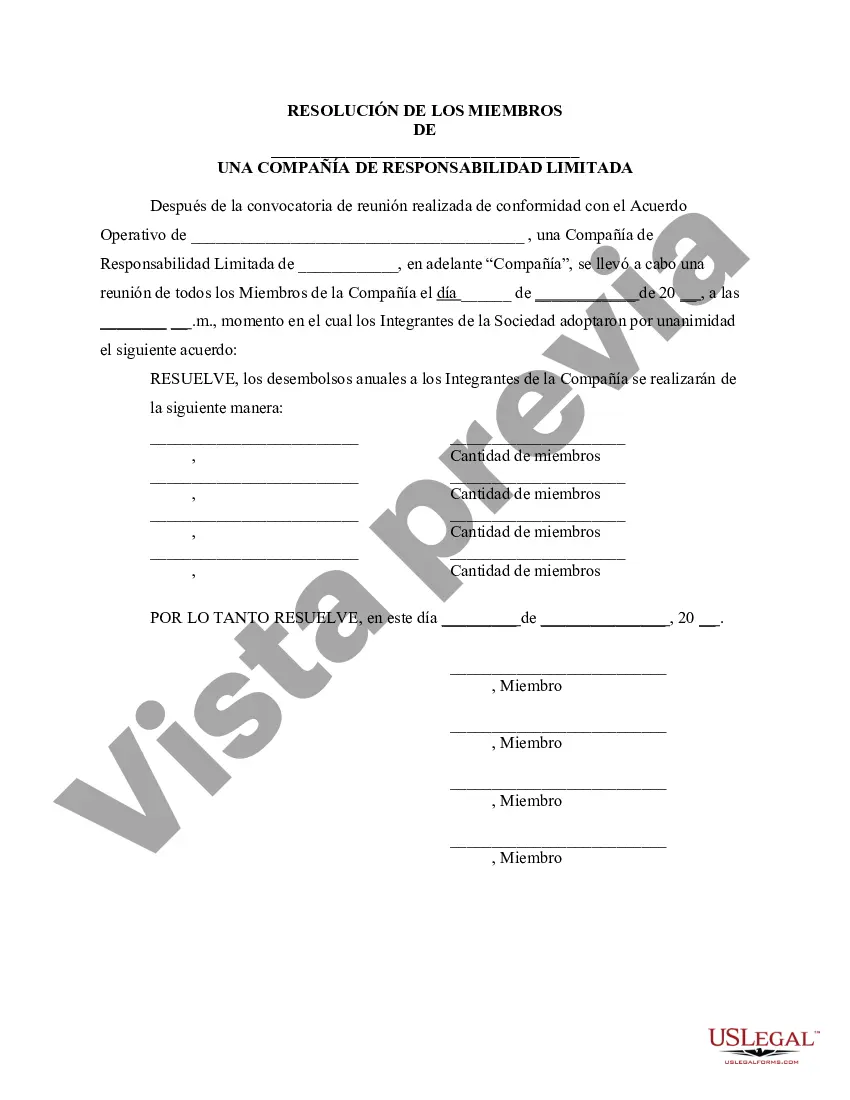

Philadelphia Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company — Types and Overview When it comes to managing a limited liability company (LLC) in Philadelphia, Pennsylvania, it is vital for the members to hold meetings and make important decisions that shape the company's operations. One such critical decision concerns specifying the amount of annual disbursements to be distributed among the LLC members. This resolution is vital to ensure transparency, fairness, and efficiency within the organization. The resolution requires a formal meeting of all LLC members, where they discuss and deliberate the annual disbursement amount. The outcome of this meeting is recorded in writing in the form of a resolution. There can be different types of resolutions for specifying the amount of annual disbursements, addressing varying circumstances and requirements. Let's explore a few of them: 1. Standard Resolution: A standard resolution is the most common type used by LLC members to determine the amount of annual disbursements. It typically includes details such as the total available funds, the percentage or proportion of funds to be allocated to each member, and any additional conditions or criteria for disbursements. This type of resolution ensures a fair distribution based on members' respective ownership interests or predetermined agreements. 2. Performance-based Resolution: LCS may opt for a performance-based resolution, especially if they have an incentive compensation system in place. This type of resolution ties the amount of annual disbursements to the performance of the company or individual members. It may utilize metrics such as revenue, profitability, or individual contributions to determine the disbursement amounts. Performance-based resolutions encourage members to actively contribute to the success of the company. 3. Priority-based Resolution: In some cases, LLC members may have varying levels of priority when it comes to receiving annual disbursements. For instance, if an LLC has preferred members or investors who hold additional rights or have made significant financial contributions, a priority-based resolution can be used. This type of resolution ensures that certain members receive their disbursements before others, based on their level of priority. 4. Emergency Resolution: Another type of resolution that can be relevant in LLC meetings is an emergency resolution. This is employed when unforeseen circumstances or urgent financial needs arise within the company. LLC members convene a meeting to vote on a temporary deviation from the usual annual disbursement process to address the emergency. This resolution ensures quick decision-making to protect the company's stability and address critical needs. In conclusion, Philadelphia Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company encompasses various types, each addressing specific circumstances and requirements. Whether it's a standard resolution, performance-based resolution, priority-based resolution, or emergency resolution, the LLC members carefully consider and document their decisions to ensure a fair and efficient annual disbursement process.

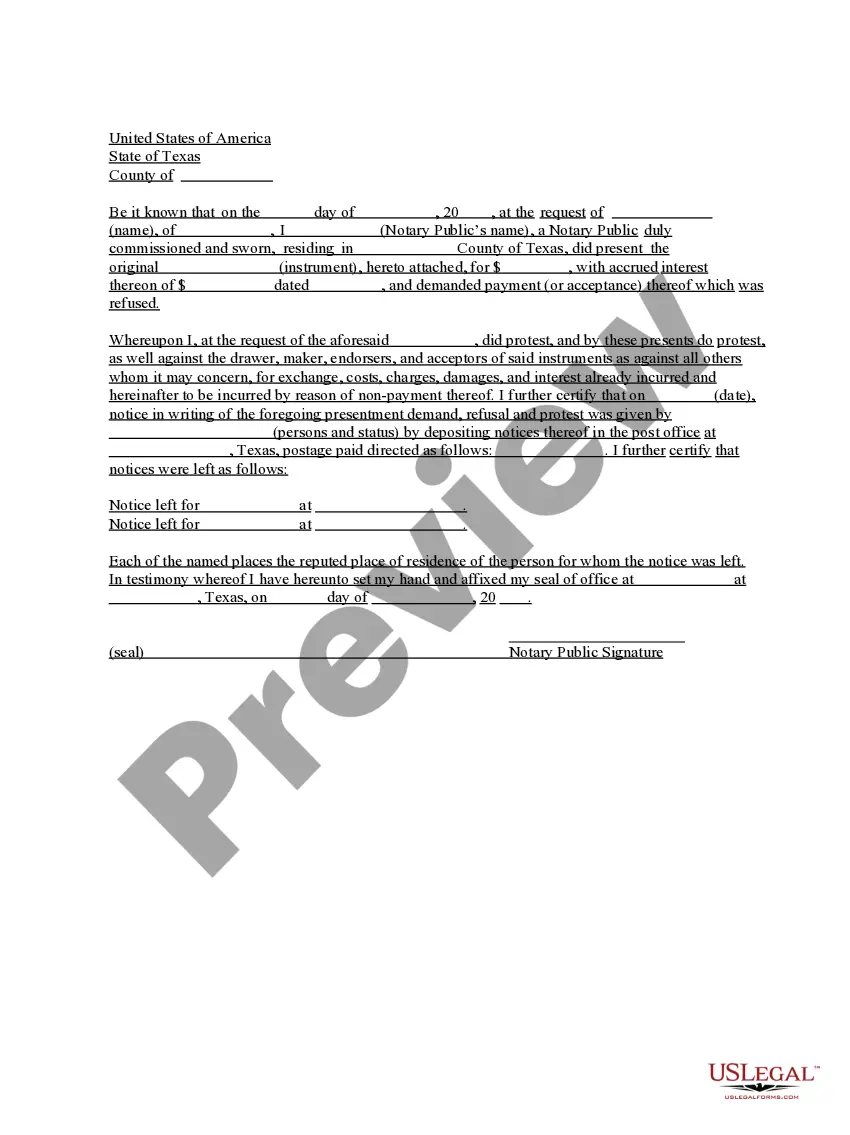

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Philadelphia Pennsylvania Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

Do you need to quickly draft a legally-binding Philadelphia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company or maybe any other document to manage your personal or business affairs? You can go with two options: hire a legal advisor to draft a legal paper for you or create it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Philadelphia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, double-check if the Philadelphia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Philadelphia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the templates we offer are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!