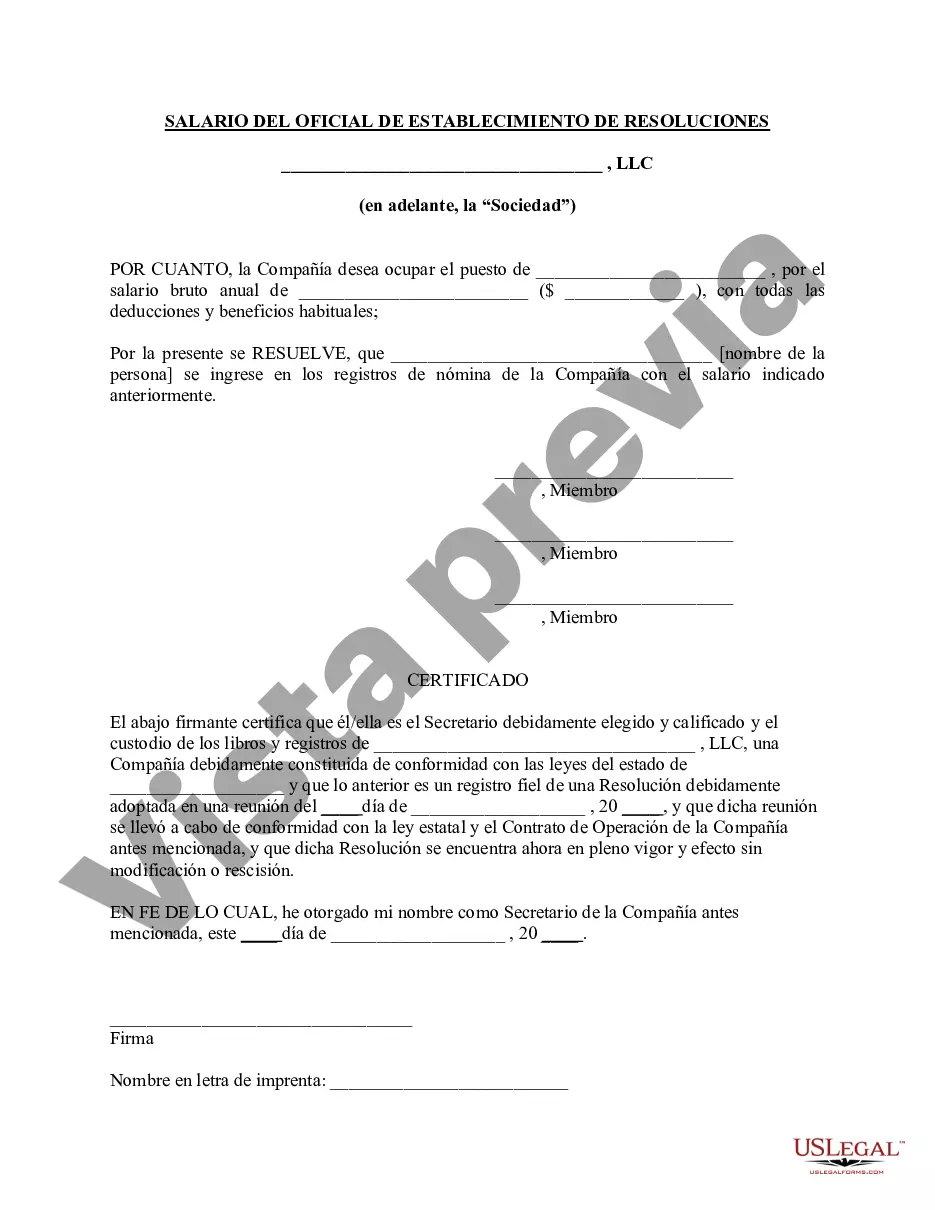

Cook Illinois Resolution of Meeting of LLC Members to Set Officer Salary is a formal document that outlines the process and decision-making involved in establishing the salary of officers within a Limited Liability Company (LLC). This resolution is crucial for maintaining transparency, ensuring fair compensation, and promoting efficient management within the company. Cook Illinois Resolution of Meeting of LLC Members To Set Officer Salary typically includes the following key elements: 1. Purpose: This section clarifies the intention of the resolution, which is to determine the salaries of the officers within the LLC. It explains that this decision is crucial for effective governance and financial stability. 2. Meeting Details: This section outlines the specifics of the meeting where the salary determination process took place. It includes the date, time, location, and attendees present during the meeting. Compliance with the LLC's operating agreement and state laws is essential. 3. Officer Positions: The resolution identifies the officer positions within the company. These positions may include Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Operating Officer (COO), and other executive roles depending on the company's organizational structure. 4. Roles and Responsibilities: This section describes the duties and responsibilities of each officer position. It highlights the significance of these roles in driving the company's growth, profitability, and overall success. Clear job descriptions help justify the officers' salaries. 5. Considerations: The resolution discusses the various factors taken into account when setting officer salaries. These may include market research, industry standards, experience, qualifications, performance, and contributions to the company's success. Compliance with employment laws regarding fair compensation is crucial. 6. Salary Determination: This section outlines the methodology or formula used to calculate the salaries of the officers. It may specify whether the salaries are fixed, performance-based, or a combination of both. The resolution also highlights when these salaries will be reviewed or adjusted, such as annually or periodically. Different types of Cook Illinois Resolution of Meeting of LLC Members to Set Officer Salary may be categorized based on the company's specific needs or circumstances. These may include: 1. Initial Salary Determination: This type of resolution is applicable when a new LLC is formed, and the initial salaries of the officers need to be established. It outlines the considerations and criteria used to set the salaries, taking into account the LLC's financial situation and future growth expectations. 2. Salary Review and Adjustment: This type of resolution is used for periodic salary reviews and adjustments. It may occur annually, biennially, or as predetermined by the members of the LLC. The resolution may detail the procedures, deadlines, and factors considered during these reviews. 3. Extraordinary Circumstances: In certain situations, such as significant changes in the company's financial stability or market conditions, an LLC may require a resolution specific to addressing these extraordinary circumstances. This may involve temporary pay reductions, salary freezes, or other measures to ensure the company's sustainability. Creating a comprehensive Cook Illinois Resolution of Meeting of LLC Members to Set Officer Salary is essential for promoting transparency, fair compensation practices, and effective governance within an LLC. It helps maintain a harmonious work environment while aligning officer salaries with the company's financial capabilities and market standards.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Resolución de la reunión de los miembros de la LLC para establecer el salario de los oficiales - Resolution of Meeting of LLC Members to Set Officer Salary

Description

How to fill out Cook Illinois Resolución De La Reunión De Los Miembros De La LLC Para Establecer El Salario De Los Oficiales?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Cook Resolution of Meeting of LLC Members to Set Officer Salary, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can purchase and download Cook Resolution of Meeting of LLC Members to Set Officer Salary.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Cook Resolution of Meeting of LLC Members to Set Officer Salary.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Cook Resolution of Meeting of LLC Members to Set Officer Salary, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you need to cope with an exceptionally difficult situation, we recommend getting a lawyer to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!