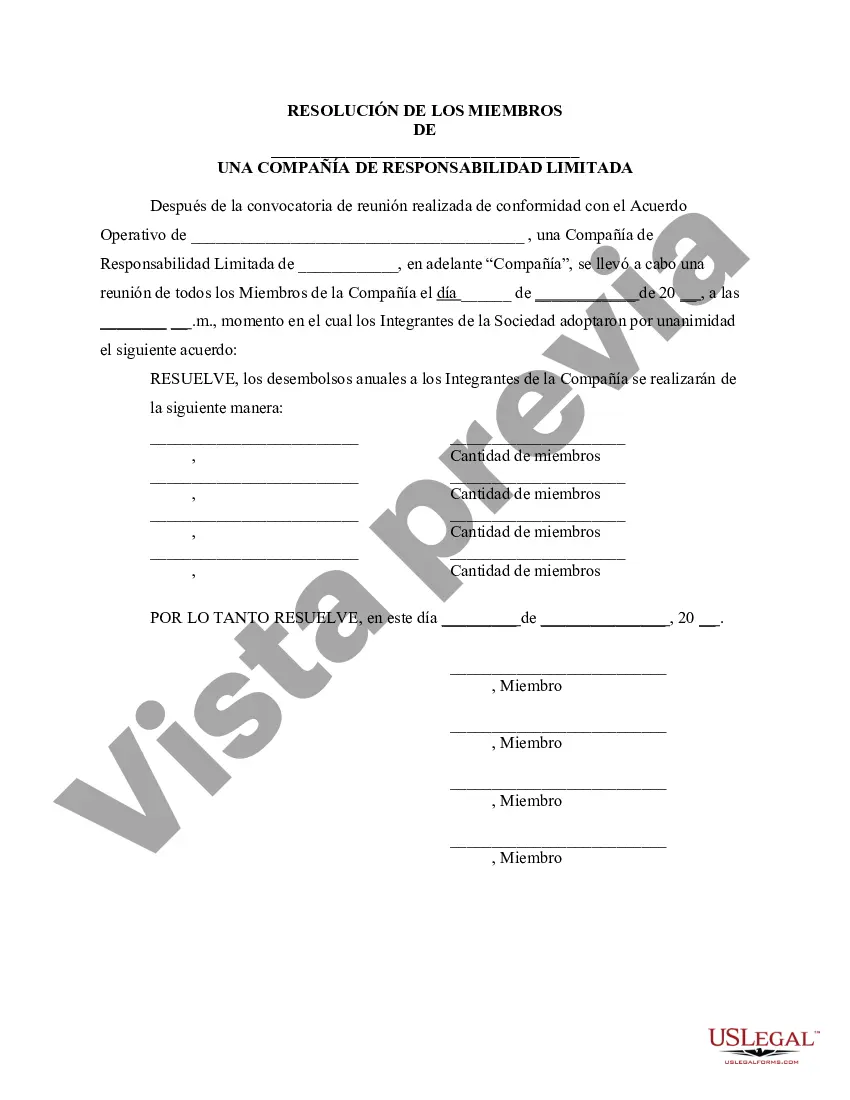

A Cook Illinois Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a critical document that guides the distribution of profits among the members of the LLC. This resolution serves to ensure transparency, clarity, and fairness in determining the amount each member is entitled to receive. The resolution begins by stating the purpose of the meeting, which is to discuss and decide on the specific amount of annual disbursements to be allocated to the members. It clarifies that the disbursements are derived from the company's profits and are distributed to each member, reflecting their ownership or membership interest. One type of Cook Illinois Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company could be focused on establishing a fixed percentage distribution among members based on their initial capital contributions. This type of resolution would clearly define each member's entitlement to the company's profits based on their financial investment during the formation of the LLC. Another type of resolution might involve a more dynamic approach, specifying a formula or methodology for calculating the disbursements. This methodology could consider factors such as the duration of membership, active participation in company activities, or other performance-related criteria that reflect individual contributions to the LLC's success. To ensure fairness and prevent any bias or conflicts of interest, the resolution ensures that all members have an equal opportunity to participate in the decision-making process regarding the amount of annual disbursements. It may outline the procedures for calling the meeting, providing notice to all members, and establishing a quorum — the minimum number of members required for a valid resolution. The resolution also covers the voting process, specifying whether a simple majority or a super majority of members' votes is needed to pass the resolution. Additionally, it may allow for absentee voting or the appointment of proxies to ensure all members have the opportunity to influence the outcome. Once the resolution is approved, it becomes a binding agreement among the members, and the specified amount of annual disbursements must be distributed accordingly. The document should be properly documented, signed, and kept as part of the LLC's official records. In conclusion, a Cook Illinois Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a crucial mechanism for fairly determining the allocation of profits among members. Whether based on initial capital contributions or a dynamic methodology, this resolution establishes clear guidelines to promote transparency, fairness, and effective decision-making within the LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Cook Illinois Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Draftwing paperwork, like Cook Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, to manage your legal affairs is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for different cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Cook Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Cook Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company:

- Make sure that your template is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Cook Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!