Alameda California Resolution of Meeting of LLC Members to Authorize Expense Accounts serves as a vital document outlining the authorization of expense accounts within an LLC. This resolution highlights the specific actions and approvals taken by the members during the meeting, ensuring transparency and accountability within the organization. By utilizing relevant keywords, we can further clarify the content's focus and potential variations: 1. Alameda County Limited Liability Company (LLC): Alameda County, located in California, possesses numerous LCS that may host meetings to address expense account authorizations. 2. Resolution of Meeting: The resolution refers to a formal decision or action taken during an LLC meeting, specific to expense accounts. 3. LLC Members: This term implies the individuals who are part of the LLC and participate in the decision-making process during the meeting. 4. Authorization of Expense Accounts: The primary purpose of the resolution is to grant authorization for the establishment, management, and use of expense accounts within the LLC. 5. Types of Alameda California Resolution of Meeting of LLC Members to Authorize Expense Accounts: a. Regular Expense Account Resolution: This type of resolution is standard and applicable to routine expense account authorizations within an LLC. b. Emergency Expense Account Resolution: This variation is invoked when immediate authorization for an expense account is required due to unforeseen circumstances or urgent business needs. c. Specific Expense Account Resolution: In cases where only certain members are granted authorization for expense accounts, this resolution specifies the individuals and their respective accounts. d. Annual Expense Account Resolution: This type of resolution is enacted once a year to reauthorize expense accounts for the upcoming period, establishing a fresh set of guidelines and limits. 6. Alameda California LLC Expense Account Guidelines: The resolution may outline specific guidelines and eligibility criteria for expense account utilization, including acceptable expenses, monetary limits, reimbursement procedures, and reporting requirements. 7. Voting Results: The resolution document should include the voting results (unanimous or majority) that led to the approval or rejection of expense account authorizations. 8. Effective Date: The resolution must include an effective date indicating when the authorization for expense accounts comes into force. By incorporating these keywords and variations, a detailed description of Alameda California Resolution of Meeting of LLC Members to Authorize Expense Accounts can be effectively provided.

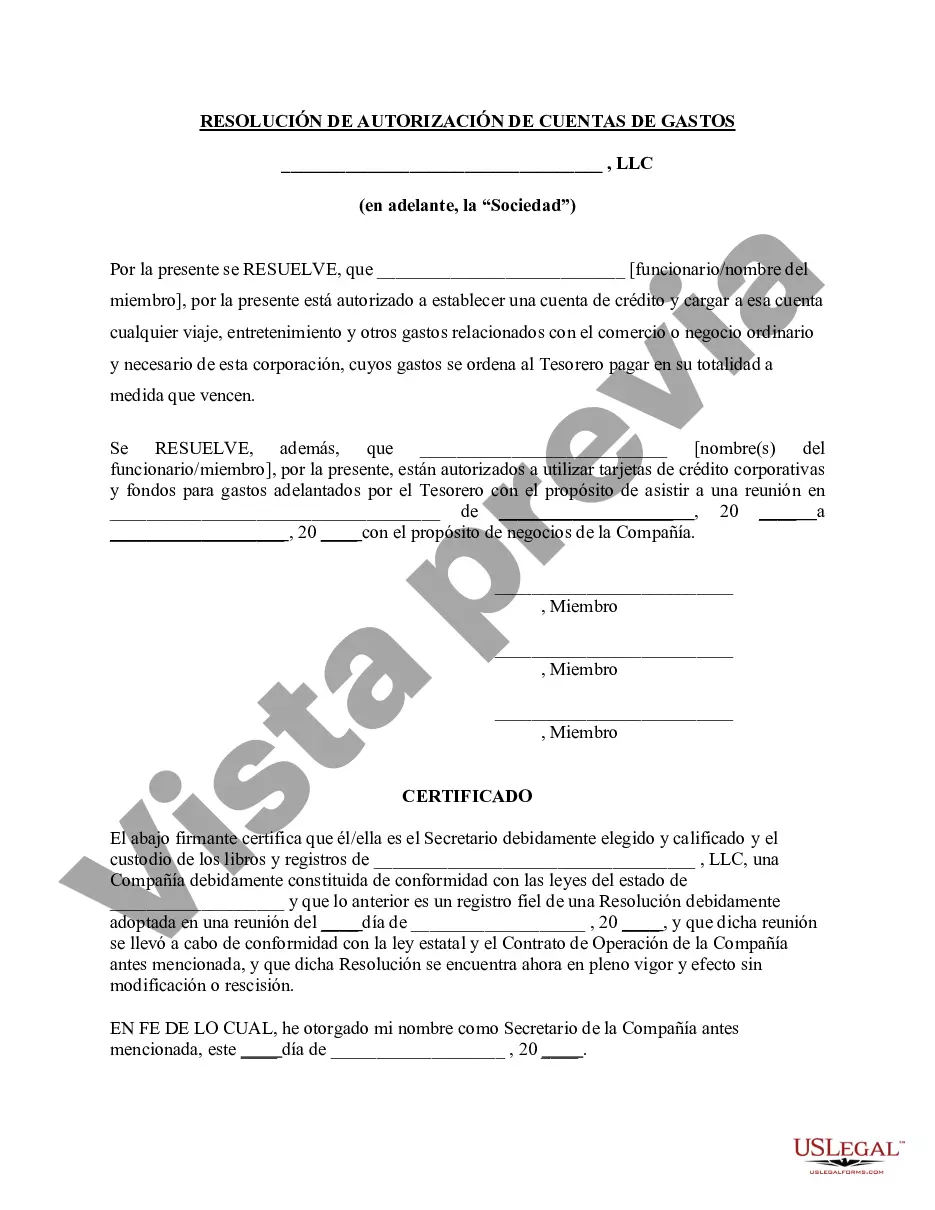

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Resolución de Reunión de Miembros de LLC para Autorizar Cuentas de Gastos - Resolution of Meeting of LLC Members to Authorize Expense Accounts

Description

How to fill out Alameda California Resolución De Reunión De Miembros De LLC Para Autorizar Cuentas De Gastos?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Alameda Resolution of Meeting of LLC Members to Authorize Expense Accounts, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed resources and guides on the website to make any activities associated with document completion straightforward.

Here's how to locate and download Alameda Resolution of Meeting of LLC Members to Authorize Expense Accounts.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Alameda Resolution of Meeting of LLC Members to Authorize Expense Accounts.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Alameda Resolution of Meeting of LLC Members to Authorize Expense Accounts, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you need to cope with an extremely complicated case, we advise getting an attorney to check your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!

Form popularity

FAQ

Un miembro de una corporacion S de Florida tiene que pagar el impuesto federal sobre el trabajo por cuenta propia solo sobre su salario; cualquier otra ganancia que obtenga a traves de la LLC no esta sujeta al impuesto sobre el trabajo por cuenta propia 15.3%.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows

Para las LLC de un solo miembro que actuan como entidades excluidas, los propietarios deben presentar el formulario 1040 si ganan mas de $400 (USD) del trabajo por cuenta propia. Como propietario, completaras tu declaracion de impuestos personal normalmente, pero con el Anexo C adjunto.

Para las LLC de un solo miembro que actuan como entidades excluidas, los propietarios deben presentar el formulario 1040 si ganan mas de $400 (USD) del trabajo por cuenta propia. Como propietario, completaras tu declaracion de impuestos personal normalmente, pero con el Anexo C adjunto.

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial.

Para formar una nueva LLC en Florida, debe presentar los articulos de organizacion en la oficina del Secretario de Estado de Florida y pagar una tarifa de presentacion de $ 100. Si necesita una copia certificada de los Articulos de Organizacion, hay una tarifa de $ 30.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows

No hay un limite maximo de miembros. La mayoria de los estados tambien permiten las LLC de un miembro unico, las que tienen un solo dueno.

Para que la LLC declare impuestos como una empresa unipersonal, debes presentar el Anexo C. Los propietarios unicos pagan impuestos sobre las ganancias y perdidas comerciales de la empresa. Para declarar impuestos como una LLC/sociedad, presenta el Formulario 1065, Retorno de los ingresos de la sociedad.

Para mantener una LLC en Texas, no necesita pagar una tarifa anual. Sin embargo, se cobran impuestos sobre las ventas y el uso de 6.25%, impuestos estatales de franquicia e impuestos federales.