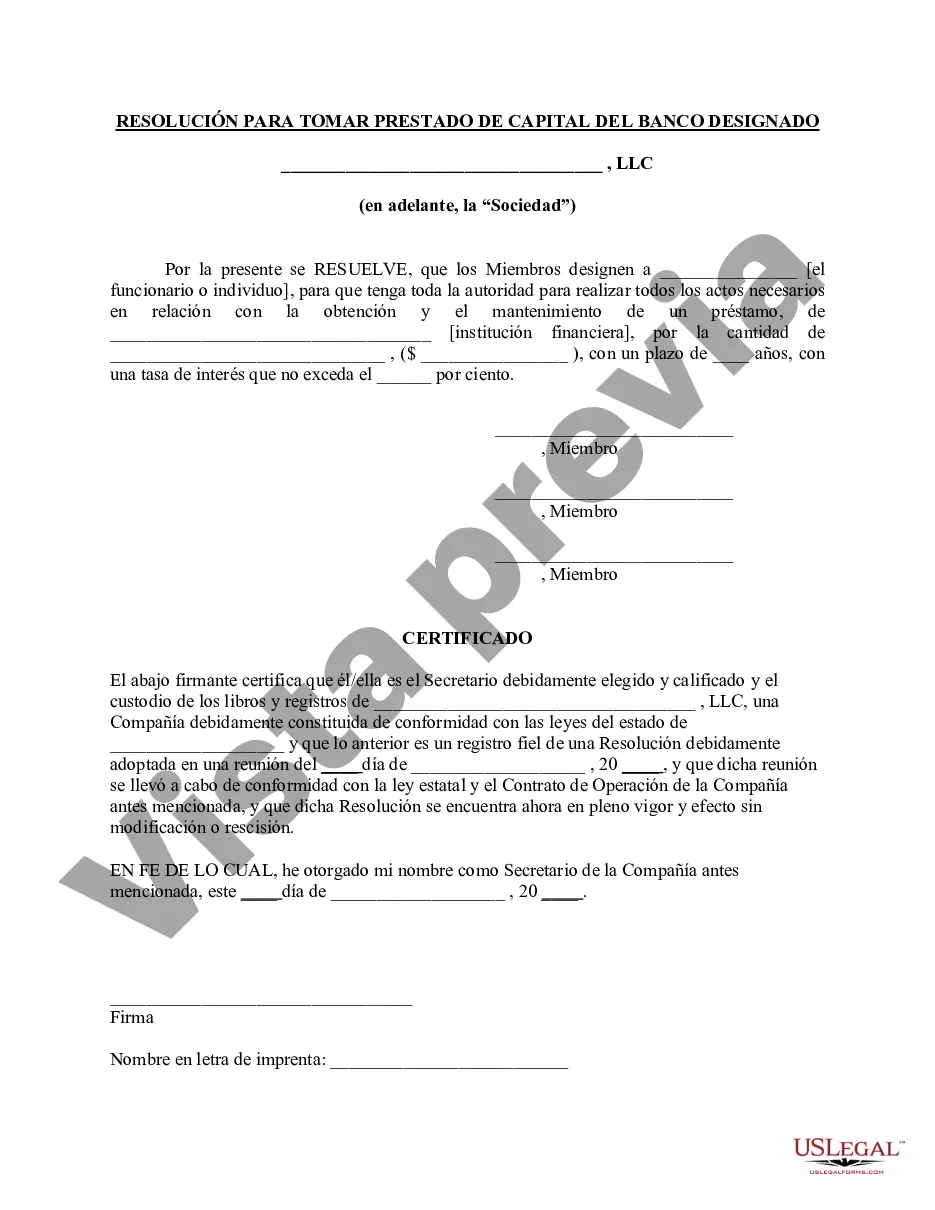

Title: Allegheny Pennsylvania Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Keywords: Allegheny Pennsylvania, resolution of meeting, LLC members, borrow capital, designated bank, types Introduction: The Allegheny Pennsylvania Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a legal document that outlines the process through which members of a limited liability company (LLC) in Allegheny, Pennsylvania, agree to borrow capital from a designated bank. This resolution aims to provide a detailed description of the procedure involved, ensuring transparency and accountability within the LLC. Types of Allegheny Pennsylvania Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: 1. Initial Capital Injection Resolution: This type of resolution outlines the initial borrowing of capital when forming an LLC in Allegheny, Pennsylvania. It specifies the amount needed and the designated bank from which the LLC will borrow the funds. 2. Expansion Capital Resolution: An expansion capital resolution is required when the LLC decides to grow its operations, introduce new products or services, or expand into new markets. This resolution signals the LLC members' agreement to borrow additional capital from a designated bank to fund these expansion activities. 3. Emergency Capital Resolution: In situations where the company faces unexpected financial challenges such as a significant loss, market downturn, or natural disaster, an emergency capital resolution is necessary. This resolution allows the LLC members to collectively borrow funds from a designated bank to address immediate financial needs and ensure the continuity of the business. Key Elements in an Allegheny Pennsylvania Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank: 1. Opening statement: The resolution document begins with a concise introduction, stating the purpose, date, and location of the meeting. 2. Identification of members: The names of all LLC members attending the meeting are listed, along with their respective ownership percentages or membership units. 3. Resolution details: This section outlines the LLC's intent to borrow capital, indicating the amount required, the purpose for which it will be used, and the specific designated bank from which the funds will be borrowed. 4. Borrowing terms and conditions: The resolution clarifies the terms and conditions of the loan, such as the interest rate, repayment schedule, and any collateral or personal guarantees required. 5. Voting and decision-making: The document includes a voting section, which confirms that the resolution was passed after thorough discussion, deliberation, and a vote among the LLC members. It may detail the voting percentage required for the resolution to be approved. 6. Signatures: Finally, the resolution is signed by all LLC members present during the meeting, confirming their agreement to borrow the capital from the designated bank. Conclusion: The Allegheny Pennsylvania Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank serves as a crucial legal tool for LCS in Allegheny, Pennsylvania, when seeking to borrow capital for various purposes. The resolution ensures that the borrowing process is formal, transparent, and compliant with applicable laws, and it provides a record of the LLC members' collective decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Allegheny Pennsylvania Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

Are you looking to quickly create a legally-binding Allegheny Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank or probably any other form to take control of your personal or business matters? You can select one of the two options: contact a professional to write a legal paper for you or create it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Allegheny Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- First and foremost, double-check if the Allegheny Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is adapted to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Allegheny Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!