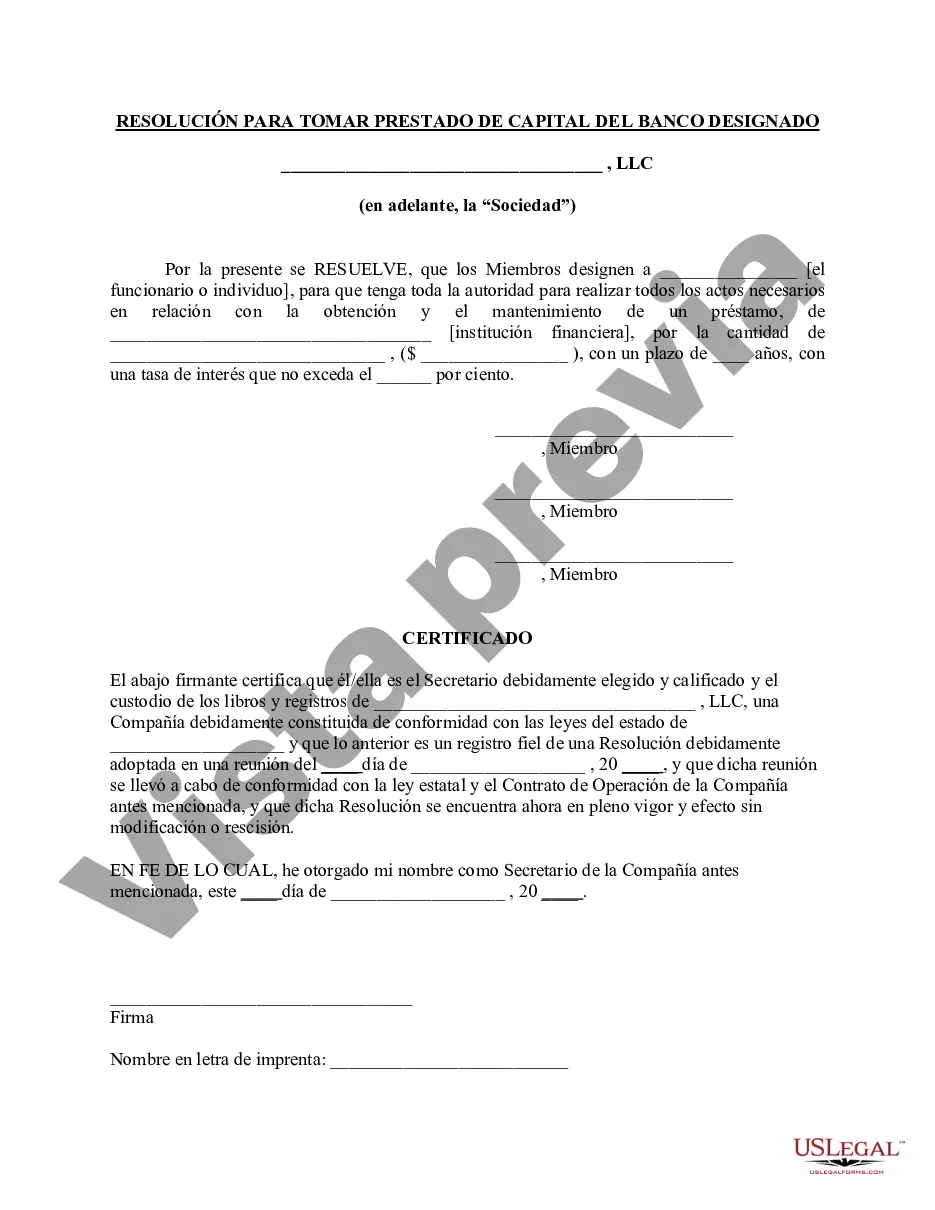

Title: Franklin Ohio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Introduction: In Franklin, Ohio, LLC members gather to make vital decisions regarding the borrowing of capital from a designated bank. This resolution aims to document the agreement to obtain financial resources that will support various financial needs and growth opportunities of the LLC. By leveraging the interest and expertise of its members, Franklin Ohio LLC ensures a well-informed decision-making process to secure funds from the designated bank. Types of Franklin Ohio Resolution of Meeting of LLC Members to Borrow Capital: 1. Capital Expansion Loan: This resolution pertains to the borrowing of capital from a designated bank to expand the LLC's business operations, such as acquiring new assets, upgrading infrastructure, or increasing production capacity. LLC members discuss the loan terms, repayment options, and the potential impact on profitability and future growth. 2. Working Capital Loan: This resolution addresses the need for short-term financial support to manage day-to-day operations efficiently. LLC members assess the working capital requirements, considering inventory management, accounts receivable, and operating expenses. The meeting aims to secure a loan that ensures smooth operations, sustains liquidity, and allows for future investment opportunities. 3. Project Financing Resolution: This resolution focuses on borrowing capital to finance specific projects or ventures undertaken by the LLC. LLC members deliberate on the feasibility, profitability, and potential risks associated with the project in question. By obtaining financing from a designated bank, they aim to mitigate business risks and ensure the project's successful execution. 4. Debt Restructuring Resolution: In cases where the LLC has existing debt obligations, this resolution is initiated to discuss borrowing capital from a designated bank to restructure and consolidate debts. LLC members explore options that allow restructuring existing loans, negotiating favorable interest rates, extending repayment periods, and improving overall financial stability while minimizing debt burdens. Key Elements in a Franklin Ohio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: 1. Purpose Statement: Clearly outlines the reason behind the resolution, whether it is capital expansion, working capital needs, project financing, or debt restructuring. 2. Loan Details: Includes the loan amount, expected interest rate, loan term, collateral requirements, repayment schedule, and conditions associated with the borrowing. 3. Terms and Conditions: Specifies the roles, responsibilities, and obligations of both the LLC and the designated bank, ensuring both parties understand the agreement's terms. 4. Voting and Approval Process: Defines the voting requirements, quorum, and the majority needed to pass the resolution. Documents the final decision made, ensuring compliance with LLC operating agreements and legal procedures. Conclusion: Through the Franklin Ohio Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, LLC members demonstrate their commitment to the growth and financial stability of the company. By carefully analyzing various borrowing options and engaging in informed discussions, LLC members secure necessary capital from a designated bank, empowering the LLC to seize business opportunities, strengthen operations, and achieve long-term success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Franklin Ohio Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Franklin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Franklin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Franklin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!