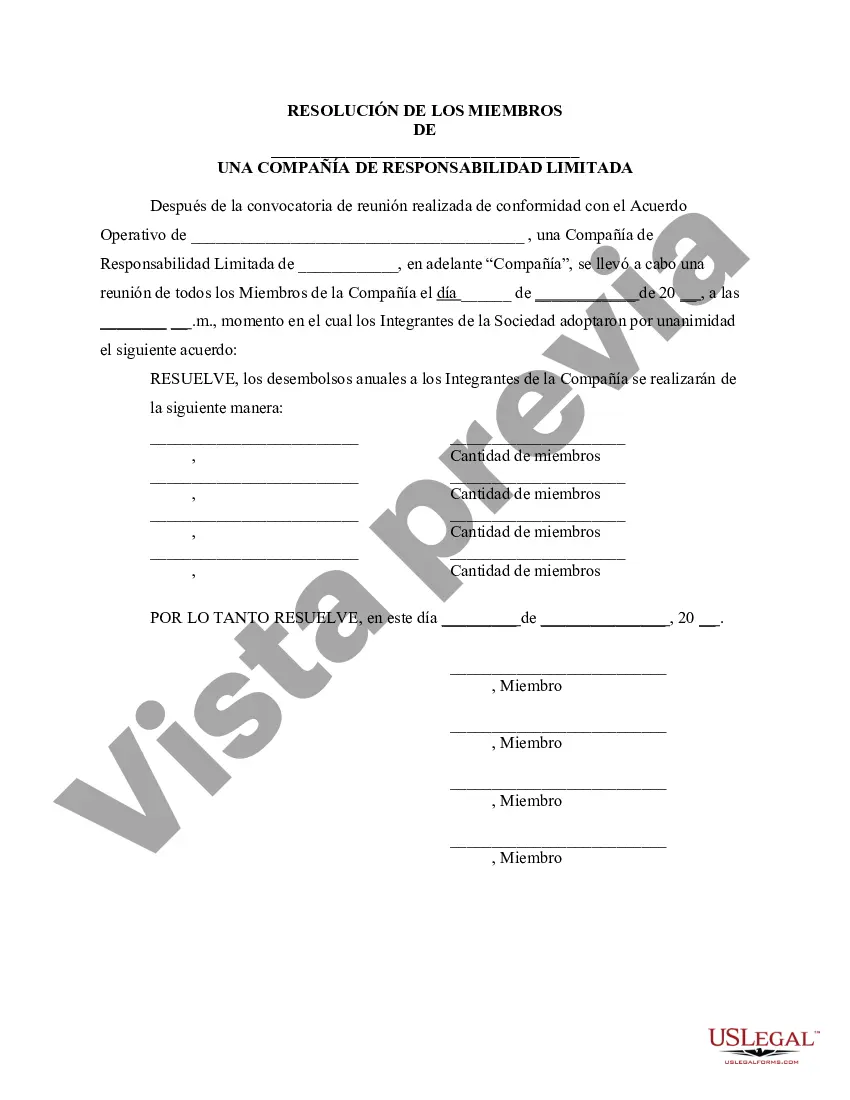

Hillsborough Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a crucial document that outlines the decisions and agreements made by the members of a limited liability company (LLC) in Hillsborough County, Florida, regarding the allocation of annual disbursements to its members. These resolutions are binding and serve as a guideline for the company's financial distribution for a specific period. The Hillsborough Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company may vary depending on the specific circumstances and goals of the LLC. Here are a few different types of resolutions that may be encountered: 1. Fixed Percentage Disbursement Resolution: This type of resolution specifies a predetermined percentage of the company's profits or revenues that will be disbursed to each member annually. By setting a fixed percentage, the LLC ensures a consistent and predictable distribution among its members. 2. Equal Share Disbursement Resolution: In this type of resolution, all members receive an equal share of the annual disbursements, regardless of their capital contributions or ownership percentages. This approach promotes fairness and equal treatment within the LLC. 3. Capital Contribution-Based Disbursement Resolution: This resolution considers the capital contributions made by the members. It establishes a formula to determine the amount of annual disbursements each member will receive based on their respective capital investments in the company. This resolution is often used to reflect the members' proportional ownership and financial commitments. 4. Performance-Based Disbursement Resolution: Some LCS opt for a resolution that links annual disbursements to individual performance or contribution to the company's success. Under this resolution, members receive disbursements based on specific metrics, such as sales targets, project completion, or overall financial performance. It serves as an incentive to motivate members to actively contribute to the LLC's growth. 5. Member Vote-Based Disbursement Resolution: This type of resolution involves a democratic approach, allowing the members to vote on the amount or methodology of annual disbursements. Every member gets an equal vote, and the resolution is determined by a majority or super majority agreement. Regardless of the specific type of Hillsborough Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, it is essential that the resolution is documented accurately, signed by all members, and kept as a record in the company's official records. This document ensures clarity, transparency, and adherence to the agreed-upon financial distribution plan among the members of the LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Hillsborough Florida Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Do you need to quickly draft a legally-binding Hillsborough Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company or maybe any other form to take control of your personal or business affairs? You can select one of the two options: contact a legal advisor to draft a legal document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-compliant form templates, including Hillsborough Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, double-check if the Hillsborough Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is adapted to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Hillsborough Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!