Cook Illinois Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is a formal document that outlines the approval process for obtaining financial capital from a designated bank in order to meet the financial needs of the Cook Illinois LLC. The resolution serves as an authorization from the LLC members, specifying the terms and conditions under which the loan will be acquired. The Cook Illinois Resolution of Meeting is a crucial process undertaken by LLC members to ensure transparency, accountability, and legality in borrowing capital from a designated bank. By following this resolution, the LLC members can navigate the borrowing process efficiently while protecting the interests of both the LLC and its members. This resolution encompasses several important elements. Firstly, it highlights the purpose for which the capital is being borrowed, such as funding operational expenses, expansion projects, or acquiring assets. The resolution also defines the specific amount of capital to be borrowed and the terms for repayment, including interest rates, repayment schedules, and any collateral requirements. It further identifies the designated bank from which the capital will be borrowed, emphasizing the importance of selecting a trustworthy financial institution. This ensures that the LLC members are associated with a reputable establishment that offers favorable lending terms and conditions. The Cook Illinois Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank can be further categorized into various types based on the specific nature of the loan. These may include: 1. Operating Capital Loan: This type of resolution focuses on acquiring immediate funds to cover day-to-day operational expenses, such as employee wages, rent, utilities, and inventory replenishment. 2. Expansion Loan: This resolution type is used for obtaining capital to support business growth initiatives, such as opening new branches, entering new markets, or investing in marketing campaigns. 3. Equipment or Asset Acquisition Loan: This resolution enables the LLC members to procure funds to purchase necessary equipment, machinery, or other assets crucial for the LLC's operations. 4. Emergency Loan: In cases where unexpected financial emergencies arise, this resolution empowers the LLC members to borrow capital quickly to address the crisis at hand. 5. Bridge Loan: This type of resolution facilitates the borrowing of capital to bridge temporary gaps in financing, such as when waiting for secured funds or pending payments. By using the Cook Illinois Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, LLC members ensure a structured approach to acquiring necessary capital, while minimizing potential conflicts and legal issues. This resolution serves as a crucial tool for promoting financial stability and growth within the Cook Illinois LLC.

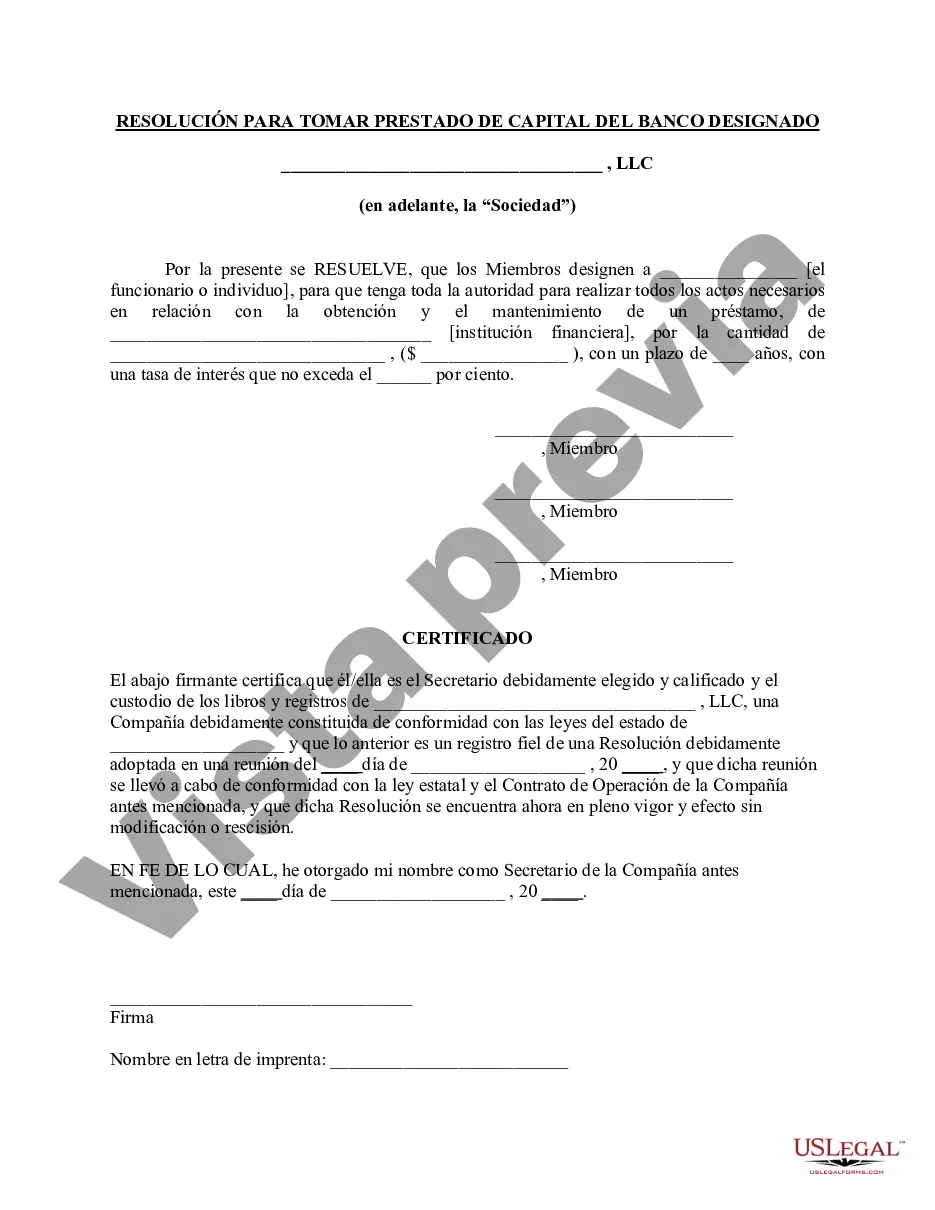

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Cook Illinois Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

Draftwing forms, like Cook Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, to take care of your legal affairs is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms crafted for various cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Cook Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Cook Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Ensure that your document is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Cook Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and get the form.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!