Title: Fulton Georgia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: A Comprehensive Overview Introduction: In Fulton, Georgia, a resolution of meeting of LLC members is a formal document that outlines the decision to borrow capital from a designated bank. This resolution serves as a legally binding agreement between the members of a limited liability company (LLC) and the chosen financial institution. The Fulton Georgia Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank helps streamline the borrowing process and ensures transparency and accountability among all parties involved. Types of Fulton Georgia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: 1. Regular Borrowing Resolution: This type of resolution is commonly used when an LLC wishes to borrow capital for regular business operations, such as expansion projects, purchasing inventory, or hiring new employees. The regular borrowing resolution outlines the specific loan amount, repayment terms, interest rates, and any collateral provided by the LLC to secure the loan. 2. Emergency Borrowing Resolution: In certain situations, an LLC may face unexpected financial challenges that require immediate capital infusion. An emergency borrowing resolution allows the LLC members to hold an expedited meeting to discuss and approve the borrowing of funds from a designated bank. This resolution emphasizes the urgency of the situation and may include additional stipulations regarding the accelerated repayment period or any interest rate adjustments. 3. Bridge Financing Resolution: If an LLC is in the process of securing long-term funding or awaiting anticipated revenue, it may opt for bridge financing to bridge the financial gap. A bridge financing resolution outlines the limited period during which the LLC may borrow capital from the designated bank until the long-term funding or anticipated revenue becomes available. It also specifies the repayment terms and any necessary interest rate adjustments. 4. Capital Expansion Resolution: When an LLC has ambitious growth plans, it may require significant capital infusion to facilitate expansion into new markets, products, or services. A capital expansion resolution details the LLC's intention to borrow a specific sum of money from the designated bank to fund these expansion initiatives. It also outlines the required repayment terms and interest rates, considering the extended time frame involved in such projects. 5. Debt Restructuring Resolution: If an LLC is facing financial challenges due to existing debts, it may decide to restructure its debt obligations by borrowing capital from a designated bank. A debt restructuring resolution lays out the LLC's plan to consolidate or refinance its existing debts into a single loan, thereby making repayment more manageable. This resolution typically includes details such as the amount to be borrowed, repayment terms, interest rates, and potentially any collateral offered by the LLC. Conclusion: The Fulton Georgia Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank encompasses various types based on specific borrowing requirements and circumstances. By utilizing these resolutions, LLC members can secure the necessary capital to fuel business growth, overcome financial difficulties, or embark on new ventures. It is essential for LLC members in Fulton, Georgia, to follow the legal procedures and maintain proper documentation when entering into borrowing agreements with designated banks.

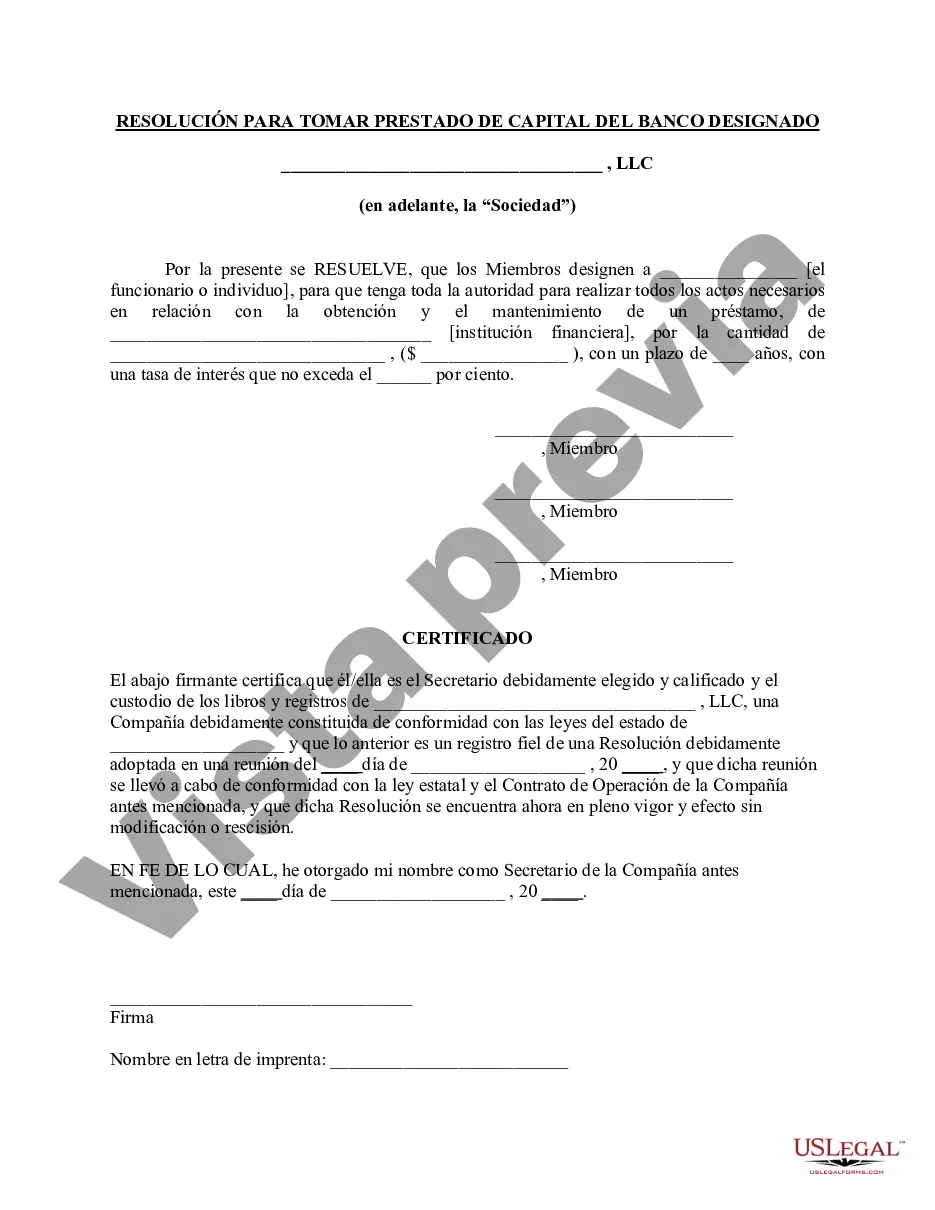

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Fulton Georgia Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Fulton Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Fulton Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Fulton Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Ensure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Fulton Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!