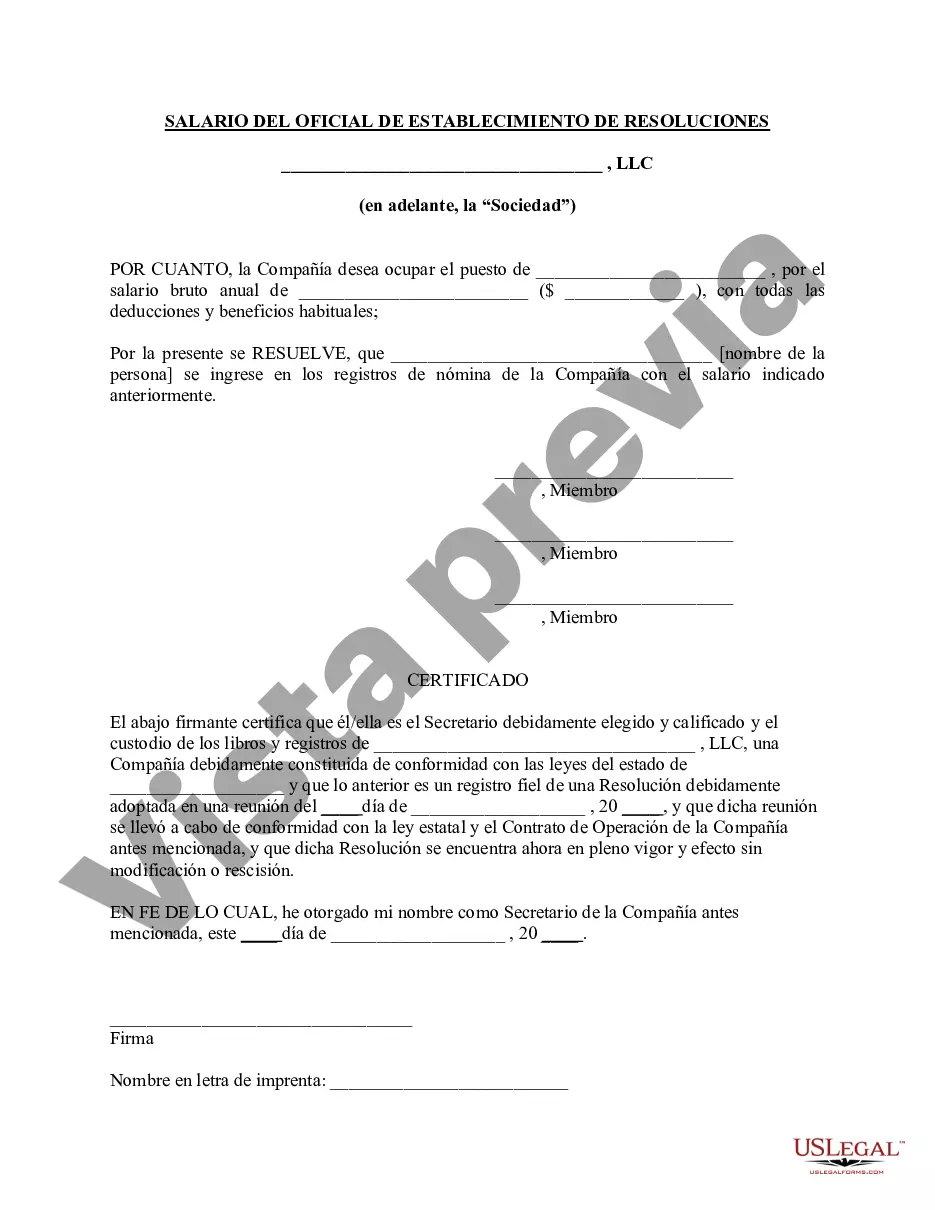

The Harris Texas Resolution of Meeting of LLC Members to Set Officer Salary is an important document in the realm of business operations. This resolution serves as a formal agreement among the members of a limited liability company (LLC) based in Harris County, Texas, regarding the determination and allocation of officer salaries within the company. It outlines the specific process and guidelines that LLC members must follow when determining the salary of officers, ensuring fairness, transparency, and compliance with applicable laws and regulations. The primary objective of the Harris Texas Resolution of Meeting of LLC Members to Set Officer Salary is to establish a framework for setting officer salaries in a manner that aligns with the company's financial resources, performance, and industry standards. This document outlines the steps to be taken during a meeting of LLC members to discuss and decide upon the salaries of officers. Keywords: Harris Texas, Resolution of Meeting, LLC Members, Officer Salary, Limited Liability Company, Harris County, Texas, determination, allocation, process, guidelines, fairness, transparency, compliance, laws, regulations, framework, financial resources, performance, industry standards, meeting. Different Types of Harris Texas Resolution of Meeting of LLC Members to Set Officer Salary: 1. Annual Officer Salary Resolution: This resolution is passed by the LLC members annually to determine officer salaries for the upcoming year. It typically takes place during a formal meeting held at a predetermined time and location. 2. Special Officer Salary Resolution: Occasionally, LLC members may require a special resolution to address unique circumstances, such as a sudden change in the company's financial situation or the addition/removal of an officer. This resolution allows for prompt adjustments to officer salaries outside the regular annual resolution. 3. Amendment to Officer Salary Resolution: In case there is a need to modify an existing officer salary resolution, LLC members can draft an amendment resolution. This type of resolution is used when changes are required due to factors like company growth, market conditions, or shifting organizational priorities. 4. Retroactive Officer Salary Resolution: This resolution addresses situations in which the LLC members agree to a retroactive adjustment of officer salaries. It may be necessary to rectify any imbalances, ensure equitable treatment, or provide compensation for past performance. Keywords: Annual, Special, Amendment, Retroactive, Adjustment, Resolution, Officer Salaries, Unique Circumstances, Prompt Adjustments, Modify, Existing, Growth, Market Conditions, Organizational Priorities, Retroactive Adjustment, Rectify, Imbalances, Equitable Treatment, Compensation, Past Performance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Resolución de la reunión de los miembros de la LLC para establecer el salario de los oficiales - Resolution of Meeting of LLC Members to Set Officer Salary

Description

How to fill out Harris Texas Resolución De La Reunión De Los Miembros De La LLC Para Establecer El Salario De Los Oficiales?

Creating paperwork, like Harris Resolution of Meeting of LLC Members to Set Officer Salary, to take care of your legal affairs is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for a variety of scenarios and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Harris Resolution of Meeting of LLC Members to Set Officer Salary template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Harris Resolution of Meeting of LLC Members to Set Officer Salary:

- Ensure that your document is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Harris Resolution of Meeting of LLC Members to Set Officer Salary isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!