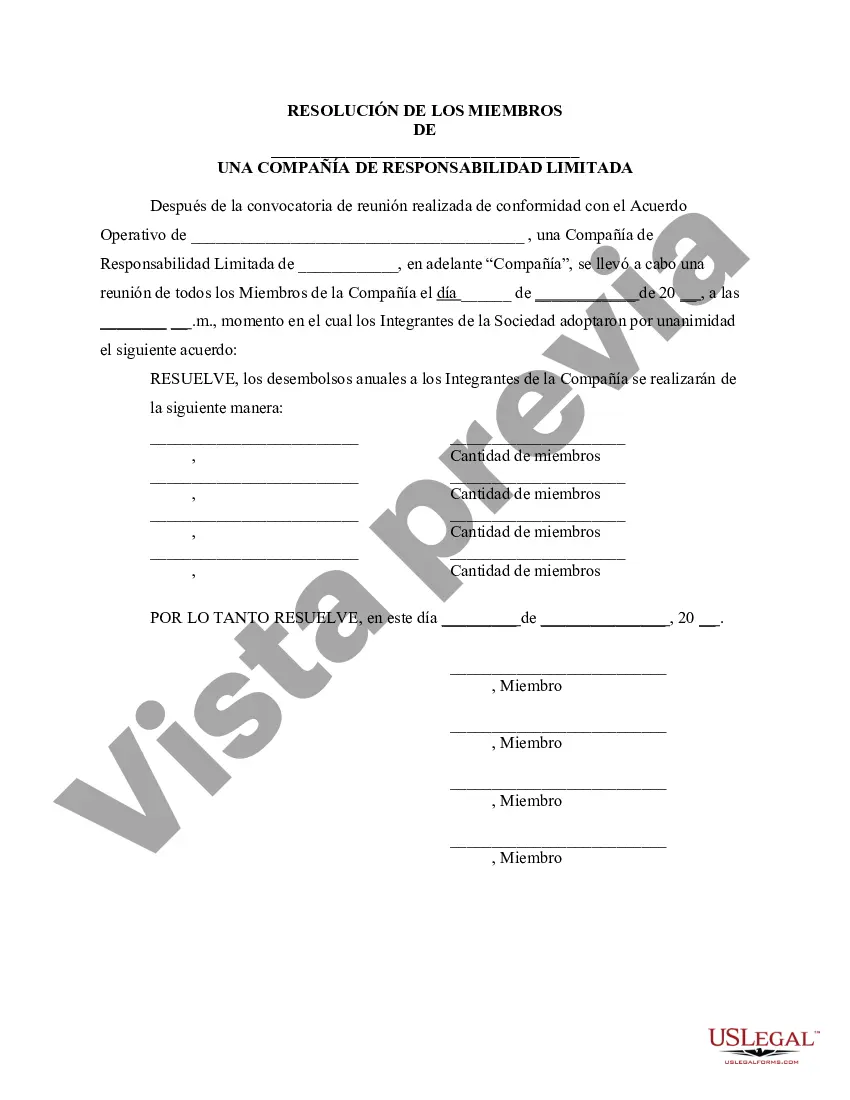

The Hennepin Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a formal resolution adopted by the members of a limited liability company (LLC) based in Hennepin County, Minnesota. This resolution serves as the official decision-making document related to determining the amount of annual disbursements to be distributed among the members of the company. This resolution outlines the process through which the LLC members come together in a meeting to discuss and specify the amount of funds that will be distributed among the members as annual disbursements. The meeting typically includes all the members of the LLC, who have the authority to make decisions collectively for the company. During the meeting, the LLC members review the financial performance, profitability, and cash flow of the company to make an informed decision regarding the amount that can be distributed as disbursements. They may consider factors such as the company's revenue, operating expenses, investments, outstanding debts, and future growth plans. Based on these considerations, the LLC members engage in discussions, debate, and negotiation to arrive at a mutually agreed-upon amount of annual disbursements. The resolution includes specific details such as the exact dollar amount or percentage of the company's profits that will be allocated for distribution among the members. It's important to note that there can be different types of Hennepin Minnesota Resolutions of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. These may include: 1. Fixed Amount Disbursement Resolution: This type of resolution specifies a fixed dollar amount that will be distributed annually to the members, regardless of the company's financial performance. 2. Percentage of Profits Disbursement Resolution: Under this resolution, a certain designated percentage of the company's profits is distributed among the members as annual disbursements. The exact percentage can be decided during the meeting. 3. Proportional Disbursement Resolution: In this type of resolution, the annual disbursements are distributed to the members in proportion to their ownership or investment in the LLC. For example, if a member owns 30% of the company, then they will receive 30% of the total annual disbursements. 4. Hybrid Disbursement Resolution: This resolution combines elements from different types mentioned above, allowing for a flexible approach based on the specific circumstances of the LLC. It may include a fixed amount for a minimum disbursement with any remaining profits distributed proportionally or according to an agreed-upon percentage. In conclusion, the Hennepin Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company serves as a key document in determining the annual disbursement distribution among LLC members. The specific type of resolution will depend on the preferences and considerations of the members involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Hennepin Minnesota Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, locating a Hennepin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Hennepin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Hennepin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Hennepin Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!