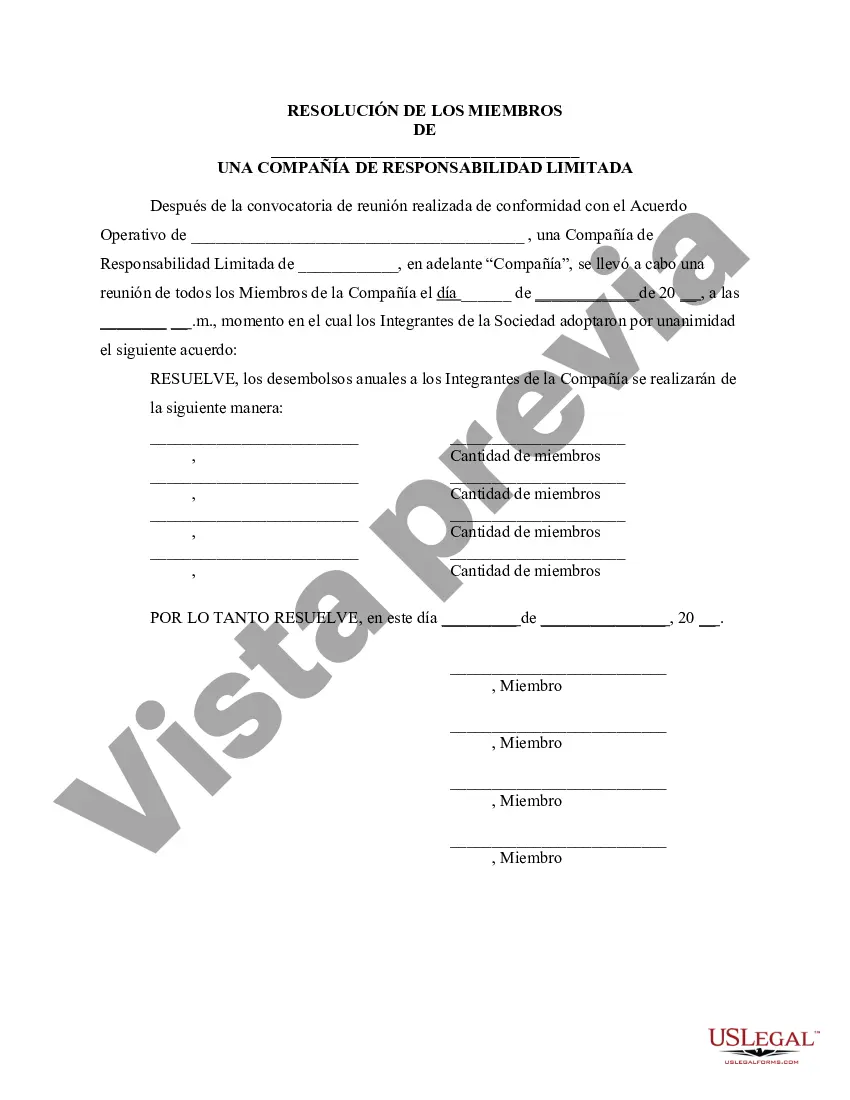

Title: Santa Clara California Resolution of Meeting of LLC Members: Determining Annual Disbursements to Members Description: In Santa Clara, California, LCS often hold meetings to discuss and make important decisions regarding the financial affairs of the company, including annual disbursements to its members. These meetings emphasize the collaborative nature of LCS, where members gather to collectively agree upon the appropriate amount to distribute among themselves. This detailed description explores the process of reaching a resolution on the amount of annual disbursements, the key factors considered, and potential variations of such resolutions. Keywords: Santa Clara California, Resolution of Meeting, LLC Members, Annual Disbursements, Company, Collaborative Decision-making, Financial Affairs. 1. Regular LLC Members Meeting for Annual Disbursements in Santa Clara, California: This type of resolution meeting is regularly scheduled within the LLC's annual calendar. It involves all members coming together to discuss, evaluate, and specify the amount of disbursements that each member will receive from the company's profits. Such meetings ensure transparency, equity, and consensus among member participants. 2. Special LLC Members Meeting for Annual Disbursements in Santa Clara, California: This type of resolution meeting may be called for specific reasons, such as unexpected financial setbacks or exceptional profits exceeding regular distributions. In special circumstances, members assemble to discuss the appropriate allocation of funds, taking into account the unique circumstances that necessitated the special meeting. 3. Extraordinary LLC Members Meeting for Annual Disbursements in Santa Clara, California: An extraordinary resolution meeting is typically organized to address significant financial matters that require immediate attention. In these meetings, members deliberate on the annual disbursements based on unforeseen circumstances, critical business decisions, or emergency financial requirements. 4. Adjusting LLC Members Annual Disbursements during a Respective Meeting in Santa Clara, California: Occasionally, an ongoing meeting on annual disbursements may require adjustments due to changes in market conditions, company performance, or the inclusion of new members. The resolution discussions encompass evaluating the need to revise the initial disbursement amount agreed upon, ensuring fair treatment and alignment with emerging circumstances. 5. Santa Clara California Resolution Meeting on Methods for Calculating Annual Disbursements to LLC Members: This type of resolution meeting focuses on determining the methodology for calculating the dividend distribution among LLC members. Discussions during this meeting delve into considerations such as profit allocation, contributions, capital accounts, or a pre-defined formula, ensuring transparency and fairness in the distribution process. 6. Ratification of Santa Clara California Resolution on Annual Disbursements by LLC Members: Following the resolution meeting, this step involves formalizing the discussion outcomes and finalizing the agreed-upon annual disbursement amount through member approval. During this final phase, the resolution is presented for ratification, requiring majority consent or a predetermined voting process to validate the decision. In Santa Clara, California, Resolution of Meetings conducted by LLC members to specify the amount of annual disbursements to members involves democratic decision-making, transparency, and adherence to legal requirements, ensuring equitable distribution of company profits among the respective members.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Santa Clara California Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

If you need to get a reliable legal paperwork provider to get the Santa Clara Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Santa Clara Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Santa Clara Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Santa Clara Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company - all from the comfort of your home.

Sign up for US Legal Forms now!