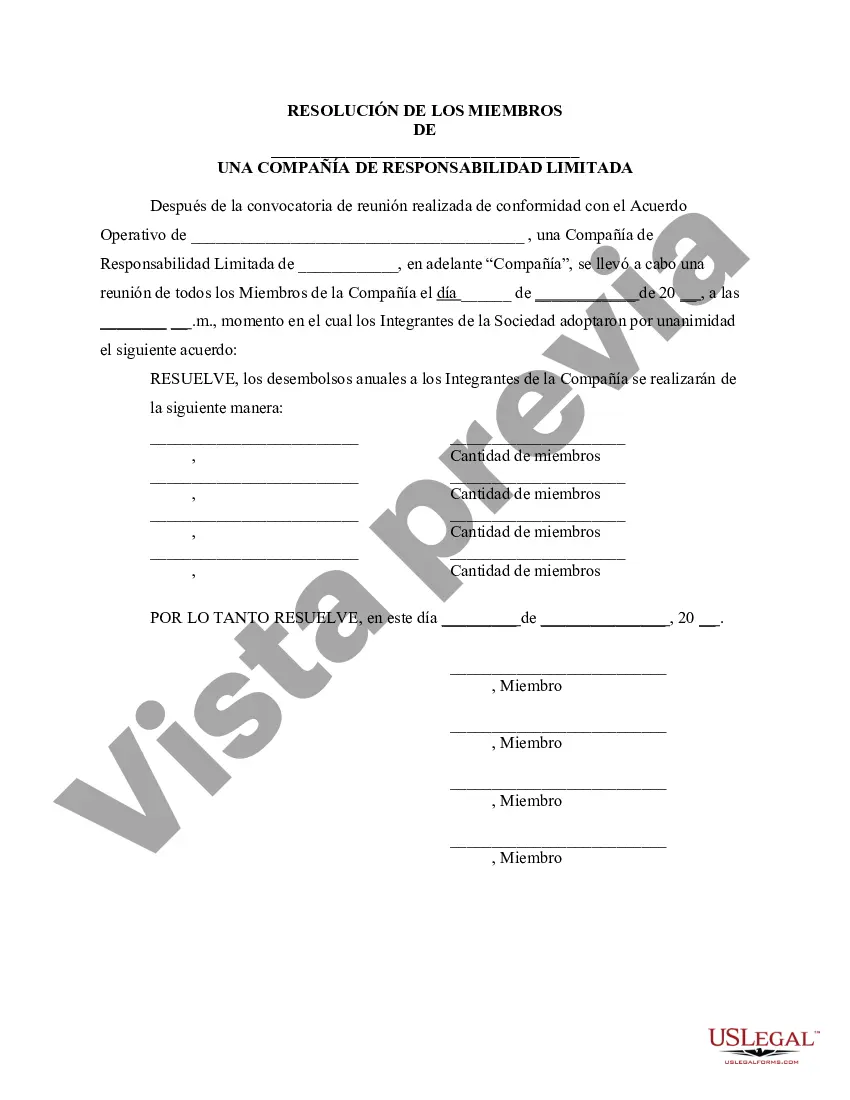

Title: Oakland, Michigan Resolution of Meeting of LLC Members: Specifying Annual Disbursements to Members of the Company Keywords: Oakland, Michigan, resolution of meeting, LLC members, annual disbursements, company Introduction: In Oakland, Michigan, an important aspect of managing a limited liability company (LLC) involves conducting meetings to make crucial decisions. One such critical decision is specifying the amount of annual disbursements to be allocated to LLC members. This article provides a detailed description of the different types of resolutions that can be made during these meetings. 1. Oakland, Michigan Resolution of Meeting of LLC Members: The primary purpose of an Oakland, Michigan resolution of a meeting of LLC members is to outline and determine the amount of annual disbursements to be distributed among the members. This resolution sets the stage for understanding the financial benefits that individual members can expect to receive from the LLC. 2. Resolution to Determine Annual Disbursement Amount: This resolution pertains to the process of deciding the specific monetary amount that will be disbursed to each member annually. The resolution may consider various factors such as the LLC's profitability, financial health, and strategic goals while determining the distribution amount. 3. Resolution Identifying Member Equity Interests: Members' equity interests play a significant role in determining their share of the annual disbursements. This resolution focuses on identifying and confirming the respective equity interests of each member, which in turn influences the amount they are entitled to receive. 4. Resolution to Adjust Disbursement Amount Based on Capital Contributions: In some cases, LLC members may contribute varying amounts of capital to the company. This resolution establishes a systematic approach wherein the annual disbursement amount can be adjusted based on the capital contributions made by each member, ensuring fairness in the distribution process. 5. Resolution to Modify Annual Disbursement Allocation Method: LLC members may decide to modify the methodology used for allocating annual disbursements. This resolution enables members to discuss and agree on new allocation methods that better reflect the company's changing needs, member roles, or performance metrics. 6. Resolution to Ratify Annual Disbursement Amount: Once the exact amount of annual disbursements to members has been determined, this resolution serves to officially ratify the decision made during the meeting. Ratification strengthens the validity of the resolution and ensures compliance with the LLC's operating agreement and applicable laws. Conclusion: Oakland, Michigan resolutions of meetings for LLC members regarding annual disbursements are essential for establishing clear guidelines and expectations. By specifying the amount to be distributed among members, along with considering factors such as equity interests and capital contributions, LCS can ensure a fair and transparent process. Additionally, resolutions may be adopted to modify the allocation method over time, keeping the disbursement system in line with evolving business needs and member dynamics.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

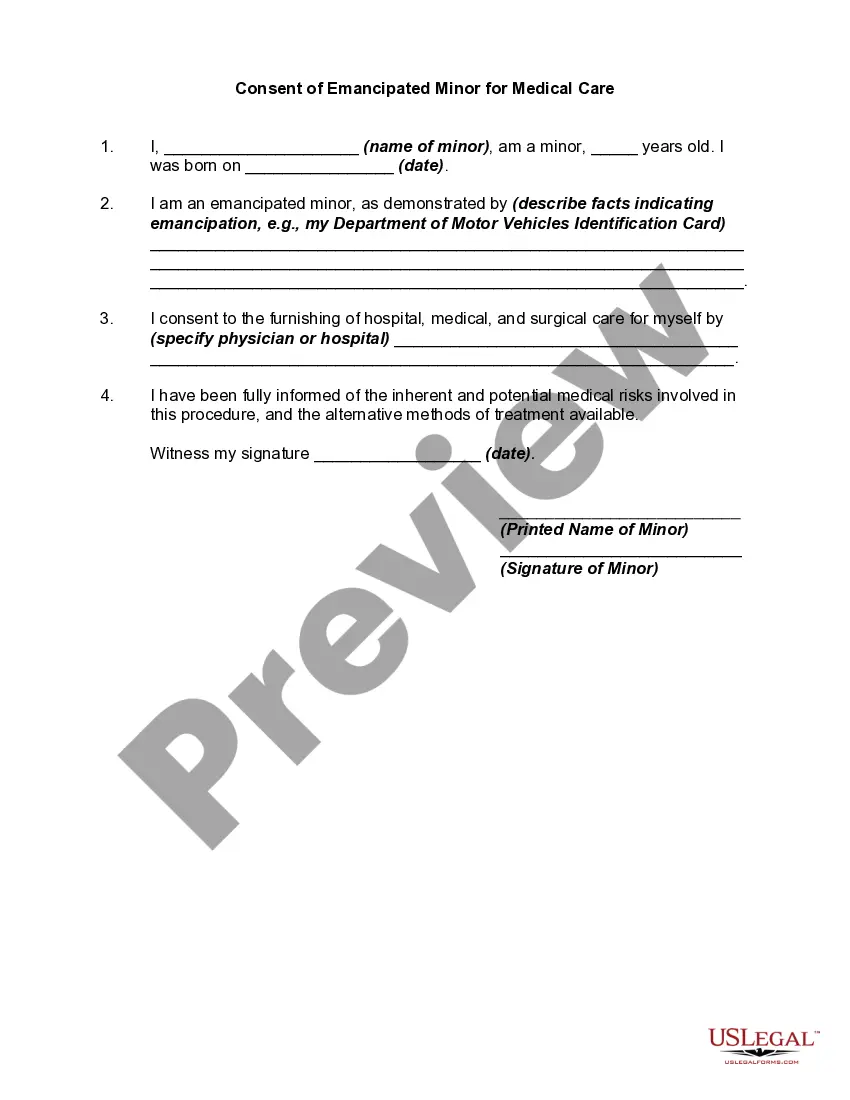

How to fill out Oakland Michigan Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

If you need to find a reliable legal document supplier to get the Oakland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support team make it easy to locate and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Oakland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Oakland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Oakland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company - all from the comfort of your home.

Sign up for US Legal Forms now!