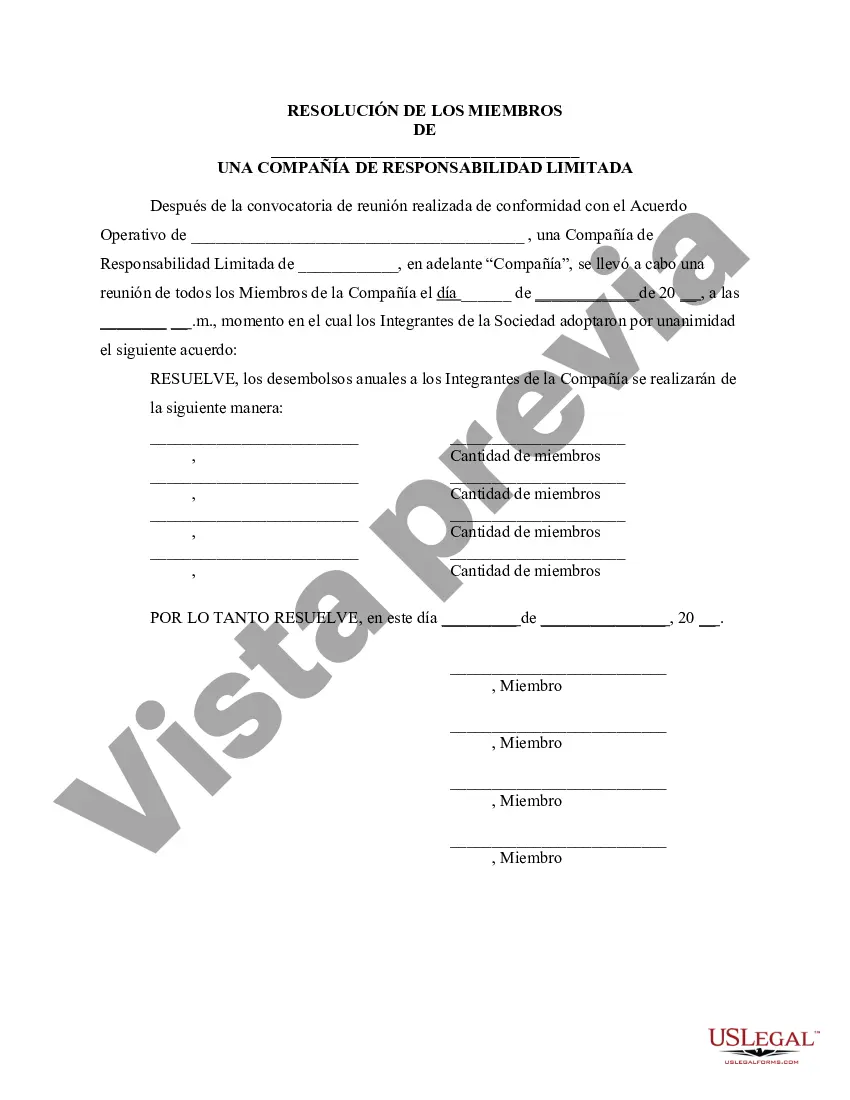

Title: Franklin, Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company Keywords: Franklin, Ohio, Resolution, Meeting, LLC Members, Annual Disbursements, Company Description: The Franklin, Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a legal document that outlines the decision-making process regarding the allocation of funds within a limited liability company (LLC). This resolution is initiated through a meeting of LLC members in Franklin, Ohio, and encompasses the determination of the amount of annual disbursements to be distributed among the company's members. The resolution serves as a pivotal tool in maintaining transparency, equity, and accountability within an LLC by clearly defining the financial distribution plans agreed upon by the members. By specifically addressing the amount of funds to be allocated annually, this resolution safeguards the interests and expectations of the members involved. Types of Franklin, Ohio Resolutions of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company: 1. Standard Resolution: This is the most commonly used type of resolution, which entails a straightforward decision-making process for determining the amount of annual disbursements to be distributed among the company's members. 2. Amended Resolution: In some cases, an LLC might need to modify or amend its initial resolution due to unforeseen circumstances or changes in the company's financial situation. Amended resolutions allow for adjustments in the amount of annual disbursements based on the updated needs and requirements of the LLC and its members. 3. Emergency Resolution: In urgent cases where immediate financial disbursements are necessary for the survival or stability of the LLC, an emergency resolution can be executed. This type of resolution overrides the standard procedure and allows for rapid allocation of funds to the members. 4. Special Resolution: If an LLC has specific circumstances or unique factors that warrant different disbursement amounts for particular members, a special resolution may be proposed and adopted. This resolution type allows for a more customized approach to the allocation of annual disbursements, taking into account individual contributions, responsibilities, or any other relevant factors specified by the LLC's members. In conclusion, the Franklin, Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a crucial legal instrument ensuring fair and transparent distribution of funds among LLC members. Different types of resolutions exist to accommodate varying situations and needs within the company, providing flexibility and adaptability to financial decision-making processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Franklin Ohio Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the recent version of the Franklin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Franklin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Franklin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!