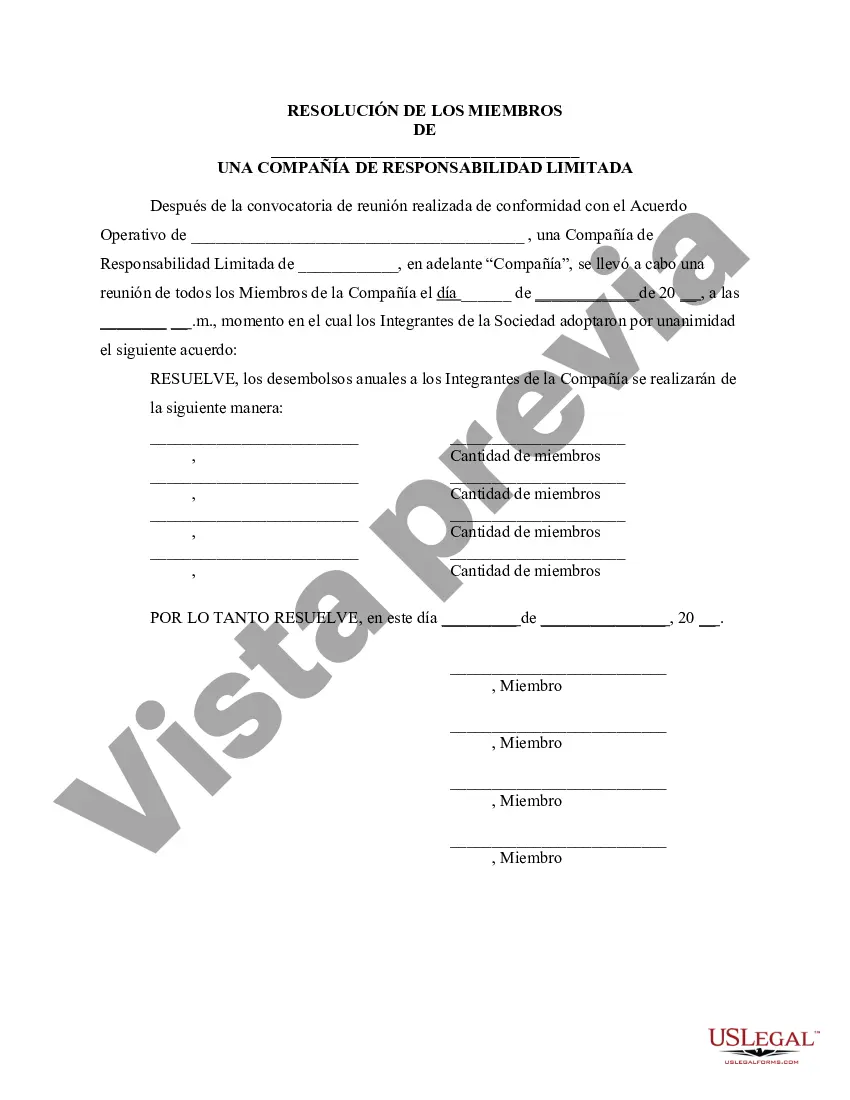

Title: Harris Texas Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company Introduction: In the vibrant business landscape of Harris, Texas, Limited Liability Companies (LCS) play a crucial role in fostering entrepreneurship and driving economic growth. One important aspect of LLC operations is determining the amount of annual disbursements to be allocated to its members. This article will explore the significance of the Harris Texas Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, providing a comprehensive overview and touching upon different types of resolutions related to this topic. 1. Understanding the Harris Texas Resolution of Meeting of LLC Members: The Harris Texas Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a legally binding document that outlines the decisions made by LLC members regarding the allocation of funds as annual disbursements. This resolution ensures transparency and accountability within the company, as it explicitly states the amounts to be distributed amongst members. 2. Importance of Determining Annual Disbursements: Determining the amount of annual disbursements is crucial for maintaining the financial stability and viability of an LLC. By setting clear guidelines, this resolution ensures fair treatment of members and facilitates efficient cash flow management. It reflects the members' mutual understanding and agreement on how profits or surplus should be distributed. 3. Different Types of Harris Texas Resolution of Meeting: a) Simple Majority Resolution: In some cases, members may agree on the allocation of annual disbursements through a simple majority vote. This type of resolution requires more than 50% of the members to approve the proposed disbursement amounts. b) Unanimous Resolution: Alternatively, LLC members may opt for a unanimous resolution, wherein all members must reach a consensus on the specified amount of annual disbursements. This type of resolution ensures an equal say for all members and promotes unity within the LLC. c) Variable Disbursement Resolution: Some LCS may decide to adopt a variable disbursement resolution, which takes into account individual members' contributions, ownership percentages, or other predetermined criteria. This method can help tailor disbursements to reflect the members' individual roles and responsibilities within the company. 4. Implementing the Harris Texas Resolution of Meeting: To officially execute the Harris Texas Resolution of Meeting of LLC Members, specific steps must be followed. These typically include preparing a written resolution document, obtaining required signatures, adhering to LLC operating agreements, and submitting the resolution to the appropriate authorities, such as the Secretary of State. Conclusion: The Harris Texas Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a fundamental aspect of LLC governance. By providing clarity on the allocation of annual disbursements, this resolution ensures fairness, transparency, and sound financial management. LLC members have the flexibility to choose between different types of resolutions based on their unique circumstances and preferences. Understanding the structure and significance of these resolutions helps LCS operate smoothly and facilitate harmonious member relationships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Harris Texas Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

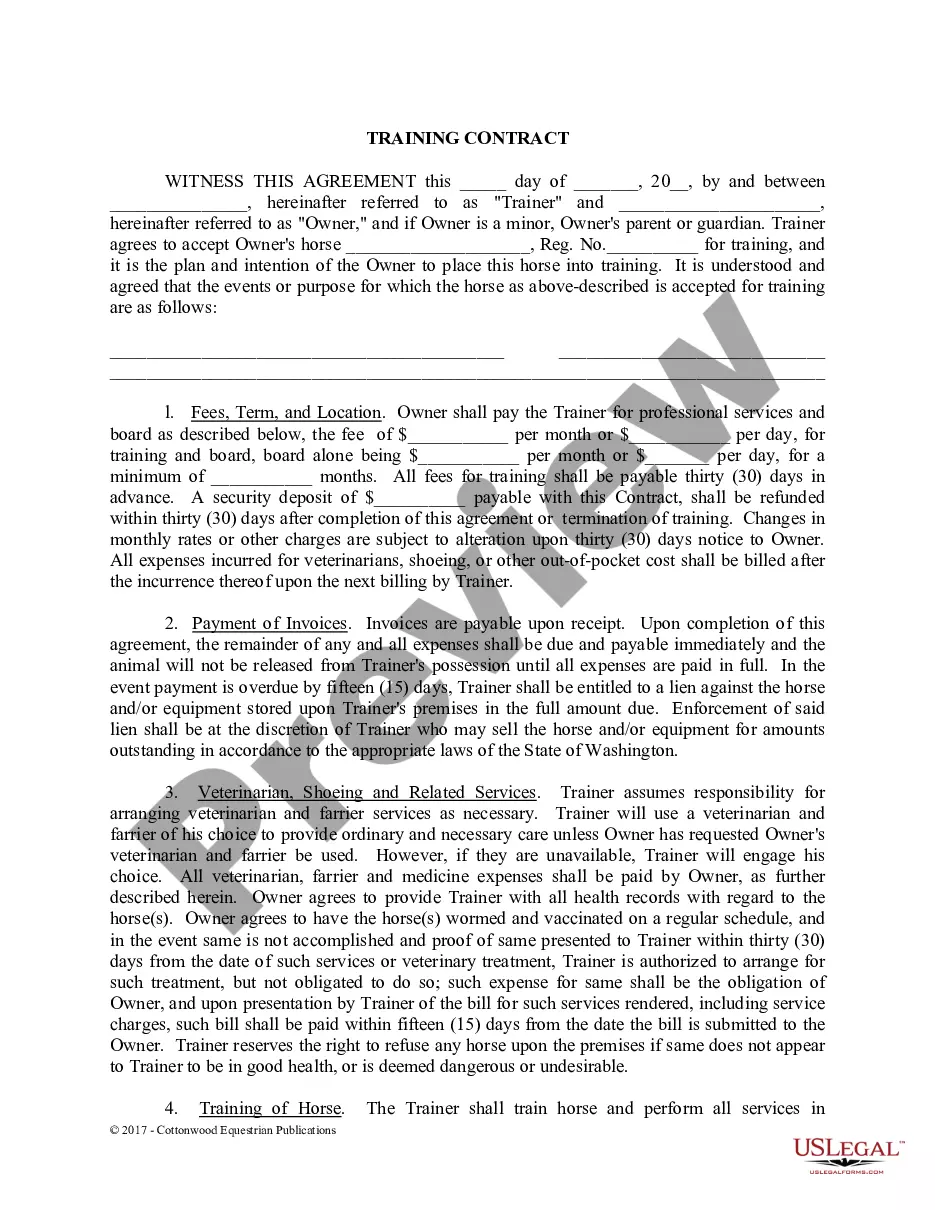

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Harris Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the current version of the Harris Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Harris Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Harris Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!