Mecklenburg North Carolina Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company In Mecklenburg County, North Carolina, LLC members have the ability to hold meetings to discuss and outline the amount of annual disbursements to be allocated to members of the company. This resolution is an important aspect of the LLC's decision-making process towards distributing profits. By having a clearly defined resolution, members can be confident in the transparent and fair disbursement of funds. The Mecklenburg North Carolina Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements serves as a legal document that outlines the specific amount of money that will be distributed among the members of the company at the end of each fiscal year. This resolution ensures that all members are aware of their entitled share and can plan accordingly for their financial commitments. Keywords: Mecklenburg North Carolina, resolution of meeting, LLC members, annual disbursements, specify amount, Mecklenburg County, decision-making process, distributing profits, transparent, fair disbursement, funds, legal document, specific amount, fiscal year, entitled share, financial commitments. Different Types of Mecklenburg North Carolina Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company: 1. Initial Disbursement Resolution: This type of resolution is enacted during the initial stages of an LLC's formation. Members set the groundwork for subsequent annual disbursement resolutions by determining the amount and method of disbursing profits among themselves. 2. Amendment Resolution: Sometimes, circumstances may change, leading members to revise the initially agreed-upon disbursement amounts. An amendment resolution allows LLC members in Mecklenburg County, North Carolina, to modify the previous resolution and specify new annual disbursements based on updated factors or business conditions. 3. Capital Contribution Resolution: In this type of resolution, members may agree to allocate a portion of the annual disbursement towards capital contributions. This decision will help fund the growth or any essential investments required for the company's long-term success. 4. Profit Retention Resolution: While annual disbursements are usually distributed among LLC members, a profit retention resolution allows members to retain a certain portion of the profits within the company. This decision is often made to reinvest in the business or maintain a financial reserve for unforeseen circumstances. Keywords: Initial Disbursement Resolution, Amendment Resolution, Capital Contribution Resolution, Profit Retention Resolution, LLC formation, revision, updated factors, business conditions, capital contributions, growth, long-term success, profit retention, financial reserve.

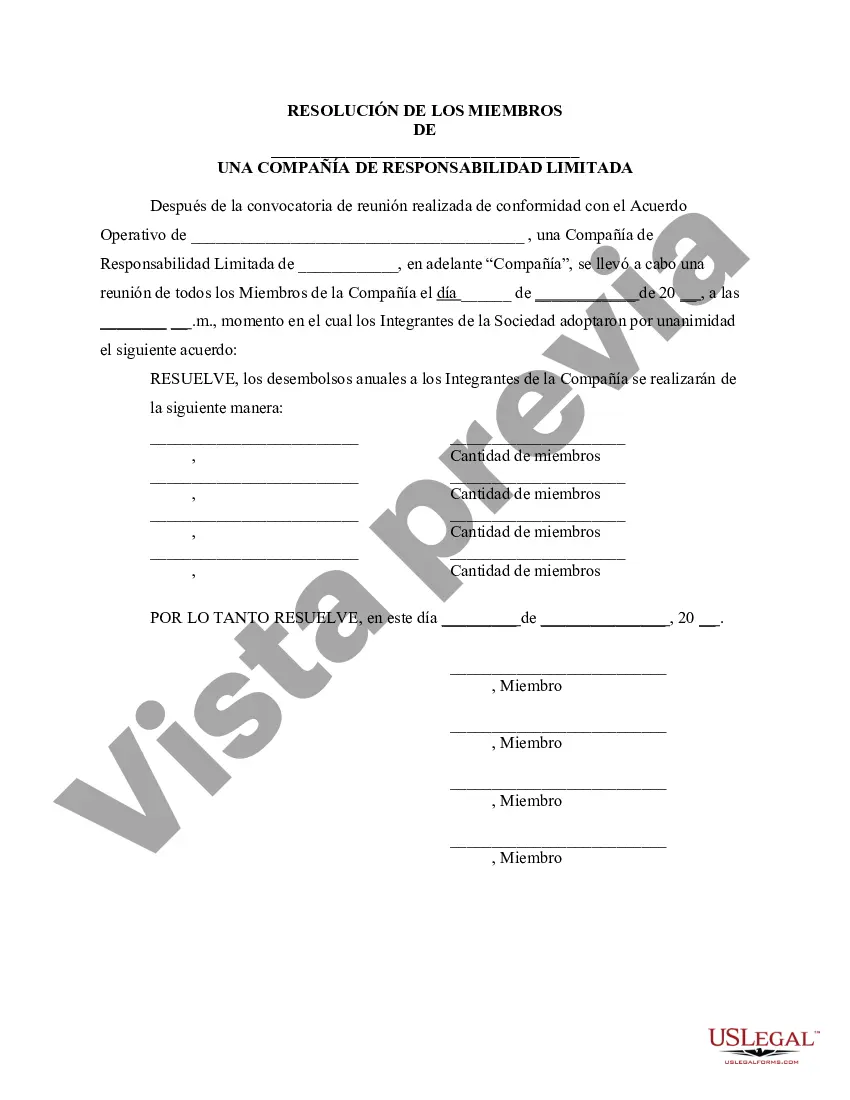

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Mecklenburg North Carolina Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Mecklenburg Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Mecklenburg Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!